China Said to Probe Speculation in Commodity Futures Rally

China’s top economic planner is investigating whether speculation has distorted commodity futures prices, due to concerns that the recent rally will drive inflation higher, according to people with knowledge of the matter.

The National Development & Reform Commission this month questioned futures brokers on whether distortion had occurred, said the people, who asked not to be identified because the information is confidential. The agency is worried over the potential impact on producer and consumer prices, they said.

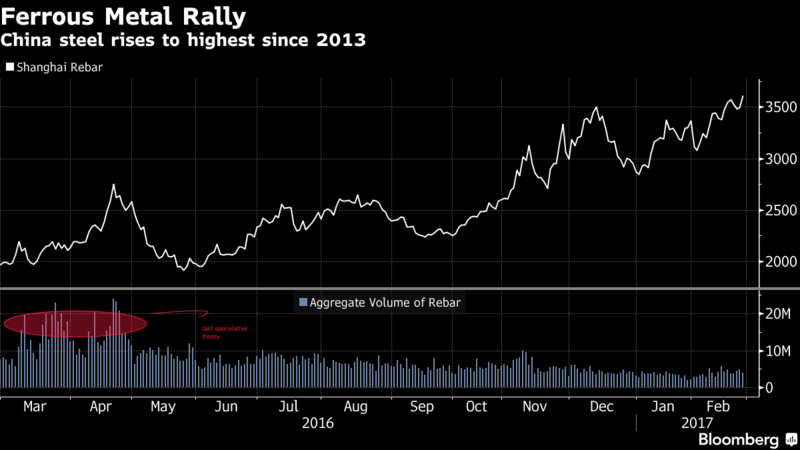

China tightened rules and raised fees on commodities trading last spring, as it sought to clamp down on a speculative frenzy that spurred a rapid run-up in prices and unprecedented volumes. Steel and iron ore futures have continued to rise on government stimulus, capacity cuts and a steadying in the economy of the world’s biggest metals consumer.

Steel reinforcement bar on the Shanghai Futures Exchange rose to its best level since Dec. 2013 on Monday, while iron ore on the Dalian Commodity Exchange was close to its May 2014 peak. However, trading in the contracts remains well below last year’s heady heights.

China doesn’t want inflated trading volumes, Fang Xinhai, vice chairman of market regulator, the China Securities Regulatory Commission, said at a briefing on Sunday, according to aan online transcript.

He said last year’s crackdown on speculation was “satisfactory” and that regulators will “stick to last year’s philosophy” when it comes to supervising futures. He added that the government will look at new measures to enhance pricing, such as attracting more industrial users to participate in the market.

The NDRC has also consulted with institutions including equity brokers on the outlook for commodity prices, according to the people. The agency didn’t respond to a fax seeking comment.

China’s producer prices in January increased the most since 2011 as mining products surged 31 percent year-on-year and raw materials rose 13 percent. The consumer-price index climbed 2.5 percent, beating analysts’ estimate of 2.4 percent.

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional