Algoma Central Corporation Posts 29% Rise in Net Earnings

Algoma Central Corporation, a leading provider of marine transportation services, today announced its results for the year ended December 31, 2016.

Fiscal 2016 highlights include:

Net earnings of $33.3 million and earnings per share of $0.86, increases of 29% and 30% respectively compared to 2015.

Earnings before interest, taxes, depreciation and amortization (EBITDA[1]) increased by $9.8 million to $89.3 million.

Collected all deposits together with accrued interest on cancelled shipbuilding contracts.

Acquired 2.5 ocean self-unloaders, doubling our interest in our international commercial pool.

Sold five buildings from our discontinued real estate business for total proceeds of $51.3 million.

Established NovaAlgoma Cement Carriers with our partner Nova Marine Carriers, marking our entry into short-sea shipping globally.

On December 29, 2016, the Algoma Innovator, the first of our new 650′ self-unloaders was launched by 3Maj Shipyard in Croatia. Subsequent to the year-end, on February 16, 2017, the Algoma Niagara, our first new 740′ self-unloader was launched at YZJ Shipyard in China.

“We are proud of the achievements of our employees in 2016,” said Ken Bloch Soerensen, President and CEO of Algoma. Mr. Soerensen continued, “Their efforts enabled the Company to deliver profitable results under difficult market conditions and advance our strategic priority of growing business in global short-sea shipping.”

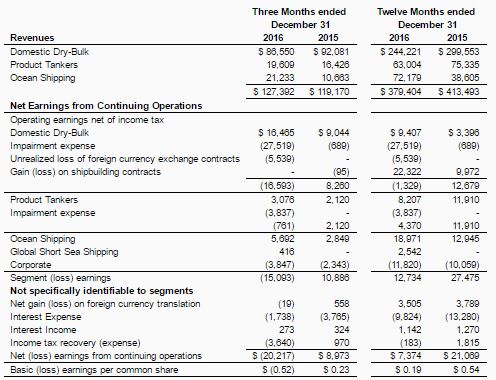

Net earnings from continuing operations, which excludes income from our discontinued real estate business, was $7,374 compared to $21,069 for 2015. Earnings for both years are affected by certain specific transactions and events, as follows:

Earnings for both years include gains related to the cancellation of shipbuilding contracts and the refund of progress payments made on those contracts. Fiscal 2016 results include a gain of $26,387 and fiscal 2015 includes a gain of $13,567.

Earnings for fiscal 2016 reflect a loss of $7,536 resulting from marking to market certain forward foreign exchange contracts that became ineffective as hedges for accounting purposes during the fourth quarter.

Earnings for fiscal 2016 are net of provisions totalling $42,661 related to impairment of the carrying value of our Domestic Dry-Bulk and Product Tanker fleets (2015 – $937) and $5,033 (2015 – $2,686) related to the accelerated depreciation on certain vessels scheduled for retirement.

Consolidated revenues for 2016 were $379,404 compared to the $413,493 reported for fiscal 2015. An increase in revenue in the Ocean Dry-Bulk segment resulting from an approximate doubling of our interest in the international commercial pool was more than offset by volume related decreases in Domestic Dry-Bulk and Product Tankers. Revenue of the Global Short-Sea Shipping segment, in which we participate via a joint venture, is not included in the consolidated revenue figure. Our Global Short-Sea Shipping venture generated revenues of $17,983. We have a 50% interest in this venture.

Results from continuing operations for the fourth quarter and for fiscal 2016 were as follows:

Cash Dividends

The Board of Directors has declared a dividend of $0.07 per common share to shareholders. This cash dividend will be paid on March 1, 2017 to shareholders of record on February 15, 2017.

In addition, the Board of Directors has approved an increase in the quarterly dividend to $0.08 per share beginning with the June 1st, 2017 dividend.

Source: Algoma Central Corporation

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional