China’s economic picture brightens as trade beats forecasts, Trump softens tone

China’s 2017 export outlook brightened considerably on Thursday as it reported forecast-beating trade growth in March and as U.S. President Donald Trump softened his anti-China rhetoric in an abrupt policy shift.

Washington’s improving ties with Beijing were underscored when Trump told the Wall Street Journal in an interview on Wednesday that he would not declare China a currency manipulator as he had pledged to do on his first day in office.

The comments were an about-face from Trump’s campaign promises, which had rattled China and other Asian exporters, and came days after his first meeting with President Xi Jinping where he pressed China to help rein in North Korea.

China’s exports rose at the fastest pace in a little more than two years in March, climbing 16.4 percent from a year earlier in a further sign that global demand is improving, the customs office reported on Thursday.

“There are increased signs of warming up in the global economy”, which helped China’s steady growth in the first quarter, Yan Pengcheng, a spokesman for the country’s top economic planning agency, told a news conference.

Import growth remained strong at 20.3 percent, driven by the country’s voracious appetite for oil, copper, iron ore, coal and soybeans, whose volumes all surged from February despite worries about rising inventories.

China’s crude oil imports hit a record high of nearly 9.2 million barrels per day, overtaking the United States.

The stronger trade data reinforced the growing view that economic activity in China has remained resilient or is even picking up, adding oomph to a global manufacturing revival, though analysts say growth in imports could slow.

“Right now domestic demand is still quite stable and robust. But the ultimate driver actually is property investment (which) we expect to slow,” Nomura economist Yang Zhao said.

Zhao expects import growth will moderate to the high-single digits in the second quarter.

Imports had surged 38 percent in February while exports unexpectedly dipped, but China’s data in the first two months of the year can be heavily skewed by the timing of the Lunar New Year holidays, when many businesses shut for a week or more.

Analysts polled by Reuters had expected March exports to have increased by 3.2 percent from a year earlier, a rebound from a 1.3 percent drop in February.

Imports had been forecast to rise 18.0 percent, after surging 38.1 percent in February.

China reported a trade surplus of $23.93 billion for March.

Analysts had expected the trade balance to return to a surplus of $10.0 billion in March, after it reported its first trade gap in three years in February.

SOLID FIRST QUARTER TRADE PERFORMANCE

China’s exports in the first quarter of the year rose 8.2 percent from the same period last year, while imports surged by 24.0 percent. The first-quarter surplus was $65.61 billion.

Despite the strong readings, China’s customs office said the trade situation remains complicated and that challenges facing exporters are not short-term.

A shadow has fallen over the trade relationship between China and the United States, its largest export market, as Trump has railed against the massive trade imbalance between the two countries, which was $347 billion in favor of China last year.

China’s exports to the U.S. rose 19.7 percent in March on-year, while imports from the U.S. rose 15.1 percent.

But China’s trade surplus with U.S. remained high in the first quarter at $49.6 billion, down only slightly from $50.57 billion in the year-ago period.

Customs spokesman Huang Songping said on Thursday that better communication between China and the United States will benefit trade and investment between the two countries.

Trump urged Xi to help reduce the gap at last week’s meeting, with the countries agreeing to a 100-day plan for trade talks aimed at boosting U.S. exports and reducing China’s surplus with the United States.

“The risk of an explicit trade war has waned subsequent to the Trump-Xi summit,” economists at ANZ said in a note.

But uncertainties remain, with rising tension on the Korean peninsula leading Trump to link trade negotiations to China’s actions with regards to North Korea’s nuclear weapons program.

Despite Trump’s comments backing away from labeling China a currency manipulator, many analysts reckon the new administration is just beginning to flex its trade muscles with Beijing and other major trading partners.

The U.S. launched a probe to determine whether imports of Chinese aluminum foil should be subject to anti-dumping and anti-subsidy duties on March 27.

China’s economic growth remained stable in the first quarter of 2017, but it’s too early to tell whether it can be sustained, the National Development and Reform Commision (NDRC) said on Thursday.

China will report first-quarter growth data on April 17, along with March industrial output, investment and retail sales.

Analysts polled by Reuters forecast China’s economy likely grew by a solid 6.8 percent in the quarter, the same pace as the previous quarter, due to sustained government infrastructure spending and a gravity-defying housing market which is feeding a months-long construction boom.

But it is widely expected to lose steam later in the year as the impact of earlier stimulus starts to fade and as local authorities step up their battle to rein in hot housing prices.

If sustained, stronger exports could cushion some of the impact from any softening in domestic demand.

Source: Reuters (Reporting by Yawen Chen and Elias Glenn; Additional reporting by Kevin Yao; Editing by Kim Coghill)

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

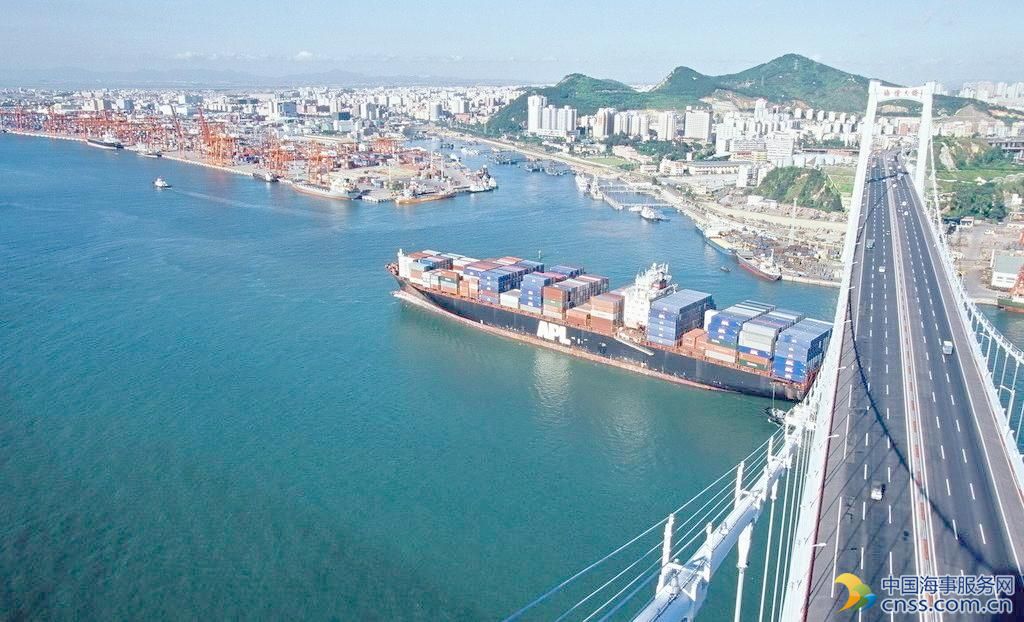

- China continues seaport consolidation as Dalian offer goes unconditional