Norden Looks to Return to Profit in 2017

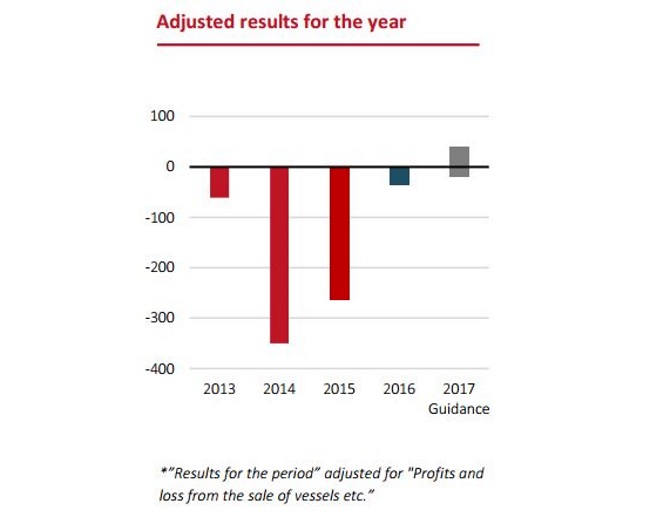

•Adjusted results for the year* 2016: USD -35 million (2015: USD -263 million) corresponding to EBIT 2016 USD -65 million (USD -282 million)

•Dry Cargo: Adjusted result for the year: USD -52 million (USD -364 million).

Q4: USD -13 million affected by extraordinary cost of USD 4 million in connection with restructuring of 2 T/C contracts.

•Tankers: Adjusted result for the year: USD 17 million (USD 101 million). Q4: USD -1 million.

•Earnings:

•Dry Cargo: 19% above the market

•Tankers: 7% above the market

•Cash and securities of USD 264 million (USD 366 million). Undrawn credit facilities of USD 250 million (USD 297 million)

•Total net commitments reduced by 37% to USD 620 million

•Vessel values: Upward-moving trend in Dry Cargo in the second half-year –decrease in the Tanker segment throughout the year.

•Operator activities in Dry Cargo increased by 7%.

•Expected adjusted results for 2017 for the group: USD -20 to +40 million based on an improving dry cargo market and a tanker market expected to be weaker than in 2016.

CEO Jan Rindbo in comment:

”In general, the markets developed as expected in 2016, and NORDEN positioned itself towards them also on the long term through a number of initiatives. We have focused and optimised the fleet, increased operator activities in Dry Cargo and reduced annual fleet operating costs by USD 15 million. This has not prevented a loss in 2016, but it plays a part in creating the foundation for the fact that the midpoint of our expectations for 2017 indicates a profit. In 2017, in Dry Cargo we will focus on taking advantage of expected improved markets and strengthening our operator activities, while in Tankers we are focusing on positioning ourselves towards possible market improvements after 2017.”

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional