Despite Trump trade deal, US natural gas exports to China face obstacles

American drillers and natural gas exporters may see limited benefits from the U.S. deal with Beijing to open Chinese markets to U.S. natural gas, analysts say.

The deal, announced by the Commerce Department on Thursday, paves the way for Chinese companies to negotiate long-term contracts to purchase liquefied natural gas from American suppliers. Beijing will allow private and state-controlled companies to import U.S. LNG and encourage them to invest in import infrastructure, a person familiar with negotiations told The Wall Street Journal.

Shares of Cheniere Energy popped 4 percent on Friday after the company told Reuters it has held “extensive negotiations” over the past month with Chinese state-owned companies about increasing LNG shipments to China.

Commerce Secretary Wilbur Ross said Friday the deal would help to “liberate American energy.”

“China is the world’s largest buyer of LNG. Now that market really is going to be open to the American producers,” Ross told CNBC’s “Squawk Box.”

In fact, Japan is the largest market for LNG, followed by South Korea and then China, according to the International Gas Union. But China is the world’s fastest-growing market for LNG, according to energy research firm Wood Mackenzie.

The deal positions the United States to capture part of that growth, which would represent $26 billion a year in purchases by 2030 at today’s prices, according Massimo Di-Odoardo, head of global gas and LNG research at Wood Mackenzie.

However, he cautioned that U.S. LNG’s fortunes in China “will depend on its competitiveness versus other global alternatives and Chinese buyer appetite for exposure to U.S. gas prices.”

Alan Bannister, regional director for energy pricing at S&P Global Platts, noted on Friday that shipping LNG to China from the U.S. Gulf Coast — where much of the export capacity is planned or being built — would be inefficient and unlikely.

“China is much nearer and much cheaper to ship from Australia, for example, or Qatar,” he said. “What I think we’re more likely to see in the real world is that U.S. Gulf Coast LNG will primarily go to Europe.”

China imported 26.1 million tons of LNG in 2016, up 32.6 percent on year, IHS Fairplay reported. The shipping news outlet noted that Australia accounted for 46 percent of China’s LNG imports in 2016, or 12 million tons. Qatar supplied 19 percent, while just around 200,000 tons came from the United States in 2016.

Limited U.S. LNG export capacity

Any uptick in exports to China would have to wait until the United States builds more of the expensive facilities where natural gas is cooled into liquid and loaded onto specialized tankers.

Only one LNG export terminal is operating in the Lower 48 states: Cheniere Energy’s Sabine Pass facility in Louisiana. Alaska has also exported LNG, primarily to Japan, for decades.

Four other facilities under construction in Texas, Louisiana and Maryland are slated to come online by 2021, pushing U.S. export capacity to 9.2 billion cubic feet, according to the U.S. Energy Information Administration.

On Friday, Ross blamed the Obama administration for holding up approvals for more than a dozen LNG export facilities. “Presumably that will be cleared out now and we will get that going,” he told CNBC.

As of January, 13 LNG export terminals were proposed to the Federal Energy Regulatory Commission, the body that approves them.

This week, the Trump administration moved toward getting those terminals approved by nominating two commissioners to FERC. The agency has been hobbled since January, when one of the three remaining commissioners stepped down, leaving FERC without a quorum.

But some analysts say market forces, not the pace of government approval, could be a more important factor.

Asia LNG prices have fallen 56 percent since 2014, during which time applications for six U.S. export terminals were withdrawn, investment banking firm FBR noted last week.

FBR acknowledges that the average review period for remaining projects has risen, but concluded that “market headwinds appear to be a larger contributor to slow development than just the 21% increase in project approval time.”

LNG capacity growth between 2015 and 2020 is projected to exceed demand growth by nearly 50 percent, causing utilization rates at export terminals to fall below 90 percent next year, FBR said, citing EIA data. It is expected to recover to 93 percent by 2021.

“Given these headwinds, investment in new capacity has virtually dried up, increasing the risk of tighter markets in the next decade,” FBR said.

However, Wood Mackenzie’s Di-Odoardo said the Commerce Department’s deal with China presents the opportunity for a “second wave of investment in US LNG” in the near term.

“Developers will now be able to target Chinese buyers directly, potentially supporting project financing. It could also support direct Chinese investment into liquefaction and upstream developments on U.S. soil,” he said.

Source: CNBC

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

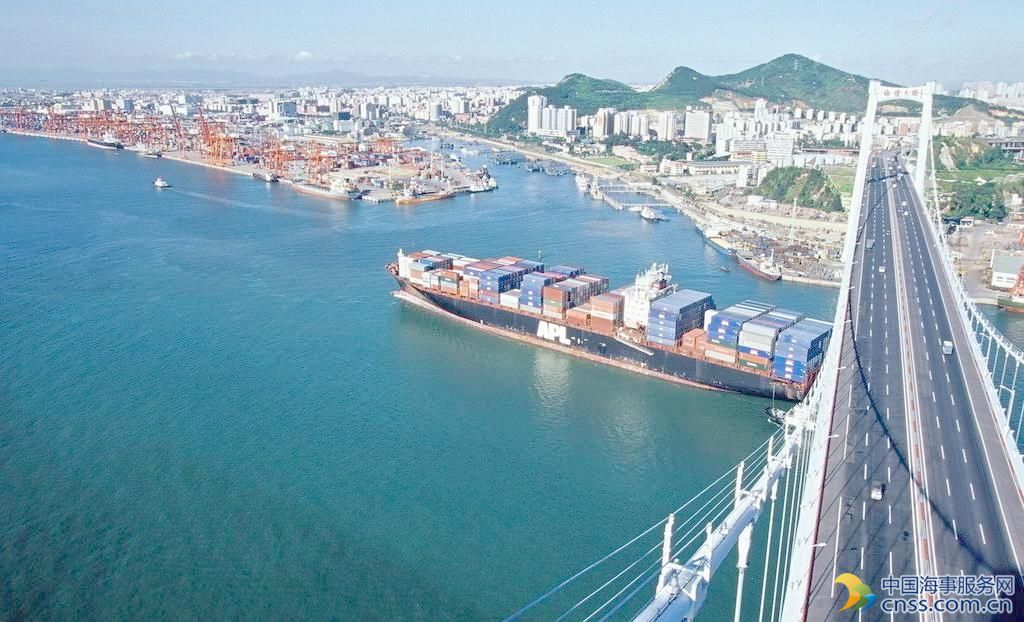

- China continues seaport consolidation as Dalian offer goes unconditional