Return of Asian investment in US tight oil

In a recent report Wood Mackenzie highlighted how the absence of major Asian companies from the US tight oil boom needs to change.

Between 2010 and 2013, Asian investors poured over US$20 billion into Lower 48 assets, mostly in shale plays. But since 2014, deal flow has dried up and involvement in the world’s hottest tight oil plays, particularly the Permian, has been negligible.

Wood Mackenzie expects this to change, particularly if Asia’s largest upstream players wish to diversify and grow production.

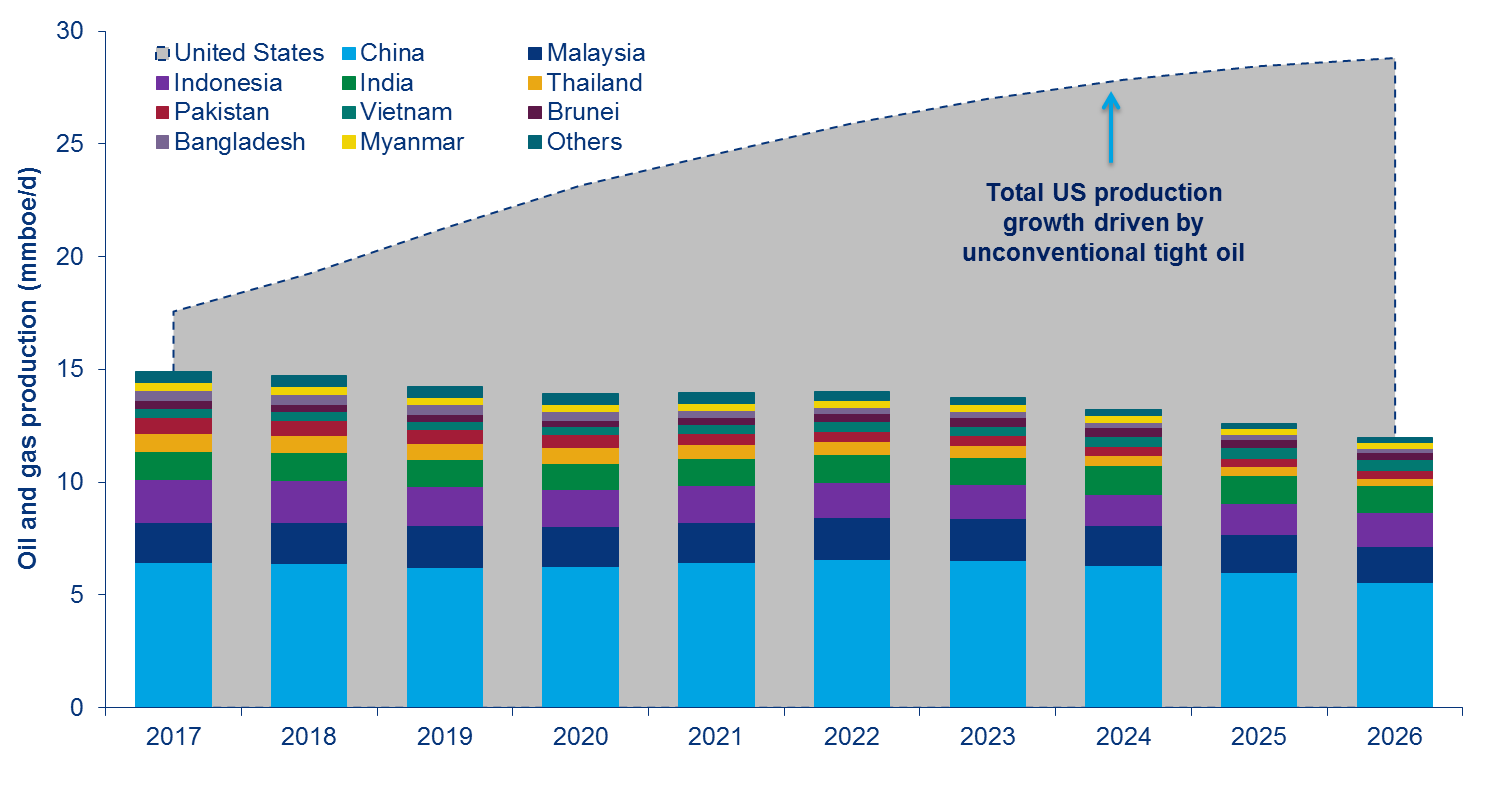

“Asia’s top 20 upstream companies are heavily invested in conventional plays across the region, where fields are mature and production is set to decline 20% over the next decade,” said Adrian Pooh, senior research analyst, Asia upstream. “On the other hand, output from the tight oil-driven US unconventional plays will grow exponentially over the same period, but their overall portfolio exposure to the theme is under 1%.”

The huge commercial resources and comparatively low break-evens of US shale oil is a compelling combination, plus assets are actively traded in the biggest and most dynamic upstream M&A market in the world.

By comparison most pre-development Asian upstream projects lack scale and are located in countries with tougher fiscal terms.

“US tight oil offers huge volumes and rapid development cycles, so if Asian players want to grow, they cannot continue to ignore this sector,” said Pooh.

In addition, many Asian investors come from positions of financial strength, with healthier cash flows and lower leverage and gearing than many international and US oil companies.

“There is a window of opportunity for outside investment into plays such as the Permian. The key is identifying the many financially-stretched tight oil operators looking for capital injections to help realise ambitious growth plans,” commented Pooh.

Rising cost inflation in tight oil will further erode margins and increase funding pressures. And if the oil price weakens, more opportunities will arise as struggling players turn to asset sales to free up capital.

But although the logic is sound, there are also reasons why many Asian players remain reluctant to get involved in such a hot M&A environment. The fast-moving tight oil market-place is particularly challenging for larger Asian companies who traditionally have long lead-times for decision-making.

And while they were active buyers in shale plays during 2010-2013, most of these deals failed to generate expected levels of value and returns. For some, bad memories will inhibit a return to US unconventionals.

“While there is room for more US exposure, there also needs to be a clear strategy to navigate through the risks and challenges,” says Pooh.

Deal clauses have to be carefully evaluated to avoid value-dilution of assets, while partnering with the right operator is needed to ensure longevity of the project and a sustainable relationship.

Oil and gas production – Asia vs US

Source: Wood Mackenzie

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional