Odfjell: Slightly weaker results QoQ expected with continuous focus on efficiency improvements

Odfjell posts its 4Q16 results on February 16th. The quarter itself is expected to be slightly slower QoQ, however, providing a positive EPS for the 4th quarter in a row. In our model, all four remaining LPG vessel orders were taken out and we also expect a compensation to be received by ODF from the Chinese yard. Buy with an unchanged TP of NOK 40/sh is kept as Odfjell continues to focus on efficiency improvements, which are seen increasing profitability margins.

Positive EPS expected to stay

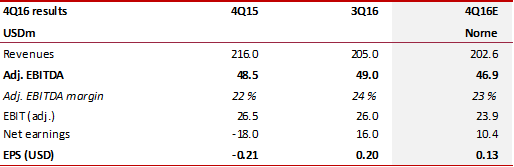

We expect only minor decline in figures QoQ to be presented next Thursday. As the spot rates continued declining in 4Q16, it should have affected company’s revenues, although less than a half of Chemical Tankers are not under a contract.

Furthermore, we follow the guidance of weaker results in 4Q, but also have in mind that the guidance for 3Q16 was to be also weaker QoQ and the results turned out flat. Thus, revenues are expected just marginally down at USD 203m vs. USD 205m in 3Q. EBIT is also seen at a similar level (USD 24m vs. USD 26m), and a positive EPS for a fourth quarter in a row, thanks to all the efficiency improvements, is seen.

Margins are projected to improve in the longer term

We have taken out the remaining four ordered LPG vessels from our estimates until further news, but expect revenues to be improving from 2017 going forward, with declining figure in 2017 due to Oman Terminal no longer in use. The market is seen to be balanced over the next two years and the fleet growth is anticipated to slow down. However, we see EBITDA improving faster than revenues, and higher margins because of company’s focus on efficiency improvements. After a very successful Project Felix, another project Moneyball with the idea of managing port-time is underway.

Strong balance sheet signals possible investments on the core fleet

We keep a Buy recommendation with an unchanged TP of NOK 40/sh, seeing a promising future for the company, strong balance sheet and more than solid multiples. Good cash position lets the company focus on investments and growth around the core fleet (announced in the last presentation), and we also see a possible split of a Gas segment, selling those two currently operated vessels.

Source: Norne Research

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional