Oil Seen at or Below $40 If OPEC Doesn’t Extend Output Cuts

Crude will probably drop to $40 a barrel or below unless OPEC and allied producers extend their collective cuts in output beyond June, according to analysts including the Abu Dhabi Investment Authority’s head of research.

The six-month cuts that took effect in January have set a floor for prices, but an increasing supply of U.S. shale oil together with record-high inventories are keeping the per-barrel price of crude from rising beyond the upper $50s, Christof Ruehl said Wednesday at a conference in Dubai.

“If OPEC and the coalition don’t extend the agreement to continue cuts, that price floor will go,” he said. “Without it, prices would fall, and there’s nothing to stop oil going below $40 a barrel.”

The Organization of Petroleum Exporting Countries and other major producers including Russia agreed in December to pump less oil to try to rein in a global glut weighing on prices. OPEC plans to decide at a meeting next month whether to extend its production cuts into the second half of the year. Benchmark Brent crude was trading 51 cents lower at $51.59 a barrel at 1:44 p.m. in London, bringing prices up 11 percent since OPEC agreed to the cuts on Nov. 30.

“The market is looking for a direction right now and ending the production cuts would be a negative for oil prices,” said Edward Bell, a commodities analyst at Dubai-based bank Emirates NBD PJSC. “Without a deal, oil could certainly be pushed below $40.”

A drop to $40 a barrel is “a clear option” should OPEC not agree to extend cuts next month, Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt, said Wednesday.

Stored Oil

Producer countries won’t come close to eliminating the excess of stored oil unless they extend their output limits into the second half of the year, said Ruehl, who worked formerly as BP Plc’s chief economist. Oil consumers would need two and a half more years to use up the current surplus in global inventories even if demand exceeds realistic expectations, he said.

There’s a general consensus that the agreement should be extended, Saudi Minister of Energy and Industry Khalid Al-Falih told reporters in Baku, Azerbaijan.

An extension by OPEC and nations outside the group is already priced into oil markets, said Robin Mills, founder of Dubai consultancy Qamar Energy. Mills said he expects the deal to be prolonged and that prices would fall as low as about $40 a barrel without an extension.

One consequence of the cuts for OPEC is that Iraq and Iran are gaining market share at the expense of the group’s biggest member Saudi Arabia, Ruehl said. The Saudis have made comparatively larger cuts in production than Iraq, which ranks as OPEC’s second-biggest producer, while Iran, the third-largest, is allowed to slightly increase output.

Abu Dhabi, capital of the United Arab Emirates, holds most of the OPEC nation’s crude reserves. The Abu Dhabi Investment Authority is one of the world’s largest sovereign wealth funds.

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

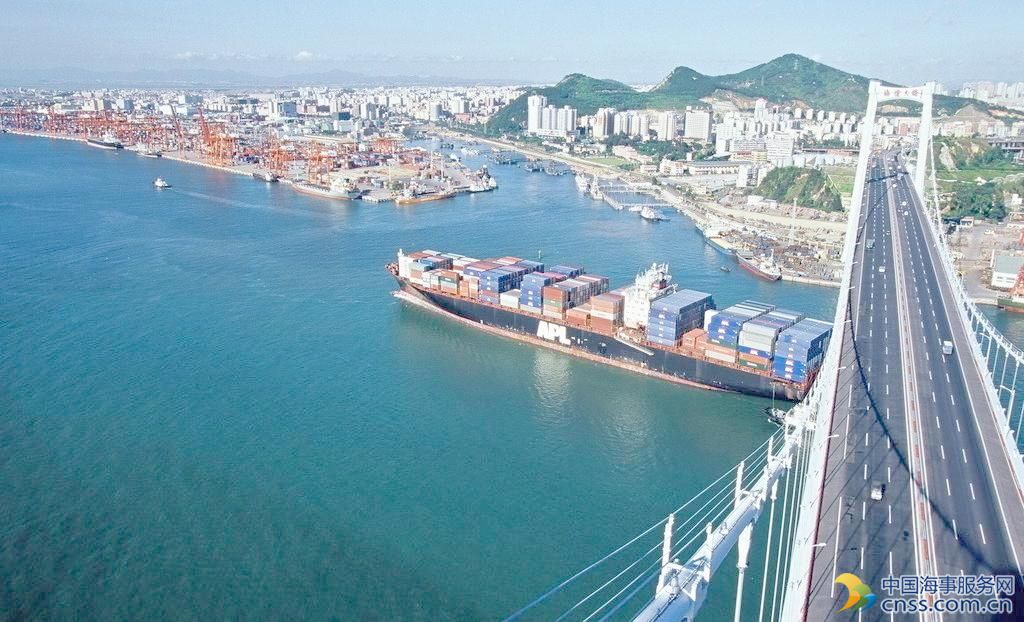

- China continues seaport consolidation as Dalian offer goes unconditional