Steel rises with iron ore in China amid new crackdown

Shanghai steel futures rose for a third straight day on Wednesday, supported by worries over tighter supply after China’s leading steel-producing city launched a fresh campaign to improve air quality.

Tangshan in northern Hebei province said steel mills that fail to meet emission standards face suspension and heavy fines. The campaign runs from May 9 to 31.

The most-active rebar on the Shanghai Futures Exchange closed up 2.5 percent at 3,077 yuan ($446) a ton.

Tangshan, home to dozens of steelmakers, is located in heavily polluted Hebei province, China’s biggest steelmaking region. Hebei produced 192.6 million tonnes of steel last year, nearly a quarter of the national total.

Tangshan accounted for close to half of that, with output at 88.3 million tonnes, and has been the target of a tough new inspection campaign aimed at rooting out firms that break the rules.

Traders say mills in Hebei were also asked to reduce or suspend production before the One Belt One Road summit in Beijing on May 14-15 to help clear China’s skies.

The fresh curbs “will help rein in steel production and rebalance the steel market, helping stabilize steel prices and speed up inventory drawdown,” Argonaut Securities analyst Helen Lau said in a note.

Along with steel, iron ore futures also rose, rebounding after recent losses.

Iron ore on the Dalian Commodity Exchange closed 2.6 percent higher at 474.50 yuan per ton. The contract fell to a four-month low of 456.50 yuan on May 5.

The recovery should help stabilize spot iron ore prices which dropped to their lowest in nearly seven months this week.

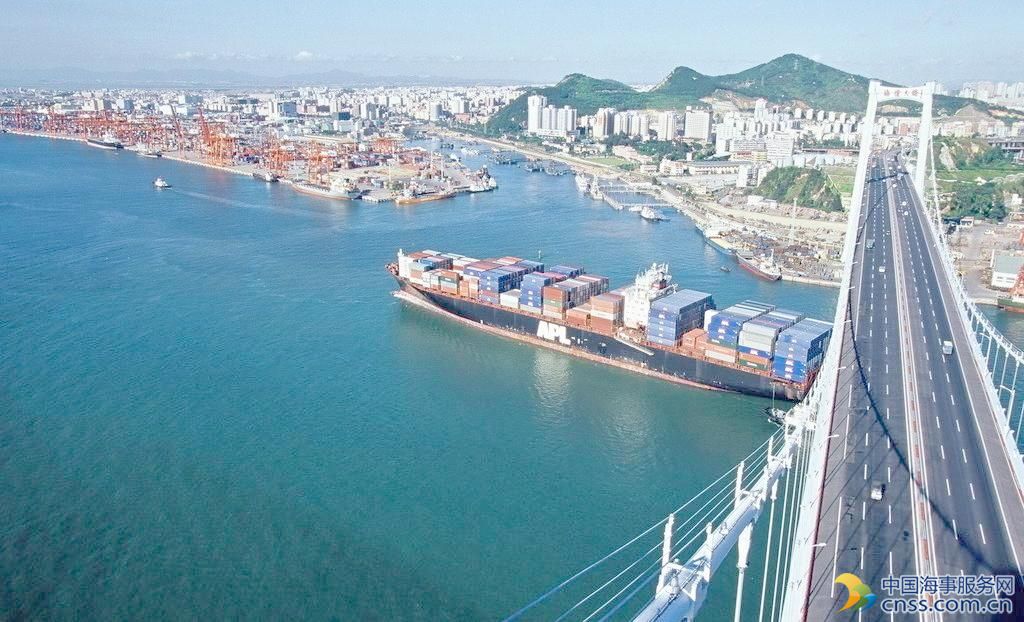

Iron ore for delivery to China’s Qingdao port rose 1 percent to $60.75 a ton on Tuesday, according to Metal Bulletin.

But ANZ analysts say the crackdown on Chinese steel mills should reduce demand for iron ore, pointing to lower prices going forward.

“Concerns remain that a combination of a crackdown on leverage, together with high stocks and seasonally weak demand, will drive further weakness in prices in the near term,” they wrote in a note.

Source: Reuters (Reporting by Manolo Serapio Jr.; Editing by Richard Pullin and Sherry Jacob-Phillips)

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional