Non-Traditional Deepwater Basins to Support Forecast Expenditure, with 2017-2021 Deepwater Spend to Total $120 Billion

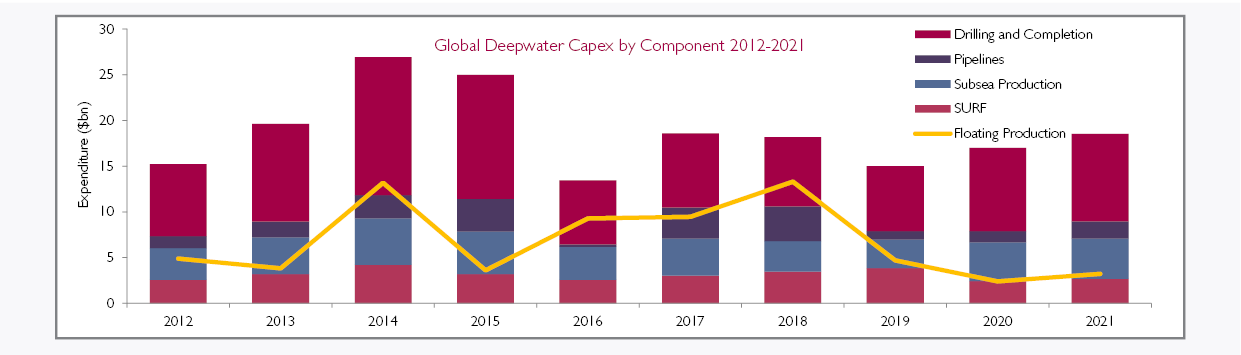

Douglas-Westwood (DW) forecasts global deepwater expenditure to total $120 billion (bn) over the 2017-2021 period. Spend is expected to decline at a -6% CAGR. However, if forecast floating production system (FPS) spend is isolated, expenditure is estimated to increase by 3% compared to the 2012-2016 period.

Despite rig day rates hitting record lows in recent years, drilling and completion expenditure is expected to total $41.6bn, accounting for 35% of Capex. Subsea production equipment, SURF (subsea umbilicals, risers, and flowlines) and pipelines will represent a combined 38% of total expenditure, whilst floating production units will account for 27% of spend over the forecast period.

Sustained low oil prices will hinder forecast expenditure, with no deepwater FPS units having been ordered between July 2015 and December 2016. This highlights several operators’ decisions to consider alternative development options, with the motive of reducing development costs.

In the near-term, Capex will be driven by traditional deepwater countries in Africa and the Americas. However, offshore installation activities on the Liza field (Guyana), SNE (Senegal), and the commencement of activities offshore East Africa, as well as the development of the Zohr field in Egypt, will support expenditure during the latter years of the forecast period. Renewed interest in developing deepwater reserves is also expected in the South China Sea and East India, which will significantly contribute to spending towards the end of the forecast period.

OEMs are beginning to feel the full impact of the downturn due to the low volume of projects sanctioned since 2014 as they are rapidly working through their record backlogs established over the 2011-2014 period. However, a number of mega projects waiting final investment decision (FID) are expected to be up for tender over the next 18 months, as operators hope to take advantage of a more competitive pricing environment. Subsequently, subsea tree installation activity is estimated to grow at a 4% CAGR over the forecast period. DW has identified over 118 deepwater fields in its World Deepwater Market Forecast with potential drilling activity, which demonstrates that many oil majors have and will continue to invest in deepwater operations to replenish dwindling production profiles.

DW’s 15th edition of the World Deepwater Market Forecast covers all key commercial themes relevant to players across the value chain in the deepwater sector:

Key drivers – discussion of factors affecting deepwater activity, including sustained low oil & gas prices, declining production from onshore and shallow water basins, E&P spend of international operators, and development of new frontiers.

Supply chain – detailing the financing of deepwater developments and local content issues. Includes analysis of contracting strategies (e.g. frame agreements), the deepwater drilling rig fleet and day rates, key players and capabilities of each sector within the deepwater market (drilling, FPS, and subsea hardware).

Procurement – factors affecting the decisions of FPS operators, including whether to lease or own vessels, and details of major leasing contractors.

Regional forecasts – forecast Capex within each region, including examples of notable projects and operators within the region and countries with the most activity.

Component forecasts – drilling and completion (subsea and surface completed wells), subsea production hardware, SURF, pipelines, trunklines, and floating production.

List of deepwater prospects – includes information on all identified prospects with drilling activities from 2017 to 2021 by operator, location, water depth, number of trees, status category, and onstream year.

Why purchase the World Deepwater Market Forecast?

DW’s market forecasting is trusted by sector players worldwide, with clients including the world’s top-10 oil & gas companies, top-10 oilfield services companies, and top-10 private equity firms.

An essential report for equipment manufacturers, offshore vessel operators, steel mills, pipeline operators, oilfield service companies, government agencies, financial institutions and oil & gas companies who need quality, up-to-date information and commercial insight to assist with their strategy in the upstream oil & gas sector.

Our proven approach includes:

Unique and proprietary data – updated year-round from published sources and insight gained from industry consultation.

Detailed methodology – the report uses research from DW’s ‘SECTORS’ database, the subscription-based information system exclusive to DW. Our global analyst team is involved in the gathering and analysis of the deepwater market data through primary research and professional networks. A project-by-project review of development prospects drives a data-rich market model and forecast.

Comprehensive analysis – comprehensive examination, analysis, and 10-year coverage of deepwater unit/km and expenditure segmented by region and component.

Concise report layout – consistent with DW’s commitment to delivering value for our clients, all our market forecasts have a concise layout consisting of industry background and supporting materials condensed to enable quick review with ‘speed-read’ summaries of key points throughout.

Source: Douglas-Westwood

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional