Brazilian Crude Trade: An Unexpected Journey?

Brazil has often found itself appearing in the energy sector headlines in recent years, but not always for the most positive reasons. During this time Brazilian oil trade dynamics have altered considerably, and while these changes have partly been influenced by unexpected events, the overall impact appears to have had benefits for crude tankers.

The Golden Age?

In the late 2000s there was plenty of positivity surrounding the Brazilian oil industry. The Brazilian economy had been expanding briskly, by an average of 3.6% p.a. in 2000-07, and by the end of this period Brazil was the world’s 10th largest economy. Brazil’s first pre-salt offshore oil field, Lula, was discovered in late 2006, with 8.3bn barrels of oil reserves – over three times the size of Brazil’s next largest field, Marlin. This and later pre-salt discoveries led to hopes of Brazil becoming a world leading oil producer, reducing its need to import crude. However, the good times didn’t last, with the economy falling into recession by 2014. Then, the double whammy of the oil price drop and the Petrobras scandal in late 2014 meant that the company’s targets for offshore oil production were revised down, with the current aim for output in 2018 standing at around half of the 4.2m bpd expected by that year back in 2010.

Imported Affairs

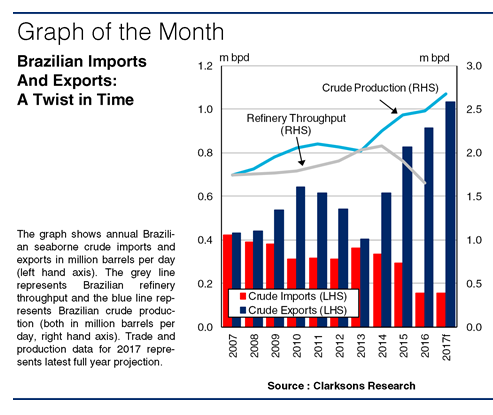

However, Brazilian crude output still began to grow strongly as more pre-salt fields came online and Petrobras focussed more on production. In 2013-16, Brazilian oil production rose by 0.45m bpd to nearly 2.5m bpd. Whilst this increase in output was not as large as had initially been expected, it has still started to drive changes in crude trade. As output of lighter pre-salt oil has risen, the need to import light crude for blending with heavy domestic grades has fallen and Brazilian crude imports dropped by 47% to 0.16m bpd in 2016. Imports have also been undermined by lack of funding in the refinery sector, leading to maintenance slippage and throughput falling by an average 11% p.a. in 2014-16.

The Final Destination?

Reduced throughput also contributed to an excess of crude available for export, and Brazilian crude exports grew at an average 32% p.a. in 2013-16 from 0.4m bpd to 0.9m bpd. As a result of changing demand trends in major oil importers, the average haul of Brazilian exports has also risen significantly over the past decade. In 2007, the US took the lion’s share of Brazil’s crude, over 35%, while Asian importers accounted for just 12%. However, by 2016, there had been a complete role reversal, with the US importing around 12% and the tranche of Brazilian crude heading to Asia exceeding 45%. As a result, in 2007-16, whilst total Brazilian crude imports and exports increased by 16% in tonnes, trade in terms of tonne-miles grew by an estimated 47%.

So, Brazilian crude trade has been an intriguing saga in the past decade. Against a backdrop of many exporters cutting oil output, Brazilian exports could be on track to top 1m bpd in 2017. Whilst times have been tough for Brazil as of late, overall, recent trends in its oil sector appear to have provided positive impetus to crude tanker demand.

Source: Clarksons

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional