Why Iron Ore Stocks Are Attractive Shorts

With China’s April PMIs disappointing, suggesting China’s tightening measures are beginning to take hold (i.e., demand for steel in China is now weakening), we expect steel supply in China to begin to moderate imminently; stated differently, this suggests iron ore demand is in the process of waning, which, against a backdrop of near-record/record iron ore inventories and aggressive domestic and seaborne iron ore supply, paints a nightmarish picture for iron ore prices over the coming months. On this trend, we would be adding to shorts in Fortescue Metals (FMG), Cliffs Natural Resources (CLF), Rio Tinto (RIO), and United States Steel Corp (X).

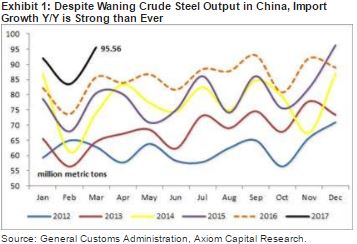

SO WHY THE IRON ORE PRICE PESSIMISM & CONFIDENCE ON THE FMG, RIO, CLF, and X SHORTS?: We believe, when looking at the data, iron ore prices are on the precipice of a “spectacular decline”. As detailed below, iron ore imports into China were up 11.4% year-on-year to 95.6mt in March, and YTD were up 12.2% year-on-year to 271mt. In our view, due to what is expected to be a 1%-2%% fall in year-on-year crude steel production in China in 2017, which is below the +1.04% year-on-year growth seen in 2016, we believe elevated imports through March point to continued inventory build, as well as a lack of seaborne-supply-discipline to falling iron ore prices (iron ore prices fell 11.9% through March).

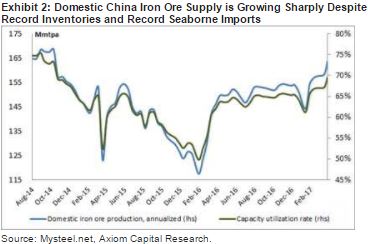

Furthermore, moving to the domestic production of iron ore in China this year, it’s clear that momentum is picking up in a very rapid manner (a troubling trend if you’re an iron ore bull). That is, of the 266 domestic Chinese iron ore mines Mysteel tracks, capacity utilization has risen from 62% as of mid-April 2016, to 69.5% as of mid-April 2017; stated differently, domestic iron ore production is up 21.4% year-on-year to 45.6mt YTD. This stellar growth, we believe, is a byproduct of higher prices driven, we believe, not by fundamentals, but rather the “financialization” of the futures trading market in bulk commodity materials in China (where traders have to constantly speculate, in the overnight markets, on the daily directional shifts in commodity prices – due to the duration mismatch in assets vs. liabilities in the ~$4tn off-balance-sheet Wealth Management Products market). Yet, with the cash cost of iron ore production in China at ~$57.8/mt, until prices fall below this level, we would expect the “rising tide” of supply to continue to be a headache for the iron ore bulls.

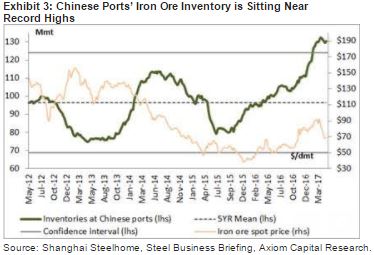

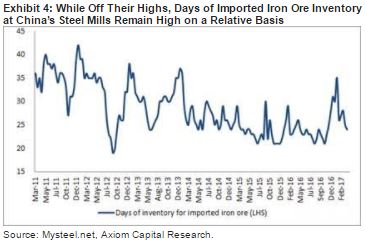

WHAT ABOUT INVENTORIES? In addition to the above, as can be seen in Exhibits 3-4 below, inventories at both the Chinese ports and steel mills are at/near record highs. That is, looking first to major Chinese ports’ iron ore inventories, we note that inventory has increased by 15% thus far this year, and is 33% higher than at the same time last year; in fact, there is enough iron ore inventory sitting at the ports in China to construct 13,000 of Eiffel towers (that’s a hell of a lot of iron ore). Furthermore, while they have come down off their peaks experienced this year, steel mills’ iron ore inventories in China are also still high when compared to historical levels.

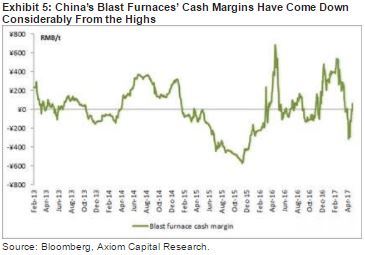

Yet, despite these high inventory levels, iron ore prices remain above our $40/mt target for April; in short, we believe this dynamic is a byproduct of both: (a) stellar margins for steel mills earlier this year, pushing them to prefer higher-grade iron ore in the face of higher coking coal prices, and (b) the aforementioned preference for higher-grade iron ore, in the face of bloated coking coal prices, enabling elevated production rates at Chinese steel mills. However, based on the sharp fall in Chinese steel mill profitability (discussed below), we believe both of these dynamics have come to an abrupt end (a problem if you are an iron ore bull).

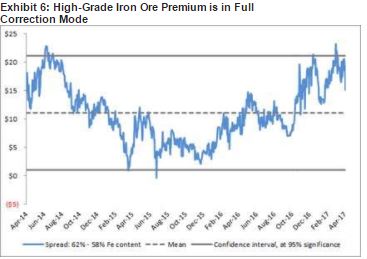

AND SPREADS? Moving on to price trends, we note that steel prices in China have been in sharp correction territory for some time now; and, with Cyclone Debbie in Australia pushing coking coal prices higher, steel mill profit margins have deteriorated. This, in turn, caused a shift in approach from the steel mills in China. More specifically, instead of opting for the higher-grade version of iron ore, in an effort to shift costs lower, mills in China instead moved toward the lower-end version of iron ore (due to its ready supply at both the ports, and at the domestic mills in China) – this trend, which remains intact today (and is an outsized, yet underappreciated, in our view, risk to seaborne iron ore prices), is evidenced by the sharp fall in the premium of 62% Fe grade iron ore when compared to 58% Fe grade iron ore (see Exhibit 6).

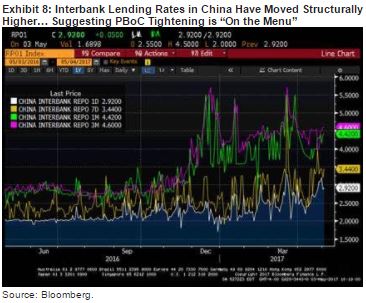

CONCLUSION: With the above as a backdrop, as we have warned for some time now, the recent correction in steel prices in China should come as no surprise. Why? Well, as detailed below (Exhibit 7), with China continuing to pump out record levels of crude steel output (i.e., supply), despite an aggressive push by the PBoC to clamp down on property speculation, as well as elevated interbank lending rates (suggesting liquidity has tightened) – Exhibit 8 – it seems, currently, supply is outstripping demand (a recipe for disaster for prices).

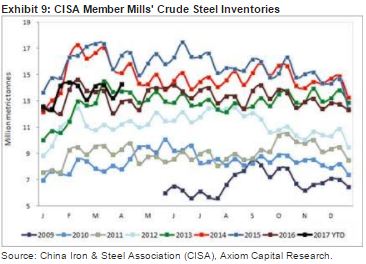

Furthermore, as detailed below in Exhibit 9, given expectations of steel demand coming into 2017 in China were elevated (on expectations of a Trump-driven rally, as well as reflation in China), aggressive inventory building defined the better part of C1Q17 in China. Consequently, with China’s April PMIs disappointing, suggesting China’s tightening measures are beginning to take hold (i.e., demand for steel in China is now weakening), we expect steel supply in China to begin to moderate imminently; stated differently, this suggests iron ore demand is in the process of waning, which, against a backdrop of near-record/record iron ore inventories and aggressive domestic and seaborne iron ore output, paints a nightmarish picture for prices over the coming months. On this, we would be adding to shorts in FMG, CLF, RIO, and X.

Source: Barron’s

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional