Worst of Both Worlds as Aussie Bucks China-Driven Drop in Iron Ore

Australia is caught in a disconnect between the trajectory of its key commodity export and a currency that refuses to follow suit, constricting an economy that policy makers are trying to stimulate.

Iron ore has slumped 30 percent since Chinese Premier Li Keqiang signaled plans March 5 to cut his nation’s steel capacity; the world’s No. 2 economy is Australia’s biggest trading partner and iron ore exports account for more than 3 percent of gross domestic product Down Under. The Aussie dollar, meanwhile, has barely budged in the past month as it trades around the 75 U.S. cent mark.

“Really, it should be going lower,” said Andrew Ticehurst, a rates strategist at Nomura Australia Ltd. in Sydney, who notes a declining U.S. dollar is helping prop up the Aussie. “If commodities are falling appreciably and the currency’s not offsetting it, that’s a net tightening in financial conditions and becomes more of a headwind.”

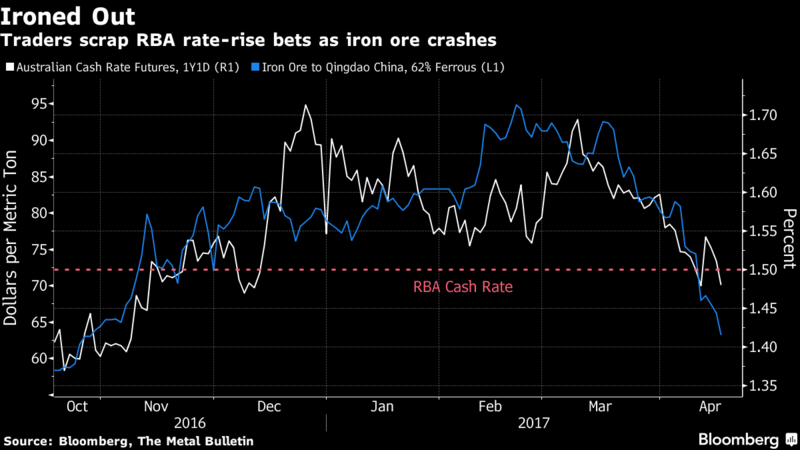

Meanwhile, interest-rate bets have moved: traders are now pricing in a one-in-five chance the Reserve Bank of Australia will end a pause in September and lower interest rates by a quarter point from the current 1.5 percent. That’s a turn away from the consensus view: that policy makers can’t cut for fear of further inflating property prices and household debt; and can’t tighten to contain the housing market because weak employment, record-low wage growth and subdued inflation suggest it would hurt the economy.

Iron ore has had a volatile 18 months: it slumped to a low of just over $38 in December 2015, then steadily rebounded until it reached a peak of just under $95 in February this year; it has since slumped to a bit over $63.

The RBA’s Head of Economic Analysis Alexandra Heath earlier this month pointed to the policy-driven nature of Chinese demand — how authorities in Beijing can ramp it up or cool it down. Li’s announcement of a target of cutting about 50 million tons of steel capacity this year pulled the floor out from the iron-ore price in March, particularly as his goal is part of a plan to reduce steel capacity by 150 million tons through 2020.

The disconnect between the Australian dollar and iron ore is unusual for the small, commodity-based trading economy. Matthew Peter, chief economist at QIC Ltd. in Brisbane, says one of the reasons the currency may not be declining now is that it didn’t run up that much during last year’s iron ore rally.

“The market was never factoring in fully the sustainability of the iron ore prices at the peaks they reached,” said Peter, who estimates the currency should be trading lower. “Part of that is just the Aussie dollar following a longer-term trend in iron ore prices rather than just following the spot price.”

The other issue is the Federal Reserve’s policy outlook. As the U.S. tightens and its interest-rate discount to Australia narrows or evaporates, that could change the dynamic.

“That should put downward pressure on the Aussie dollar,” Peter said. “It needs to shrink to around 70 cents in our view to be consistent with the Australian economy getting back to trend over the next two years.”

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional