Asia Fuel Oil-Falling inventories lifts cash differentials to 4-week high

Market sentiment improved on Thursday after official data showed onshore fuel oil inventories in Singapore fell to a six-week low, lifting cash differentials and narrowing the prompt month contango structure of 380-cst fuel. SINGAPORE INVENTORIES – For the first time in four weeks, Singapore onshore fuel oil inventories fell below the 4 million tonne mark in the week to March 29 after shrinking 6 percent, or 247,000 tonnes, from the previous week, the latest official data showed.

In a sign of easing arbitrage inflows, imports into Singapore fell for a third consecutive week, down 20 pct from the previous week, to their lowest since the start of the year at 936,000 tonnes.

But a 38 percent decline in exports to 447,000 tonnes over the past week helped lift net imports up 9 percent from the previous week to 489,000 tonnes.

WINDOW TRADES

Two 380-cst fuel oil cargoes traded in the Platts window totalling 40,000 tonnes, one in the front of the trading window and another in the middle.

Stronger buying interest lifted cash differentials of the 380-cst fuel to a 4-week high of minus 18 cents a tonne to Singapore quotes, 39 cents a tonne narrower from the previous session.

PAPER MARKETS

The ICE traded 380-cst April/May time spread narrowed its contango structure by 15 cents a tonne from the previous session to minus 5 cents a tonne by 1700 Singapore time (0900 GMT) amid active trade totalling more than 735,000 tonnes worth of the fuel, sources said.

Falling crude prices narrowed Singapore’s April 180-cst fuel oil discount to Dubai crude by 9 cents a barrel from the previous session to minus $4.05 a barrel.

REFINERIES

Kuwait National Petroleum Company’s (KNPC) total refining capacity will fall to 0.746 million barrels per day (mbpd) after the closure of its ageing 0.2 mbpd Shuaiba refinery on April 1, its chief executive, Mohammad Ghazi al-Mutairi, said on Thursday.

Source: Reuters (Editing by David Evans)

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

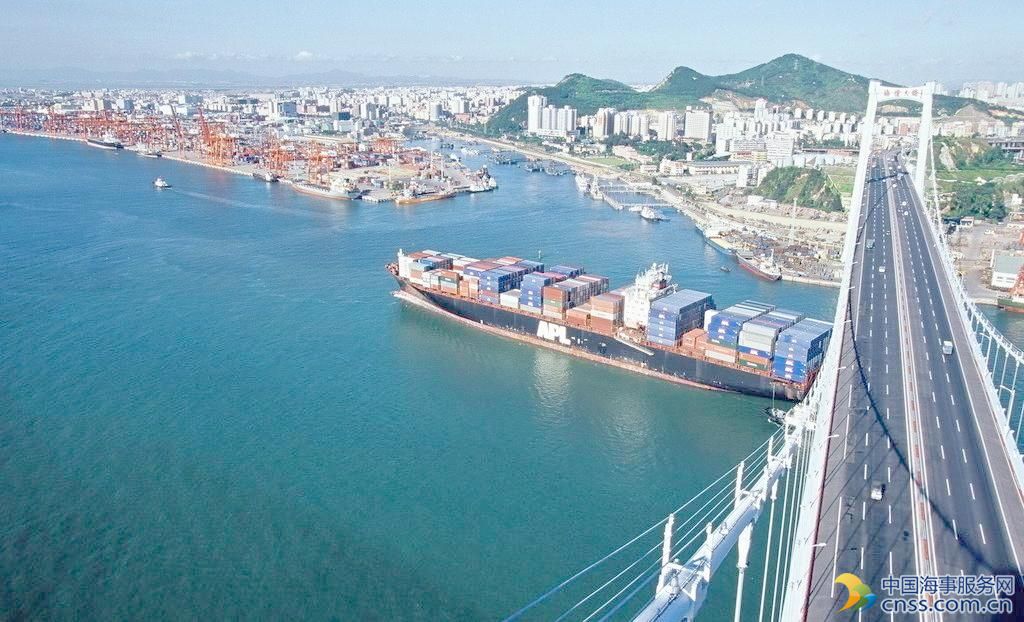

- China continues seaport consolidation as Dalian offer goes unconditional