Asian met coal prices skyrocket 32% overnight

Spot met coal prices in the Asia-Pacific region soared Wednesday as mills jostled for cargoes amid news that BHP Billiton, the world’s largest met coal producer, declared force majeure due to logistical problems caused by Cyclone Debbie.

S&P Global Platts assessed Premium Low Vol FOB Australia up $58.50/mt, or 32%, to $241/mt FOB Australia Wednesday, the largest daily rise since the assessment began in 2010, and greater than the $35/mt hike on January 14, 2011, caused by Cyclone Yasi.

“The [premium coking coal] market is going berserk,” one source said, with “all traditional market players hunting for cargoes.”

The source said Wednesday evoked memories of Cyclone Yasi in 2011.

The source indicated BHP’s declaration of force majeure was an important signal and trigger that sent global steelmakers scrambling for non-Queensland met coal supply.

This followed force majeures declared by Yancoal, Qcoal and Jellinbah Group. One steelmaker said that while other miners had not publicly declared force majeure, they had already declared it on a “cargo-by-cargo basis.”

Firm market demand was reflected by the flurry of spot trades for met coal from several swing suppliers — Canada, the US, Russia and China — for a wide spectrum of products.

The buyer pool also appeared to be diverse, with Northeast Asia, India and Europe all understood to have purchased cargoes.

Related blog:Situation room: Cyclone Debbie hits world’s metallurgical coal capital

GLOBAL SUPPLY SHORTAGE

The wide geographical range of trades points to the global magnitude of the supply shortage faced by the market.

This was reflected in bid indications from end-users Wednesday. The highest indicative bid was $240/mt FOB Australia for premium HCCs by a large international steelmaker.

Another international steelmaker saw a price range of $200-$250/mt FOB Australia as a bid indication due to a scarcity of resources.

Mirroring these bid indications were trades done, or very close to being done.

One was for a premium coal of Australian origin re-exported from Chinese ports at $240/mt FOB China. The volume was said to be 60,000 mt.

Another was Chinese premium HCC with CSR over 70% at above $260/mt FOB China, for 60,000 mt for an April laycan.

“The price is high because there are no coals,” a market source said.

A steelmaker said: “Some of our shipments have been canceled. The problem [shortage] is real.”

Other premium HCCs were also traded, with more than two trades of Canadian coal, though all on a floating price basis.

In the second-tier segment, there were no trades being done, but a sell-side source indicated he would increase his offer price by $13/mt day on day for non-Australian HCC with 55-60% CSR.

There was a spot offer for US coal with 62-63% CSR, 29-30% VM and 0.9% sulfur at $205/mt CFR India. This was for a Panamax cargo for an April 10-20 laycan.

In the semi-soft market, a supplier raised his offer by $35/mt day on day to $130/mt for 39-40% VM, 5-6% ash coal, saying inquiries had now risen.

“We’re expecting some inquiries from China, and there have been ones from India and Japan. There just isn’t much coal available,” he said.

One major Asian steelmaker said he would bid $130/mt for 36-39% CSR, 34-36% VM semisoft coal.

The PCI market, in contrast, saw the smallest uptick.

A spot trade was done for Russian material with 19-21% VM, below 10% ash, 0.3-0.5% sulfur and around 65-75 HGI at around $125/mt CFR India, for an April 5-15 laycan.

MILLS ACQUIESCE TO LARGE COKE RISE

In the metallurgical coke segment, a major North China-based coke maker was heard to have raised its prices by Yuan 80/mt, with no pushback from steelmakers.

The met coke export market also saw stronger inquiries, in particular from the international market because of the impact of Cyclone Debbie, participants said.

This was because some steelmakers were turning attention to importing met coke, rather than coking coal, should supply be tight.

One coke supplier indicated he had received very strong inquiries Wednesday morning from multiple sources seeking cargoes.

The most competitive offer heard Wednesday was $303-$305/mt FOB China for 64/62% CSR material.

MILLS TRY TO COPE WITH SURGING COSTS

Steelmakers surveyed Wednesday indicated there could be several ways in which they could try to cope with surging met coal costs.

In the short term, the easiest option would be to seek alternative supplies of met coal, two steelmakers said.

Should they fail, options could include temporarily downgrading met coke quality due to the scarcity of premium HCCs.

Slowing the coking time in the coke ovens could also help to reduce met coal usage. Some steelmakers indicated increasing PCI injection rates could also help to reduce met coke consumption.

The least favored option, in the short run, could be steel production cuts or importing Chinese met coke, several steelmakers said.

Source: Platts

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

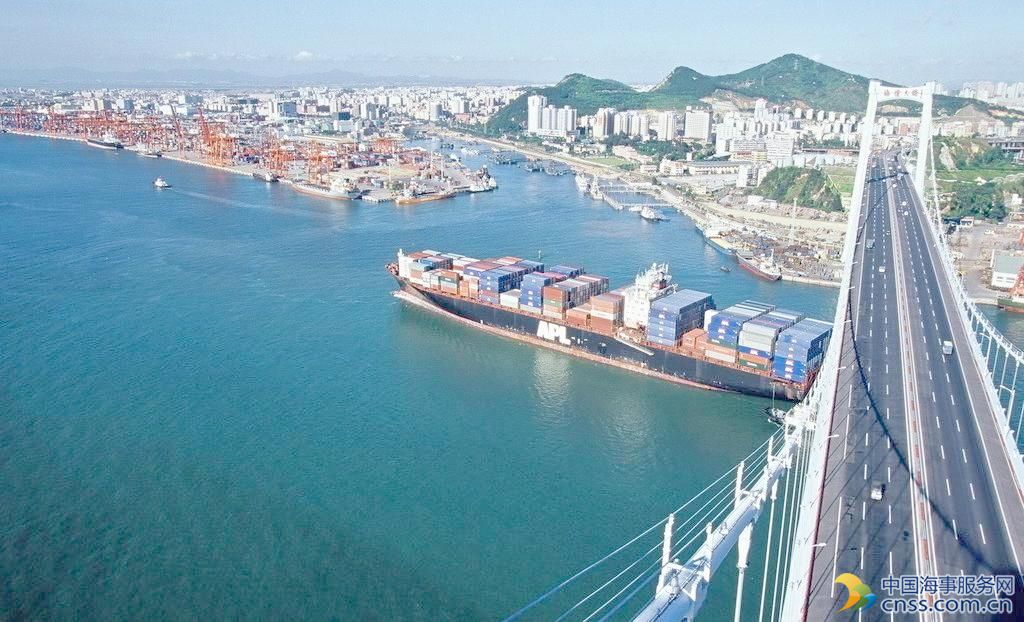

- China continues seaport consolidation as Dalian offer goes unconditional