Rare split on IMF board puts Greek bailout at risk

Some members of the International Monetary Fund are growing concerned with the terms of Greece’s bailout program, fueling fears the fund might pull out of the much-needed rescue plan for the country.

The IMF’s annual review of the Greek economy published on Tuesday revealed a rare split among its board members, showing they are in disagreement over the austerity measures imposed on Athens and over the country’s huge debt burden.

The report said that “most” of the 24 IMF executive directors agreed Greece is on track to reach a fiscal surplus of 1.5% of gross domestic product. It said Athens does “not require further fiscal consolidation at this time, given the impressive adjustment to date.”

However, some of the board members argued that Greece still needs to bring the surplus up to 3.5%, as agreed in the last bailout in 2015.

“Most Executive Directors agreed with the thrust of the staff appraisal, while some Directors had different views on the fiscal path and debt sustainability,” the IMF said in the assessment.

The IMF usually keeps its deliberations confidential, so any differences on the board are rarely exposed to the public.

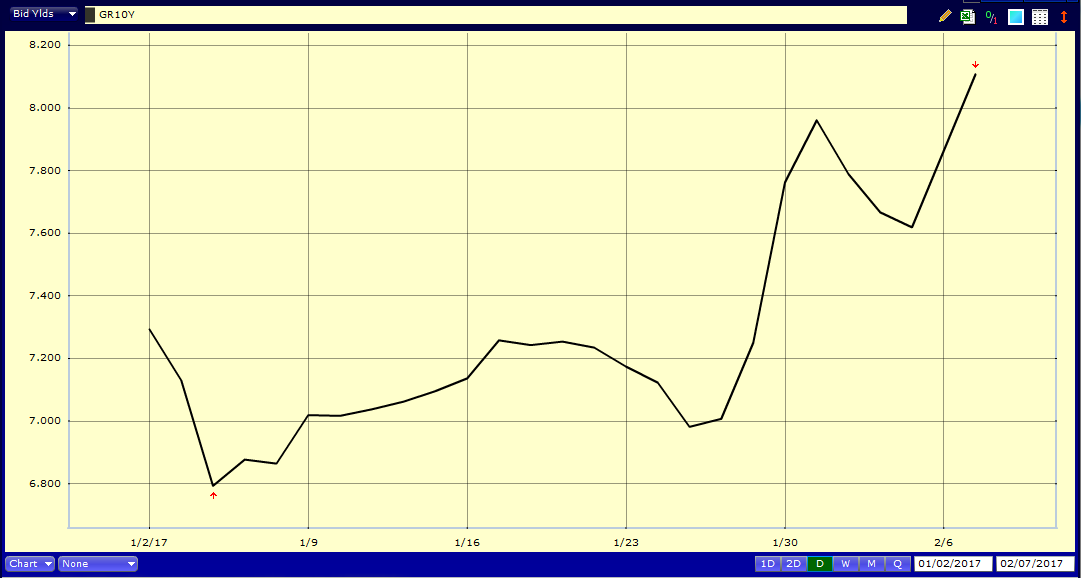

The yield on 10-year Greek government debt surged 26 basis points after the report on Tuesday to 7.925%, according to electronic trading platform Tradeweb. Economists consider borrowing costs above 7% unsustainable in the long term.

The internal discord reflects the ongoing standoff between the IMF and European authorities over the future of Greece’s rescue package. The IMF argues the European partners are imposing far too tough austerity measures on Athens and says the European creditors should offer Greece longer-term debt relief to turn the economy around.

A spokesperson for German Finance Minister Wolfgang Schäuble said on Monday that an IMF decision to end its participation in the Greek bailout plan would mean an end to the entire program, according to reports.

Source: MarketWatch

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional