Goldman Sees China Reviving Metals Bogged Down by Global Angst

After a rough ride over the past month, metals could be on the verge of a recovery. And it’s thanks to China, according to Goldman Sachs.

The upside will stem from a reduction in overcapacity, strong Chinese property sales — a key driver of the increase in metals demand last year — and a rebound in the country’s fixed-asset investment, Goldman analysts including Max Layton wrote in an April 20 note.

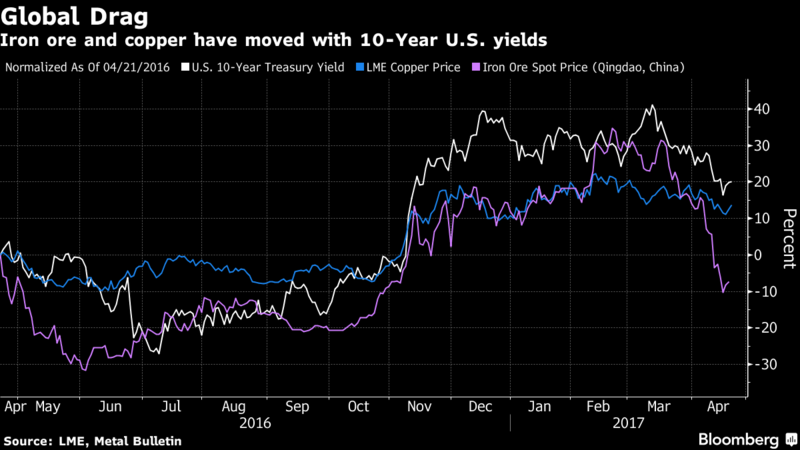

They put the recent selloff down to bearishness over the global outlook. Stalled policy stimulus in the U.S., tightening in China’s money markets, property curbs and a crackdown on off-balance-sheet lending — plus the French election and North Korea tensions — have hurt global risk sentiment, the analysts said, highlighting the correlation between iron ore, copper and 10-year Treasury yields.

“Although downside risks clearly remain elevated, our base case is that these risks will not materialize in a manner bearish for the markets,” Layton and his colleagues wrote. “While the market has been focusing on downside risks to Chinese and global growth – we highlight a major upside risk to metals demand coming from the Chinese property market.”

The analysts said they remain “constructive” on the outlook for copper fundamentals and expect refined copper supply growth to slow sharply. A lack of technical support is a very near-term downside risk, but strength in Chinese property and related sectors including consumer appliances should boost the metal, they said. Goldman is also bullish on aluminum due to supply-side reforms.

Although it’s rallied in the past three days, iron ore has been hit hard this year, sliding 28 percent from a peak in February to a five-month low this month. China is the world’s biggest consumer of the steel-making ingredient.

While the market has been “particularly concerned about the unwind in Chinese steel and iron ore prices,” the Goldman analysts said rebar margins remain solid. The selloff in steel is largely due to a higher level of supply and weak export growth, they said.

As the “reflation trade” ignited by Trump’s victory faded, it took down metals and iron ore, said Commerzbank AG economist Zhou Hao in Singapore. “Investors place their chips when global growth sentiment improves and sell them if reflation fades away.”

Goldman said 10-year Treasury yields indicate the recovery in metals could endure. The yield, which has moved with iron ore and copper prices since Donald Trump’s election in November, should rise to 2.65 percent by June, the note said.

While Goldman sees Chinese economic growth slackening this year, metal prices probably won’t be affected because supply will slow over the next three to six months, the analysts said. There has also been a recent pullback in copper net speculative positioning, suggesting that some slowdown in Chinese manufacturing activity is already priced in.

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional