VLCC Orders Ruling The Roost

With contracting this year only slightly less subdued than in 2016, there has been a welcome influx of activity in the VLCC sector, which accounts for 52% of global year to date contracting in dwt terms. VLCC ordering in 2017 so far has been dominated by Greek owners and most orders have been placed at Korean yards. However, when looking at the VLCC orderbook as a whole, further trends emerge.

Counting Our Chickens

In the first five months of 2017, there have been 27 VLCCs of a combined 8.5m dwt reported ordered. This is a 366% increase year-on-year in dwt terms on extremely subdued 2016 levels and has provided a much needed boost for certain shipyards. Furthermore, VLCC orders account for 52% of year to date contracting in dwt terms as well as 11% of estimated year to date investment. If in the first 5 months of 2017 there had been as many VLCC orders as the same period last year, then total global ordering in the year to date would have suffered a 50% decrease year-on-year in dwt terms.

Prices Take A Swan Dive

Shipowners have been placing orders in the VLCC sector against a backdrop of falling newbuild prices, with the guideline newbuild price for a c.320,000 dwt vessel dropping to $80m in March this year, its lowest level since February 2004. These low prices have proved attractive to owners, though contracting in the other crude tanker sectors has remained muted, with only 2 Suezmaxes and 5 Aframax crude tankers reported ordered in the year to date.

Greek Owners Sniping Away

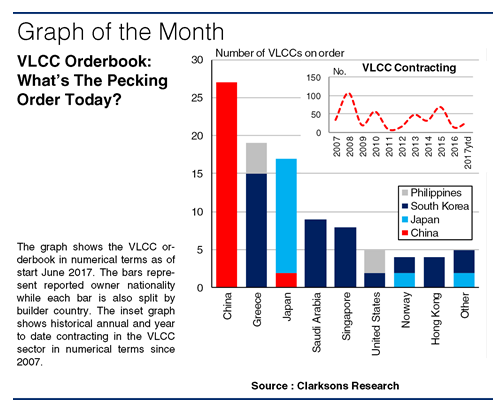

In 2017 so far, most VLCC orders (19 of 27 contracts) have been placed by Greek owners, while Singaporean and Chinese owners have placed 6 and 3 contracts respectively. However, the orderbook tells a slightly different story, with Chinese owners accounting for 28% of the VLCCs on order currently. Meanwhile, Greek and Japanese owners account for 19% and 17% of VLCCs on order respectively in numerical terms.

Owners Flocking To Korea

The majority of orders in the year to date (70%) have been placed in South Korea. This has provided much needed support for some yards, and has helped the Korean orderbook to eventually increase in dwt terms following 19 months of continuing decline. Korean yards currently account for 44% of the VLCC orderbook, with orders in the Philippines also placed at the subsidiary yard of Korean group HHIC. Elsewhere, Chinese and Japanese yards, accounting for 30% and 19% of the VLCC orderbook respectively, have benefitted primarily from orders placed by domestic owners.

Overall, VLCC contracting has been relatively firm in the year to date while newbuild prices have fallen. Greek owners have ordered the most VLCCs in 2017 so far, while the current orderbook is led by Chinese owners. 70% of VLCC orders placed in 2017 have been at Korean yards, who have benefitted from the ordering uptick in the sector. However, VLCCs only represent 16% of the global orderbook in dwt terms and yards will still be hoping for improved activity across a broader range of sectors.

Source: Clarkson Research Services Limited

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional