Sovcomflot: Robust strategy delivering solid results despite market volatility in 2016

PAO Sovcomflot (‘SCF Group’), Russia’s largest shipping company and one of the world’s leaders in energy shipping, as well as in servicing offshore upstream oil and gas projects, has today announced its results for the full year to 31 December 2016.

2016 Highlights

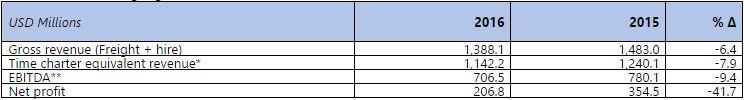

Gross revenue (freight and hire) of USD 1,388.1 million (2015: USD 1,483.0 million) vs the tanker spot market drop by more than 40 per cent and time charter market drop by up to 25 per cent

Time charter equivalent revenue[1] (TCE) of USD 1,142.2 million (2015: USD 1,240.1 million)

EBITDA[2] of USD 706.5 million (2015: USD 780.1 million)

Net profit of USD 206.8 million (2015: USD 354.5 million)

Three 42,000 tonnes DWT, double-acting, Arc7 shuttle tankers delivered to service Gazpromneft’s Novy Port export facility in the Ob River Estuary

Enhancing of SCF ice-fleet capacity by acquisition of nine modern ice-class tankers

Consolidation of all fleet technical management operations within a single governance structure under the new uniform brand SCF Management Services

Strengthening of Sakhalin 2 Icebreaking Support Vessel services with launch of Gennadiy Nevelskoy (IceBreaker6) and acquisition of two IBSVs from Swire Pacific Offshore, SCF Endeavour and SCF

Enterprise (IceBreaker ICE-10), extending the Group’s global leadership in the IBSV segment

Christophe de Margerie launched – 172,600 m3, innovative double-acting, Arc7 LNG carrier designed to serve Russia’s Yamal LNG project

Raising of USD 1.26 billion of debt capital including USD 750 million of unsecured public debt and USD 512 million of bank loans raised for purposes of funding the SCF fleet renewal programme and for the refinancing of maturing debt.

Sergey Frank, President and CEO of Sovcomflot said:

“Sovcomflot has delivered a solid set of results for 2016, despite market volatility in a year that has severely tested our industry. As growth in oil refinery throughput and up-front demand ran ahead of end-consumption underpinning tanker rates in 2015, so 2016 witnessed a material softening in demand that impacted negatively spot tanker freight rates, albeit with some respite in the final quarter.

“Sovcomflot strengthened its position as the World’s largest harsh environment tanker operator through the opportune acquisition of nine well-maintained tankers that became available as part of the PRISCO bankruptcy proceedings. Further, we built upon our leadership position in IBSVs with the acquisition two existing vessels and launched a new IBSV all committed to the Sakhalin II Project. In a year when we celebrated our tenth anniversary as an independent owner and operator of gas carriers, we launched the first of a new class of pioneering Arctic LNG carriers, in which our technical experts have played a vital developmental role.

“Our overall performance owes much to having a diversified fleet, where our conventional tanker operations are balanced by our strategic focus on higher value added market sectors, such as offshore development services and gas transportation. Serving the transportation needs of large scale industrial projects such as Sakhalin 1 and 2, Novy Port, Varandey, and Prirazlomnoye provides consistent earnings visibility to underpin tanker market volatility and ensures continuous employment for a significant proportion of our fleet. Reflecting this, we ended the year with substantial future contracted revenues of USD 8.1 billion.

“As ever, I am especially grateful to our seafarers and personnel for their professionalism and loyalty. This team, along with the continuous support of our core charterers, has made 2016 another year of solid performance for Sovcomflot.”

Evgeniy Ambrosov, Senior Executive Vice-President, Chief Operating Officer of Sovcomflot, commented:

“In 2016 we successfully introduced three advanced design Arctic shuttle tankers to serve the Novy Port project. These vessels were developed specifically to address the navigational year-round demands of the Ob River Estuary. Their introduction serves to demonstrate our desire to work closely with charterers to resolve complex maritime challenges for our mutual benefit. Later in the year one of these three vessels, Shturman Albanov, was awarded the world’s first Polar Ship Certificate.

“With our commitment to operating in some of the world’s harshest environments, in January we were particularly pleased to see the launch of Christophe de Margerie, the world’s first icebreaking LNG carrier. Together with other developments during 2016, it has strengthened Sovcomflot’s reputation as an owner and operator of some of the most advanced vessels afloat.

“2016 saw a strengthening of Sovcomflot’s position in the marine 3D seismic market, arising from further detailed survey work. During the year, the company successfully surveyed about 7.3 sq km of Arctic shelf, in cooperation with key Russian oil and gas majors, which obtained quality data despite the complicated geological-geophysical conditions.”

Igor Tonkovidov, Executive Vice-President, Chief Technical Officer of Sovcomflot, said:

“In 2016 we took the important step of consolidating all our technical fleet management activities under a single governance structure and overarching brand – SCF Management Services. This successful reorganisation draws upon the significant technical skills and heritage of our legacy technical management operations, whilst providing improved organizational effectiveness and efficiency associated with a larger unified operation. The new structure also allows us to better respond to the increasing complexity of international regulation’s impact on maritime operations.

“SCF Group continues to invest significant resources into in-house training of its crews and to enhance the proficiency of the support teams ashore. The structured development of this specialized expertise and skill base is a source of competitive advantage for Sovcomflot. It was no surprise, therefore, that in 2016 insight from the Group’s technical experts was sought for and provided to a wide range of international maritime initiatives, from developing pioneering new classes of ships (e.g. for Yamal LNG), to formulating the IMO’s Polar Code and developing policies through the Arctic Council. Underpinning our work, however, is our philosophy that whatever the operational context, ‘Safety Comes First.”

“SCF Group actively facilitates the use of LNG fuels in the marine transportation of commodities which will pave the way for a cleaner and more environmentally friendly shipping industry profile. This is very much in line with Company’s environmental policy especially in ecologically sensitive areas and matches well the aspirations of oil majors and the International Maritime Organization’s Marine Environment Protection Committee (MEPC) in their drive for cleaner fuels”.

Nikolay Kolesnikov, Executive Vice-President, Chief Financial Officer of Sovcomflot, commented:

“Last year the Group was successful in raising an additional USD 1.26 billion in debt capital. This has enabled the Group’s debt repayment profile to be significantly improved, and has covered our capital expenditure requirements. The deals include USD 512 million of long-term bank loans from Russian and international banks raised for purposes of funding the fleet renewal programme and for the refinancing of maturing debt.

Additionally last summer SCF Group returned to the international debt capital markets with a new USD 750 million seven year Eurobond offering to finance a simultaneous tender offer for the Group’s outstanding Eurobonds due in 2017. The new bond offering generated strong demand from investors and enabled very competitive pricing, with a coupon of 5.375 per cent which matched the coupon on the Group’s debut 2010 Eurobond issue, whereas the tender offer achieved one of the highest ever tender participation rates for borrowers from Russia of 83 per cent”.

2016 Full Year Financial Highlights

*Time charter equivalent (TCE) represents shipping revenues less voyage expenses and is commonly used in the shipping industry to measure financial performance and to compare revenue generated from a voyage charter to revenue generated from a time charter

**Earnings before interest, tax, depreciation and amortisation

Earnings per share for the year ended 31 December 2016 were USD 0.103 (2015: USD 0.173).

Dividends-per-share of RUB 3.04, for the year to 31 December 2016, were declared and paid on 30 June 2016 and 11 July 2016 respectively, amounting to RUB 5.97 billion – equivalent to USD 92.9 million (2015: RUB 0.57, totalling RUB 1.13 billion, equivalent to USD 20.5 million).

In 2016, the Group completed a series of debt fund raisings totalling USD 1.26 billion which covered fully Sovcomflot’s capex requirements. The deals include USD 512 million of long-term bank loans from Russian and international banks raised for purposes of funding the fleet renewal programme and for the refinancing of maturing debt. Additionally last summer SCF Group returned to the international debt capital markets with a new USD 750 million seven year Eurobond offering to finance a simultaneous tender offer for the Group’s outstanding Eurobonds due in 2017. These financing deals confirm the robustness of the Group’s business model and its proven ability to deliver throughout shipping cycle, and its sustained access to sources of capital through the cycle. At the close of 2016, Sovcomflot’s ratings from S&P and Moody’s were on par with Russian sovereign ratings (BB+ and Ba1 respectively), and Fitch rating stood at BB. The outlook on all ratings is currently ‘stable’

A full version of the consolidated financial statements of PAO Sovcomflot is available in the Investor section of Sovcomflot’s website: http://www.scf-group.com/en/investors/

2016 Business Segment Highlights

Crude Oil Transport: Time charter equivalent (TCE) revenue for the year ended 31 December 2016 was USD 477.4 million (2015: USD 542.1 million).

Oil Products Transport: Time charter equivalent (TCE) revenue for the year ended 31 December 2016 was USD 193.3 million (2015: USD 240.3 million).

Gas Transport: Time charter equivalent (TCE) revenue for the year ended 31 December 2016 was USD 140.6 million (2015: USD 137.5 million).

Offshore Development Services: Time charter equivalent (TCE) revenues for the year ended 31 December 2016 was USD 250.9 million (2015: USD 228.8 million).

Other: Time charter equivalent (TCE) revenues for the year ended 31 December 2016 were USD 79.8 million (2015: USD 91.4 million).

2016 Operating Highlights

In January, the world’s first Arctic LNG carrier was launched for Sovcomflot. Named Christophe de Margerie after the former CEO of Total SA who did so much to realize the Yamal LNG Project, this pioneering vessel will transport liquefied natural gas (LNG) from the Yamal peninsular. With a cargo capacity of 172,600 m3, the vessel has Arc7 ice class (RS) enabling her to break ice of up to 2.1 metres thickness and is packed with unique and ground breaking features designed for Arctic operations. The Christophe de Margerie is the prototype for a series of 16 Arctic LNG carriers, she will be the first to load at the Port of Sabetta on the Yamal peninsula providing start-up work for the Yamal LNG project for the subsequent vessels to follow. The vessel will be operated under a long-term time charter agreement between the SCF Group and the Yamal LNG.

Three new 42,000 tonnes deadweight, double-acting, ARC7 tankers were delivered over 2016 (Shturman Albanov, Shturman Malygin and Shturman Ovtsyn). These high specification shuttle tankers are being used to transport crude oil under long-term time charter to Gazprom Neft from the Novoportovskoye field on the Yamal Peninsula. The design of these vessels addresses the specific challenges of operating in the Ob River Estuary, especially the restricted depth (approximately 10 metres), and presence of ice from October to July. The three tankers can operate year-round at temperatures down to minus 45 degrees centigrade and are capable of breaking ice up to 1.8 metres thick. Later last year, Shturman Albanov became the first vessel to receive the Polar Ship Certificate. This Certificate, issued by the Russian Maritime Register of Shipping (RS) on 22 December 2016, confirms the vessel’s compliance with the requirements of the International Maritime Organisation’s Polar Code, which took effect on 1 January 2017.

The icebreaking supply vessel (IBSV), Gennadiy Nevelskoy (IceBreaker6) and named after a famous Russian Arctic explorer, was launched in June 2016. This reinforced IBSV vessel is the first of four ordered by Sovcomflot for operations at the Sakhalin-2 project under long-term time charter to Sakhalin Energy. The subsequent three to be delivered over 2017 are IceBreaking Standby Vessels (IBSVs), with a similar IceBreaker6 notation and equipped for carrying more maintenance personnel.

In September, the Group acquired two icebreaking supply vessels (IBSVs), operating on the Sakhalin-2 project, from Swire Pacific Offshore, allowing the Group to strengthen its global leadership in the IBSV segment.

On 26 September, SCF Group completed the acquisition of nine ice-class tankers from the bankruptcy process of Primorsk International Shipping Ltd. (“PRISCO”). This followed a successful bid to the American Court handling PRISCO’s bankruptcy case. The nine well-maintained vessels acquired by SCF Group, for USD 215 million, included one crude oil Aframax tanker, three LR2 oil product tankers and five MR oil product tankers. The transaction has allowed Sovcomflot to further consolidate its position as the world’s biggest owner and operator of ice-class tankers.

In November, the Group celebrated its tenth anniversary as an independent operator of gas carriers, since its first LNG (liquefied natural gas) carrier joined its fleet on 7 November 2006. The commencement of gas carrier operations marked a breakthrough for Sovcomflot, into a new market segment which had been previously inaccessible to Russian companies. Currently, the Group’s fleet includes eight LNG carriers and four LPG (liquefied petroleum gas) tankers. These vessels serve well-known global charterers such as Gazprom Marketing & Trading, Sakhalin Energy, Shell, Tangguh LNG, Trammo, and Sibur.

Awards

Last year, Sovcomflot and its operations received international industry recognition for its operations, people and vessels.

In July, Sovcomflot received an environmental achievement award in recognition of its excellent fleet performance by the Port of Long Beach (California, USA) Green Flag Program in 2015. This voluntary programme was set up to reduce the atmospheric emissions of vessels by encouraging ships to slow down when approaching the port. A commemorative Green Flag is granted to operators that demonstrated that 90 per cent or more of all their vessel trips complied with the Program, slowing down to 12 knots (22 km/h) or less within 20 or 40 miles (32 to 64 km) of the Long Beach harbour.

In December, the Group received an award from the US Coast Guard in recognition of the 29 company vessels that participate in the AMVER (Automated Mutual-Assistance Vessel Rescue System) programme. Founded in 1958, AMVER is a computer-based voluntary reporting network of vessels for responding to emergencies at sea.

In 2016, the Group received two industry awards from Marine Money, an international ship financing publication. Nikolay Kolesnikov, Executive Vice President & CFO of Sovcomflot, was recognised as the ‘Dealmaker of the Year 2015’, while a 14-year USD 340 million long-term credit facility agreement, signed between Sovcomflot and Sberbank CIB in December 2015, was named ‘The Project Financing Deal of the Year 2015 – West’.

Meanwhile, Sovcomflot and its vessels were also shortlisted for awards by a diverse range of other organisations, including a Safety Award as part of the 2016 Lloyd’s List Global Awards and the Group was a highly-commended finalist in the ‘Industry Leadership’ category of the 2016 Platts Global Energy Awards.

Fleet Management

In August, the Group announced the successful consolidation of its technical management subsidiaries, responsible for the management of the Group’s fleet, within a new single governance structure. Following this consolidation, the Group’s technical management companies were rebranded and fully unified under the umbrella brand SCF Management Services.

This consolidation followed the celebration in March of the 25th anniversary of the Group’s fleet technical management subsidiary SCF Unicom, at an event in Limassol, Cyprus. The event was attended by Nicos Anastasiadis, President of the Republic of Cyprus and other distinguished guests.

As at 31 December 2016, Sovcomflot’s fleet comprised 146 owned and chartered vessels (including vessels in joint ownership with third parties) amounting to over 13.0 million tonnes DWT in total.

Vessels under construction as at 31 December 2016 comprised: one ice breaking LNG carrier; one multi-functional supply vessel (IBSV); three IBSVs (standby vessels). All the vessels are scheduled for delivery by November 2017.

Source: Sovcomflot

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional