Euro Trading Calm Belies Risk of Lehman-Like Volatility Spikes

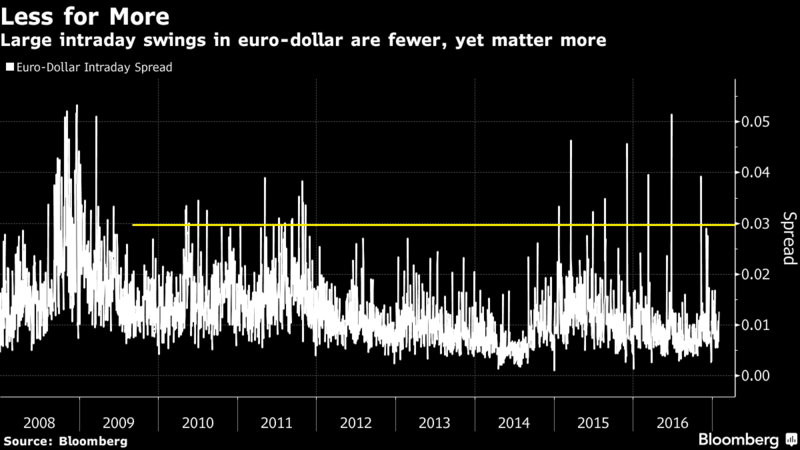

Even as the average daily trading range for the euro-dollar pair shrank last year to 91 pips, the second-smallest since the global financial crisis, violent eruptions of volatility capable of wiping out days of gains have become more frequent.

Fluctuations exceeded 300 pips on nine days during 2015-2016, compared with not even once during the prior three years. Swings beyond 400 pips, unseen since the 2008-2009 turmoil that caused the collapse of Lehman Brothers Holdings Inc., were recorded three times in the last two years.

The Swiss National Bank’s decision to scrap the cap on the franc in January 2015 heralded a new era of stomach-churning spikes in volatility. The Federal Reserve’s move away from record low interest rates and political shocks from Brexit to Donald Trump’s victory have fueled spells of market instability since then. Euro-area political risks fanning concern about the monetary union’s future are pointing to more uncertainty ahead.

“The euro-dollar’s intraday price action is not as volatile as it used to be,” said Andy Soper, head of Group-of-10 options trading at Nomura Holdings Inc. “A sudden spike in volatility can wipe out a day’s or even a week’s move quite quickly if you are incorrectly positioned.”

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional