Adani To Begin Work On Australian Project In Shadow Of $15-Billion Group Debt

The Adani Group has restructured some of its businesses even as its looks set to begin pre-construction work on its $16.5-billion Australian Carmichael Project next month.

It carved out a subsidiary within Adani Power Ltd. for the Mundra plant, which carries a debt of more than Rs 25,000 crore. The power business contributes nearly half the group debt. The group also hived off port services and renewable energy businesses.

The rejig came ahead of the group finally striking a deal with the Queensland government to begin work on the coal mine and ports project, seven years after the ports-to-power conglomerate first sought approvals. The Gautam Adani-led infrastructure major faced a series of hurdles, including opposition from environmentalists as the project is seen as a threat to the Great Barrier Reef off the coast of Queensland.

Here’s all that has happened at Adani group in the last few months…

Weighed Down By Debt

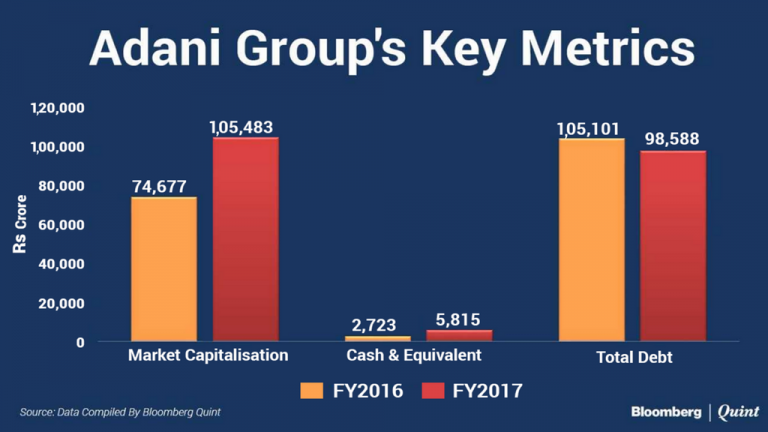

Adani Group companies’ market capitalisation rose 41 percent to Rs 1.05 lakh crore in the year ended March. Its cash and cash equivalents doubled to Rs 5,815 crore. Debt remains the biggest concern and fell marginally to Rs 98,588 crore ($15 billion) in the year ended March.

Adani Group didn’t respond to BloombergQuint’s emails seeking a response on how it plans to pare debt and fund the coal mine project. No Australian banks have been approached and a funding package worth $2.5 billion will be finalised by March, Bloomberg had reported quoting an Adani spokesman.

Adani’s Good And Bad Apples

Adani Power Ltd. is the main trouble spot, contributing half of the group debt. It’s has the highest debt-to-operating income ratio among peers like Tata Power Ltd. and Reliance Power Ltd.

Adani Transmission Ltd. is the least indebted, with lower debt-to-operating income than state-run rival Power Grid Corporation of India Ltd.

Refinancing Worries

Adani Ports & Special Economic Zone Ltd., the holding company for Adani Abbot Point Terminal Pty Ltd., owns the coal terminal in North Queensland under a 99-year lease. Adani faces the challenge to refinance nearly $736-million debt, representing nearly 70 percent of the debt of this arm, maturing in November 2018, Arnon Musiker, senior vice-president at Moody’s Investor Service, had said in his March report maintaining a negative outlook.

Adani Ports’ rating was recently revised to ‘stable’ from ‘negative’ by Standards & Poor’s after the company said in its earnings presentation that there were no outstanding related-party loans, advances and deposits as of March 31. S&P said that such transactions expose the company to group’s debt and it’s important to ensure that it remains insulated from the credit quality of the rest of the conglomerate.

Adani reorganised the structure of some of the group companies, including the power and ports businesses recently.

Mundra Plant Slump Sale

The company’s board approved a slump sale of 4,620 MW Mundra plant in Gujarat to a new subsidiary, Adani Power (Mundra), according to its exchange filing. A slump sale is the transfer of an asset or part of a business for a lump sump consideration to another entity. The move is seen as a step towards making Adani Power a holding company for the group’s power assets, including the Mundra plant. It would lead to a transfer of Rs 25,270-crore Mundra debt to the new subsidiary.

Adani is also reported to be looking at options for its Mundra plant after the Supreme Court quashed the company’s plea for a higher tariff to compensate it for an increase in the cost of Indonesian coal. In a June 16 report, Care Ratings placed the company’s long-term loans worth Rs 6,418 crore “under credit watch with developing implications” on account a possible impact of Adani’s plan to sell the power plant.

Most foreign brokerages have a ‘sell’ rating on Adani Power, the most indebted group company. Crisil Ratings recently said the company was ‘non-cooperative’ for a rating exercise.

Adani Ports & SEZ

The company in February decided to demerge its marine business into its wholly owned subsidiary Adani Harbour Services Pvt. Ltd. on a slump-sale basis, according to its exchange filing. At the end of financial year 2015-16, the marine business had a turnover of Rs 571.7 crore, about 10 percent of the company’s total revenue. The demerger is stuck at the National Company Law Tribunal, which has convened shareholder meetings on June 27 to seek approval.

Proxy advisory firm IiAs had flagged “lack of adequate disclosure” regarding the transaction. The Adani Harbour Services is yet to disclose how it would raise Rs 200 crore to acquire the marine business of Adani Ports, IiAS said in a note.

Adani Green Energy No Longer A Subsidiary

The group flagship Adani Enterprises’ stake in Adani Green Energy fell below 50 percent after the renewable energy producer issued fresh shares. As a result, Adani Green ceased to be a subsidiary of the company, a filing to exchanges said.

The development comes after India Ratings upgraded some bank loans rating of Adani Green Energy. The upgrade reflects an improvement in the operational performance due to better plant load factor since commencing operations in March 2016.

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional