Dry Bulk: Freight and the Grain Glut – Why the price of grain matters little to the dry bulk market

Genetically modified grains are becoming even more commonplace in global agriculture. Behemoths like Monsanto, Bayer and Dupont are constantly working towards new genetic strains of staple grains such as wheat, corn and rice, with the aim of improving yields and creating grains that are more robust in the face of floods, droughts and pests.

While GMO crops have been genetically engineered by the direct manipulation of its genome, hybrids and improved varieties developed through the less controversial technique called cytogenic hybridization have been largely responsible for what is often referred to as “the green revolution”. Norman Borlaug, who set this technological advance in motion received the Nobel Peace Prize in 1970, being credited with saving over a billion people from starvation.

Both of these techniques hold the potential to further increase global cereal yields, adding to what in recent years has been a succession of bumper harvests that fill stocks to the brim. As developments in high yield crops continue, we can therefore expect the current glut to persist, barring any force majeur event that creates a regional shortage.

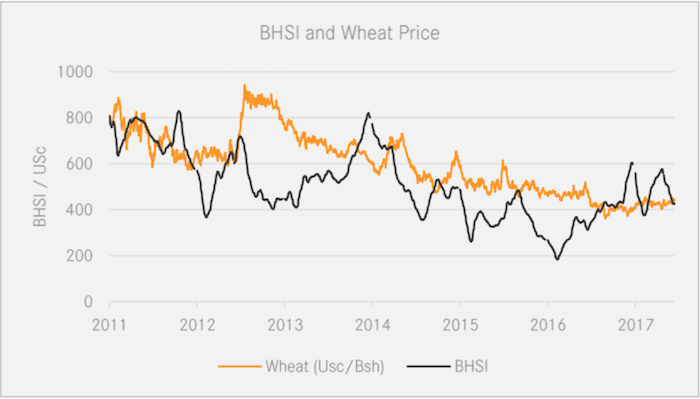

What then should we expect in terms of shipping? Firstly, the argument in terms of shipping? Firstly, the argument that the overall supply, and even finding stocks, reduced the need for seaborne transport can be dismissed as there is no correlation, between either tonne mileage (as seen in the adjoining graph), or freight rates, suggesting that other drivers such as demographic growth plays a large enough role to make bumper crops somewhat irrelevant.

What improvements in yield and gluts really affect is the price of the commodity. Taking wheat as an example, the increased availability has dramatically reduced prices, which in turn, aside from making life hard for struggling farmers, gives buyers far greater choice of supply. Yet while the cost structure of the market has changed in favor of consumers, the underlying demand is still what affects the overall volumes shipped. As the improvements in crop technology occur more or less at the same rate across the world’s major grain houses, and given the competitive international price environment, local pricing gaps large enough to fundamentally change trade routes are unlikely, and if they occur, short lived.

The dry bulk segment, should therefore not be too gravely concerned about the drop in grain prices, and continue its efforts to create a more profitable supply side by limiting forays into the newbuilding market. Thins may be looking up a little, but we are far from out of the woods yet.

Source: Affinity Research – Comment on Dry Bulk by George Nordahl

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional