Greece Hits Back Against IMF as Bond Market Remains Spooked

Greece pushed back against the International Monetary Fund’s view that the government’s economic reforms are heading off track.

In official responses, published with an IMF report on Greece late Tuesday, Finance Minister Euclid Tsakalotos said the fund’s assessment was not based on recent evidence, while Bank of Greece governor Yannis Stournaras said it downplayed progress on the financial sector and was unduly pessimistic.

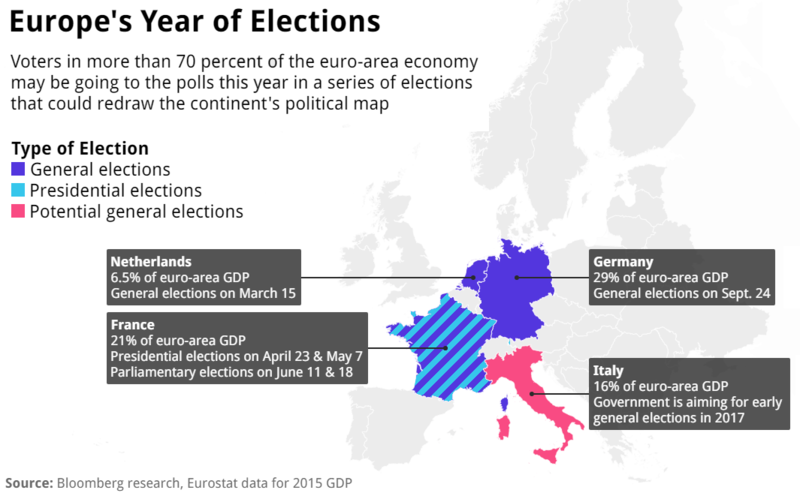

Talks between Greece and creditors for the completion of the second review of its 86 billion-euro ($92 billion) bailout program have stalled over significant differences between the IMF and euro area on projections for Greece’s economy, targets and debt sustainability. A deal between creditors is needed by a meeting of euro-area finance ministers in Brussels on Feb. 20, before the Dutch elections on March 15. After that, reaching agreement could become even trickier.

The impasse is the latest in a long line of disputes that have buffeted Greek securities since the nation regained market access. While the nation’s bonds trade with thin volumes and have a largely specialized investor base, flare-ups in its debt talks have previously spilled into other markets, spurring increased volatility.

The yield on two-year notes inched closer to 10 percent on Wednesday after jumping 80 basis points the day before as the quarrel fueled concern the country is running out of time to complete the review before the busy election season begins. The yield rose another four basis points to 9.77 percent at 12:38 p.m. in Athens.

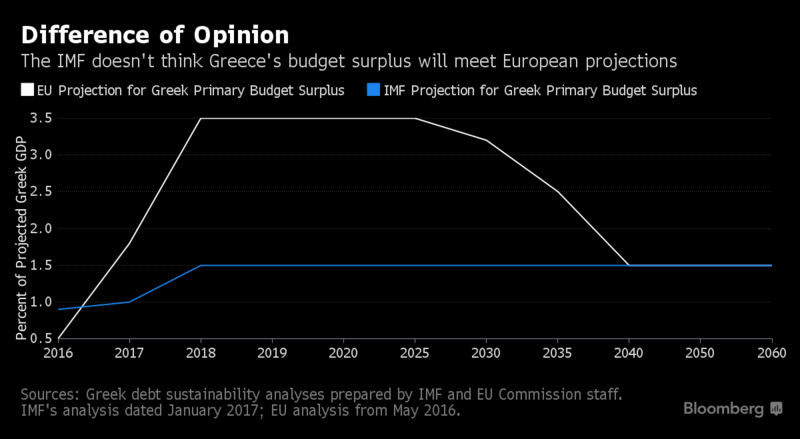

Greece won’t meet fiscal surplus targets set by its euro-area creditors, the IMF said on Monday, after executive directors met to discuss the fund’s annual assessment of the nation’s economy. The country’s debt burden and gross financing needs may become “explosive” after 2030, the fund said.

While the IMF is standing fast in its refusal to lend Greece more money as long as it deems the country’s debt unsustainable, both debt restructuring and carrying on without the fund are outcomes that are politically unpalatable in many euro-area countries such as Germany, which also holds elections this year.

“The IMF sees no solution that does not involve debt relief,” Gabriel Stein, an economist at Roubini Global Economics, said in a note to clients. While the issue is complicated by German insistence on IMF participation, “in today’s political climate, Germany cannot afford to cut Greece loose” and “this strengthens the hand of the IMF and of Greece in their respective negotiations,” he said.

The fund’s assessment of the Greek economy presents an overall picture of the reform effort that’s not representative of the actual achievements of the Greek government during its bailout program, Tsakalotos said in his response. This means the effect of reforms on economic growth aren’t duly accounted for in the IMF’s debt sustainability analysis, he said.

Dutch Finance Minister Jeroen Dijsselbloem, who chairs the Eurogroup of euro-area finance ministers, echoed the Greek criticism of the IMF in an interview on RTLZ on Tuesday. The IMF published a “a very gloomy report” that had become outdated in the meantime, he said.

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional