Further OPEC cuts will deepen oil supply deficit in second half of 2017: IEA

The oil market has finally swung into a supply deficit, and demand is expected to outstrip output even more in the second half of the year if OPEC agrees to extend its production cuts, according to a top energy watchdog.

Speaking at the Platts Crude Oil Summit in London on Wednesday, Neil Atkinson, head of oil analysis at the International Energy Agency, said the current agreement by more than 20 major oil producers has succeeded in making a dent in the global supply glut that has kept prices under pressure in recent years.

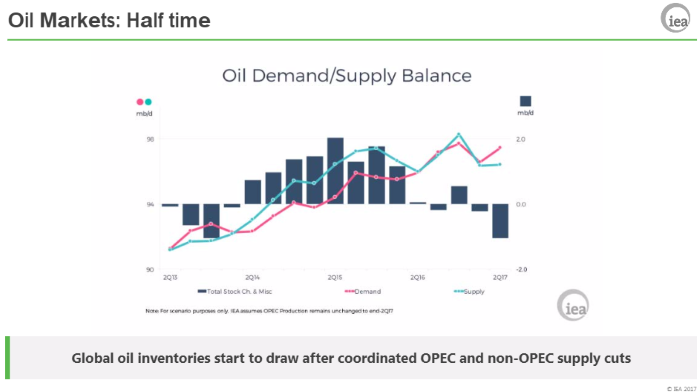

“It is starting to become clear that if the objective of the OPEC cuts was to flip the market from surplus into deficit that is now slowly beginning to happen,” he said and pointed to the chart below.

“And moving to the second quarter of 2017, which is of course the current outlook, we are seeing quite a significant surplus between supply and demand,” he added.

The Organization of the Petroleum Exporting Countries and 11 non-cartel members in late November agreed to slash production for six months by 1.8 million barrels a day. While the producers have largely complied with the production quotas, oil prices have struggled to gain momentum as U.S. shale producers have started to ramp up production in response to the OPEC-led cuts.

In recent weeks, crude and Brent prices have slipped below the trading levels seen before the historic output deal was agreed in November.

Market participants are now largely expecting OPEC to extend, and possibly deepen, the supply cuts when they meet for a summit on May 25. Atkinson said such a move will see the supply deficit become even bigger in the second half of the year.

“If you were to take the IEA’s oil report and look at estimates of what OPEC might do — it might rollover the existing levels — and assume no changes to the demand and supply outlook, you will find that as we move to the second half of the year it is likely that the surplus in demand and supply will grow,” he said.

The IEA currently sees global oil demand growth of 1.3 million barrels a day, lower than the growth of 1.6 million seen in 2016 and the 2 million recorded in 2015.

Source: MarketWatch

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional