Korea’s bulkers expect better year on improved commodity trade

The worst may be over for Korean bulkers whose troubles received lesser spotlight due to stumbling by the two ocean-going majors including Hanjin Shipping that went bankrupt.

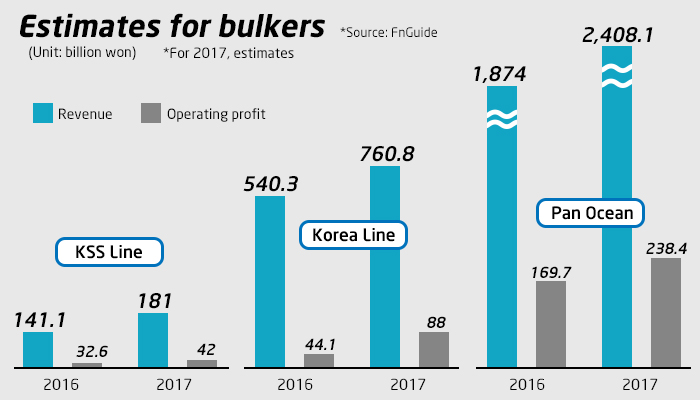

According to the securities industry Monday, Korea Line Corp. could expect operating profit to at least double this year to about 88 billion won ($76.7 million) to 100 billion won from last year’s 44.1 billion won thanks to improvement in raw material trade.

The Baltic Dry Index (BDI), which tracks shipping costs of raw materials such as iron ore, coal and grain, was at 757 points as of Monday, up sharply from last year’s low of 290 in February.

The dry bulk carrier is also likely to be helped by Daehan Shipping Co. (formerly Samsun Logix Corp.) that it acquired last year from this year’s income statement.

KSS Line that specializes in transporting bulk liquid like oil and natural gas fared well last year due to its specialty field. Its operating profit increased to 32.6 billion won last year from 29.7 billion won. This year, it would add six new vessels to beef up its fleet to 32. Three of the new vessels are large-sized gas carriers and likely to boost income by 30 percent.

Pan Ocean Co.’s bulk business will also benefit from a rebound in commodity trade.

Its operating profit for this year is estimated at 240 billion won, improving from last year’s 169.7 billion won.

Source: Pulse

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional