Russia indicates it can lift oil output if deal on curbs lapses

Russian oil output could climb to its highest rate in 30 years if OPEC and non-OPEC producers do not extend a supply reduction deal beyond June 30, according to comments by Russian officials and details of investment plans released by oil firms.

The Organization of the Petroleum Exporting Countries, along with Russia and other non-OPEC producers, pledged to cut 1.8 million barrels per day (bpd) in output in the first half of 2017.

With global inventories still bulging, Gulf and other producers have shown increasing willingness to extend the pact to the end of 2017. Saudi Arabia and Kuwait signalled last week they were ready to prolong cuts.

Russia, whose contribution to the cuts was 300,000 bpd, has yet to state publicly whether it wants cuts to run beyond June, although Moscow was represented on a panel monitoring the pact that on Friday recommended an extension.

But Russian officials have also indicated that local oil companies were ready to push up output once the pact runs out.

“According to investment programmes of (Russian) companies, it is possible Russian oil production will increase once the deal expires,” Deputy Prime Minister Arkady Dvorkovich said, adding firms had been held back while the deal was in place.

“If there are no restrictions, they will decide not to hold back,” he said, speaking at the weekend on the sidelines of an economic conference in the East Siberian city of Krasnoyarsk.

He did not give figures, but Energy Minister Alexander Novak told Reuters in March that output could reach 548 million-551 million tonnes a year in 2017, equivalent to 11.01 million-11.07 million bpd, the highest average since 1987.

In 2016, Russia produced about 547.5 million tonnes, or an average of 10.96 million bpd.

Under the deal with OPEC, Russia was to cut production to 10.947 million bpd from 11.247 million bpd, the level achieved in October 2016 that was the highest in the post-Soviet era.

NEW OILFIELDS

Although Russia has not said publicly it wanted cuts extended, Novak has said he would meet Russian oil companies this month to discuss the issue. He also said an extension would be discussed with OPEC on May 24.

Without an extension, Raiffeisenbank analyst Andrey Polishchyuk forecast Russian output rising about 2 percent in the second half of 2017 to a peak of about 11 million bpd.

“That’s because we have new oilfields,” he said.

Projects and statements by Russian firms also indicate they are ready to increase output once restraints are lifted.

Russia’s biggest oil producer Rosneft has said it plans to boost output this year thanks to newly acquired oilfields, including Kondaneft group of fields in Western Siberia, the heartland of Russian production.

The company had targeted 2 percent annual output growth in 2015-2017. Without any acquisitions, that would push 2017 production to more than 214 million tonnes, or 4.3 million bpd.

Lukoil, the country’s second-largest producer, has said it sees its oil output rising slightly if the global deal is not extended and could restore production to its pre-deal level in three to four months.

Mid-sized producer Tatneft said it expected to increase 2017 output by 0.5 million tonnes a year, or about 10,000 bpd, if the global production pact lapsed.

Source: Reuters (Additional reporting by Olesya Astakhova in Moscow and Polina Nikolskaya in Krasnoyarsk; Editing by Edmund Blair)

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

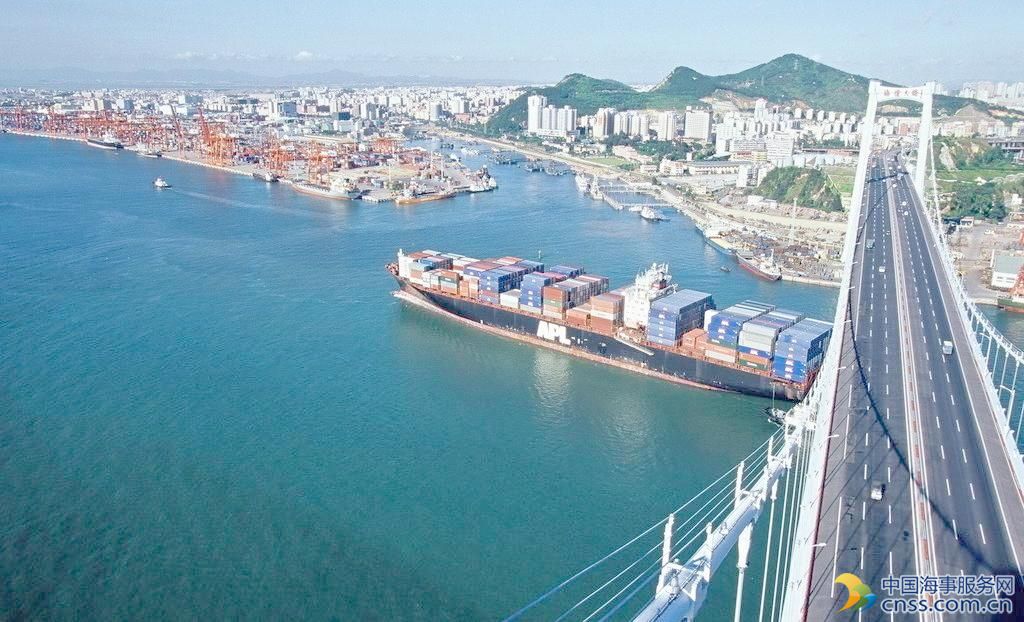

- China continues seaport consolidation as Dalian offer goes unconditional