Bunker prices still in irregular trend

Fuel indexes have declined over the past two weeks amid concern that rising U.S. output will offset efforts by the Organization of Petroleum Exporting Countries and its allies to trim a global glut. Meantime, OPEC’s supply cuts have had some success as U.S. inventories have fallen for the past three weeks. Global stockpiles increased by less than average during the first quarter and producers’ compliance with the agreed supply cuts was at 98 percent in March (while it is expected that compliance in April may decrease to 92-95 percent).

MABUX World Bunker Index (consists of a range of prices for 380 HSFO, 180 HSFO and MGO at the main world hubs) has decreased slightly in the period of Apr. 27 – May. 04:

380 HSFO – down from 284.79 to 282.57 USD/MT (-2.22)

180 HSFO – down from 326.07 to 324.21 USD/MT (-1.86)

MGO – down from 507.36 to 498.21 USD/MT (-9.15)

OPEC is hoping an extension of cuts will have a more lasting effect, delivering stability to markets and lifting prices up to $60 – the level several OPEC members have indicated they want in order to balance their budgets. Meantime, the impact of the first round of cuts was compensated in part due to the ramp-up in production during the fourth quarter of 2016. Huge inventories were reported in the U.S. early in 2017, though there were declines in OECD inventories: evidence that the OPEC and non-OPEC cuts were having some effect, despite rather low compliance from non-OPEC states.

There are active speculations now that OPEC could extend its oil production cut agreement by less than six months – the period that is widely assumed to be the log-ical continuation of the initial deal. The argument is that OPEC producers need their oil production and their market share. That is possible that, for example, Iran and Iraq may not partake in an extension, despite declarations from both that they support the deal. Iraq, for its part has clearly stated it will take part in an extension, as long as there is consensus in the cartel about its necessity. Iraq undertook to cut 210,000 bpd from its output between January and June and is now reportedly at 97 percent of compliance.

Saudi Arabia in turn is aware that it would be ceding some market share with the OPEC deal. The kingdom is trying to preserve its market share amid the cuts and has been lowering the official selling price for Arab Light and Arab Extra Light varieties for Asia for two months now. Saudi Arabia is also said to be trying to attract buyers from European markets by changing the way it prices its oil in order to make it easier for hedging.

While Russia says it has fully implemented its pledged 300,000 barrel-a-day output reduction, there are still doubts whether the country would be willing to join OPEC in extending the agreement for another six months. Russian officials said they wouldn’t commit until the official meeting at the end of May. The problem for Russia is that the initial agreement corresponded with winter months, when output typically falls. That made any cuts easy. But the six-month extension will overlap with the Russian summer, which usually sees an uptick in production.

According to the International Energy Agency (IEA), the volume of new oil dis-coveries hit a record low in 2016 – the result of severe cuts to exploration budgets amid declining oil prices. The number of new conventional drilling projects also dropped to the lowest level in 70 years. The global oil industry only discovered 2.4 billion barrels last year (in comparison with 9 billion barrels that companies discov-ered on average each year for the past 15 years).

That stands in contrast to the U.S. shale industry, which saw a strong rebound in 2016 even as global exploration and development slowed down. U.S. producers boosted the number of rigs drilling for oil by 9 to 697 machines last wekk (the number of working rigs has more than doubled from a 2016 low of 316 in May). The rising U.S. rig count will continue to keep a lid on prices until U.S. inventories decline.

Moreover, President Trump signed an executive order on Apr. 28, that is going to open up new offshore acreage for drilling, areas that were put off limits by the Obama administration. The executive order covers areas of the Atlantic, Gulf of Mexico and even the Arctic. However, the process could be drawn out and will be subjected to legal scrutiny, so it is unclear when or if the executive order will lead to action.

One more factor of pressure: Libyan oil production has now topped 760,000 barrels – the highest level since December 2014. Fighting between the two rival govern-ments and related militant groups has affected the recovery of Libya’s oil sector. The El-Feel oil field in western Libya reopened last week after two years, and other oil facilities that had been closed due to militant activities have also become operational again. Libya is exempt from the terms of the OPEC’s deal at the moment.

So the global market is waiting to see whether OPEC will decide to roll over the production cuts until the end of the year. But there’s still plenty of skepticism: inventory draws will have to be deep, and compliance among OPEC and non-OPEC members strong, for the anticipated increase in U.S. production to be successfully offset. We expect next week the same irregular trend in bunker prices.

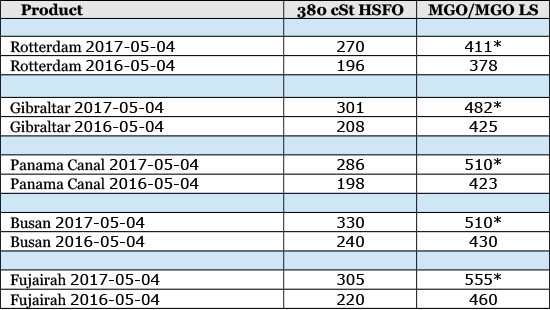

* MGO LS

All prices stated in USD / Mton

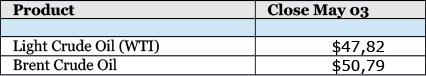

All time high Brent = $147.50 (July 11, 2008)

All time high Light crude (WTI) = $147.27 (July 11, 2008)

Source: Marine Bunker Exchange

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional