South Korea headed for LNG import boost after election

Whatever the election result, South Korea is likely to see a boost in LNG imports at the expense of coal-fired and nuclear power generation capacity as major candidates’ top pledges remain focused on addressing public concerns over worsening air pollution.

Fine dust pollution has emerged as a key issue in the presidential election, set for May 9, to replace former President Park Geun-hye, who was impeached in March over a corruption scandal involving large family-run business conglomerates, or chaebol.

All three main candidates have pledged to reduce coal-fired and nuclear power capacity to address the country’s public health concerns, and instead increase gas-fired power production and renewable energy resources to offset the supply shortfall.

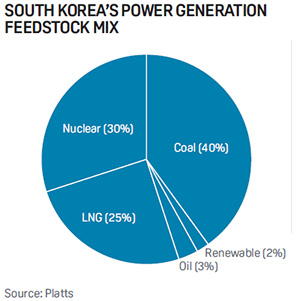

South Korea’s Power Generation Feedstock MixThe candidates’ pledges come at a time when South Korea has been increasingly hit by higher concentrations of fine dust in the air.

South Korea runs more than 50 coal-fired power plants that supply about 40% of the country’s total electricity, followed by nuclear (30%), LNG (25%), oil (3%), and renewable sources such as hydropower, solar, wind and fuel cells (2%).

Front-runner Moon Jae-In has unveiled the strongest measures among the major candidates, having promised to reverse the country’s existing plans to build new coal-fired power plants and nuclear reactors, with the goal of reducing fine dust pollution by 30%.

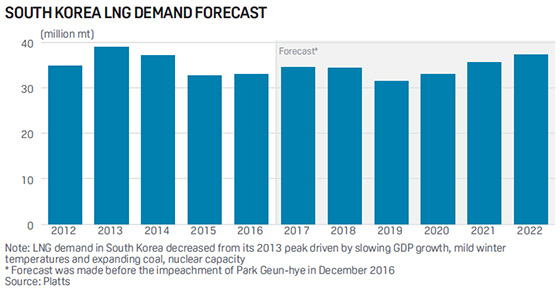

Following years of stagnant LNG demand growth, Platts Analytics forecasts South Korea’s consumption to see steady growth from 2019 onwards, reaching 37.3 million mt by 2022, although still below the record 39 million mt imported in 2013.

South Korea LNG Demand Forecast

SILENT ON OVERSEAS DEVELOPMENT

But the presidential candidates have stopped short of unveiling policies on the country’s overseas oil and gas development, as their state expenditure plans are heavily focused on welfare programs and national defense in the wake of mounting nuclear threats from North Korea.

In addition, state-run developers such as Korea National Oil Corp. and Kora Gas Corp., which have in the past led the country’s upstream projects, are now under great pressure to reduce heavy debts after an asset shopping spree when oil prices were high.

They are now seeking to divest some assets, but facing hurdles due to the slump in oil prices since late 2014.

With public attention focused on welfare and North Korea, oil and gas development has been sidelined in the presidential election campaign, with analysts warning about the lack of a long-term energy policy and energy supply troubles.

This is particularly important for South Korea, which has to import almost all its energy requirements from overseas. South Korea is the world’s fifth-largest crude oil buyer and second-largest LNG buyer.

“Consistent efforts for oil and gas asset acquisition are necessary for South Korea, which is vulnerable to price volatility,” said Sonn Yang-Hoon, a prominent energy expert at Incheon University, west of Seoul.

“A fundamental shift is underway in the global energy market following the oil price slump since 2014, which offers opportunities to import-dependent South Korea. Whoever becomes the next president is urged to use the changing market to boost its energy security,” he said.

Below are the candidates’ key energy policies:

MOON JAE-IN

The 64-year-old former human rights lawyer represents the progressive opposition Democratic Party, the biggest party, with 121 seats in the 300-seat National Assembly.

Maintains a strong lead with a support rating of about 40%, according to recent public surveys.

Says he will shut aged coal-fired power plants and scrap plans for nine coal-fired power plants where construction is less than 10% complete.

Vows to close down the aged Wolsong-1 nuclear reactor and halt construction of two large nuclear reactors, Shin Kori 5 and 6.

Vows to take measures to replace aged gasoil-powered vehicles, considered another cause of fine dust emissions, with electric vehicles and those powered by compressed natural gas and LPG, which could affect the country’s demand for auto fuels.

AHN CHEOL-SOO

Former medical doctor and software mogul represents the People’s Party. Latest public surveys peg his support rating at 20%.

Has promised to scale back electricity production from coal-fired power plants and nuclear reactors and replace them with LNG and renewables.

Aims to increase the ratio of renewables in the country’s electricity mix from the current 1.1% to 20% by 2030 and use LNG as a bridge to clean renewables.

HONG JOON-PYO

Represents the Liberty Korea Party and has a support rating of 15%, according to recent public surveys.

Vows to scrap plans for new coal-power plants and nuclear reactors.

Promises to lower taxes on oil products by up to 50% as part of efforts to boost sagging domestic consumption. Lower taxes, which account for half of retail oil prices, could boost South Korea’s oil demand, which has been on the decline due to rising domestic prices and slow economic growth.

Source: Platts

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional