Dry Bulk: Indian Iron Ore Exports: One To Look Out For Again?

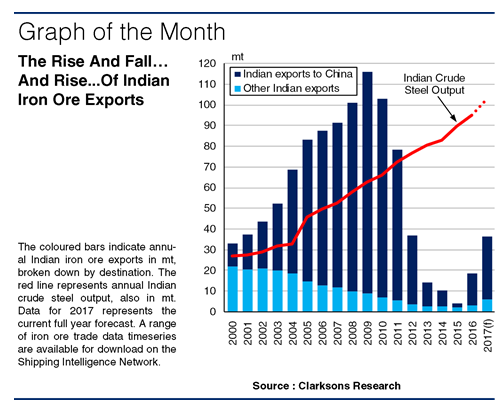

While Australian and Brazilian exports are expected to be the key drivers of seaborne iron ore trade growth in 2017, shipments from elsewhere are projected to rise 11% to 250mt this year. This partly reflects a surge in Indian iron ore exports, which were almost fully eradicated by government policies by 2015. This month’s Commodity Countdown explores the highs and lows of Indian iron ore exports.

Heady Heights, A Sharp Drop

Indian iron ore exports increased more than threefold between 2000 and 2009 to 116mt, driven by rising output and firm Chinese demand. This period established India’s position as a significant iron ore exporter, with the country’s shipments accounting for 13% of global seaborne iron ore exports in 2009. However from July 2010, India’s government imposed a series of mining restrictions and a 30% tariff on iron ore exports. Indian iron ore shipments subsequently fell sharply from the 116mt in 2009 to just 4mt by 2015.

Back From The Abyss

Then, in February 2016, the Modi government cut the country’s iron ore export tariffs and several mining restrictions. India’s iron ore miners responded by ramping up output 21% to 156mt in 2016, while the country’s iron ore exports hit 19mt. This was also supported by the high iron ore price environment in Q4 2016, which improved miners’ profit margins. High prices continued into Q1 2017, supporting a threefold y-o-y rise in Indian iron ore exports to 15mt in January-April.

The Bullish Outlook

Looking ahead, Indian iron ore exports are projected to almost double to 37mt in 2017 which, assuming the additional volumes are absorbed by Chinese demand and do not replace other exports, could add another 1% of growth to global seaborne iron ore trade this year. The outlook for Indian iron ore export growth also appears promising, given reports that output caps for iron ore miners in Goa and Karnataka are to be raised from a total 50mtpa, while additional road links between Goa’s iron ore mines and west-coast terminals are under construction.

Some Causes For Caution

However, there are a number of downside risks to future Indian iron ore export growth. Firstly, global iron ore price levels have eased somewhat in recent weeks, cutting Indian miners’ profit margins. Furthermore, Indian steel output has grown substantially in recent years, rising 6% to 95mt in 2016. Sustained growth in Indian steel output has the potential to increase the country’s iron ore consumption, potentially absorbing volumes otherwise destined for export over the coming years. On a final note, given the country’s proximity to the Chinese market, increasing Indian iron ore exports could actually pose a risk to global iron ore tonne-mile trade, should they replace shipments from other, more distant exporters.

So, a change in government policies and firm Chinese import demand have seen a substantial increase in Indian iron ore exports recently. Overall, while India is still far from reclaiming its position as a key iron ore exporter in global terms and while there are some downside risks, the country’s rising ore exports may be one to keep an eye on in the years ahead.

Source: Clarksons

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional