US oil export surge steals more OPEC share

As OPEC tries to keep oil off the world market, U.S. oil producers are pouring more onto it.

The U.S. last week sent more than 1 million barrels a day of crude out of the country, the third biggest export week ever, and double the average amount exported in 2016. It is also the third time this year that U.S. exports exceeded a million barrels a day, an industry record.

“It should be somewhat supportive of [U.S. oil prices] in the short run, particularly if the exports keep up. But it obviously is a challenge for the global market and a renewed threat to OPEC and their designs of keeping prices up,” said John Kilduff of Again Capital

While the U.S. exported oil, it also exported fuel last week — a steadily growing business. The U.S. sold 1.1 million barrels of diesel fuel, in line with the recent average, but 608,000 barrels a day of gasoline, up from less than 400,000 barrels a day a year ago.

Analyst say the jump in exports means U.S. producers are grabbing more share at the expense of OPEC and its partners, at a time when the cartel and other producers are considering whether to extend their deal to hold 1.8 million barrels of oil off the market.

But the U.S. may also be seeing the early signs of a potential rebalancing of its own supply picture, and that could ultimately help clear a logjam of domestic oil barrels.

“What we’re now seeing in the U.S. is refinery utilization increasing, as the maintenance season draws to a close. At the same time, there’s good demand for gasoline and diesel which is helping get inventories under control. Those product inventories are less than they were this time last year,” said Andrew Lipow, president of Lipow Oil Associates.

U.S. refineries supplied 9.5 million barrels a day of gasoline last week, up from 9.2 million the week earlier. Refinery runs increased by 425,000 barrels a day.

The government’s weekly data also showed a drop in U.S. gasoline supplies of 3.7 million barrels, nearly 2 million more than expected, and a decline in U.S. diesel inventories fell by 2.5 million barrels, double the forecast. Crude oil inventories rose 867,000 barrels last week, half of what was expected, and at the Cushing, Oklahoma, storage hub, crude stocks fell by 220,000 barrels.

Oil prices, as a result jumped, with West Texas Intermediate futures rising 2.4 percent to $49.51 per barrel. Prices were also boosted by disruption in Libyan supply.

Record high U.S. oil supplies led to a glut of U.S. refined products, which had been a negative factor for crude prices this winter. The oversupply coincided with the refining industry’s “shoulder season,” the time of year when refineries shut down for maintenance and to switch over to summer-grade fuels.

Some analysts say the gasoline glut of February now appears to be clearing and could be setting up for strong demand in April. That means refinery demand for crude will also rise.

“I’m pretty confident we’re going to get a run higher in crude and we’re going to get a run higher in gasoline. April is going to set the tone in the second quarter,” said Tom Kloza, global head of energy analysis at Oil Price Information Service. Kloza said prices of both should rise as demand goes higher.

Kloza said April typically sees a lift in gasoline demand over March, and on average it’s been about 100,000 barrels a day during the past 10 years. But last April, demand ran counter the normal trend and actually fell.

“I think when you look at vehicle miles traveled and you look at car sales, we had a funky start to the year,” said Kloza. “I think April will see considerably higher demand than March, if you throw in the wild card of exports as well as imports, you have enough tinder there to spark an increase in gasoline prices,” he said.

Last week’s bump in exports comes as the U.S. also lowered the amount of crude it imported. The U.S. bought 7.2 million foreign barrels a day, mostly from Canada. Those imports are just about the same level as the four-week average but down from the prior week’s 7.8 million barrels a day. The U.S. also produced 9.1 million barrels a day, a recent high.

“The bottom line is imports edging lower and exports edging higher. That’s all positive for crude, not to mention crude runs,” said Michael Wittner, global head of oil research, at Societe Generale. “This is what’s going to turn the U.S. crude stocks situation around. Net imports and crude runs going up. … Imports on their own should be edging down and exports should be increasing. Put the two together. I think it’s pretty positive. It’s constructive.”

The monitoring committee of OPEC and its nonmember partners met this past weekend in Kuwait. The committee agreed to review whether a global pact to limit supplies should be extended by six months, it said in a statement Sunday

Kilduff said he was skeptical that the U.S. market is really swinging toward rebalancing. “Certainly if it keeps up at this pace, you would think it would help the balance. But we were up again in the lower 48 states in terms of production,” he said.

OPEC has said there are signs of rebalancing elsewhere in the world, but that the market is heavily focused on U.S. data, which shows a stubborn glut.

“There are signs elsewhere that some inventories are getting liquidated, like for storage in South Africa, we’re seeing oil come out. We don’t see floating storage of crude oil in the North Sea so there are some signs that things may be getting better for OPEC,” Lipow said.

Restrictions on U.S. oil exports were removed in late 2015, when very few exports were allowed but most went to Canada. In 2015, 92 percent of U.S. exports went to Canada, but in 2016, just 58 percent went to Canada, though it was still the largest export market for crude.

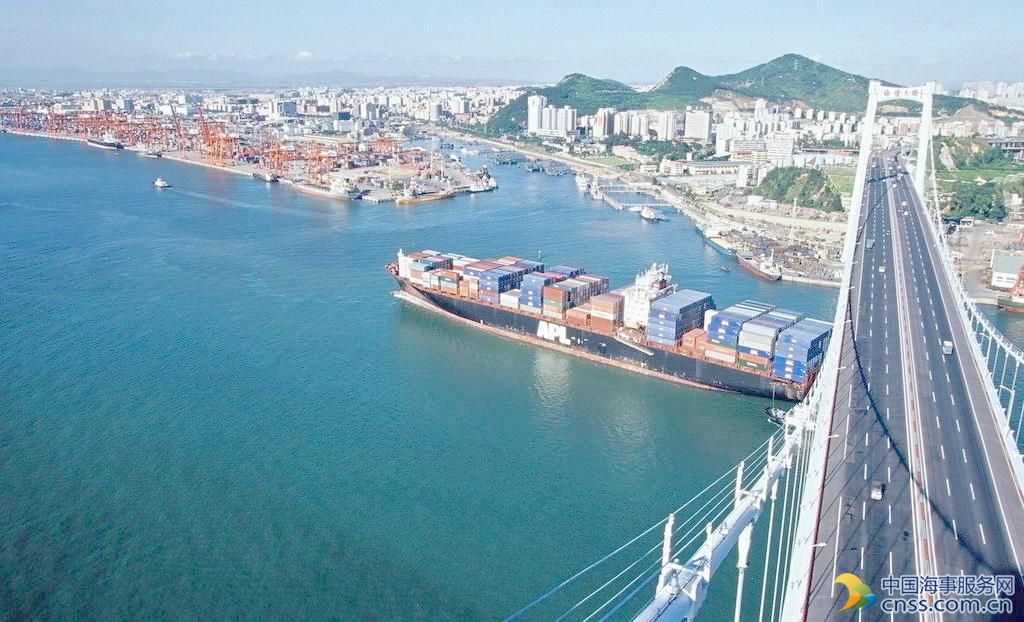

The U.S. exported oil to 26 different countries in 2016, up from 10 the year earlier. According to government data, oil went to European destinations such as the Netherlands, Italy, the United Kingdom and France. Curacao was the second-largest destination and China was the third.

Source: CNBC

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional