Till Death Us Do Part For Box Shipping’s Leading Pair?

Conventionally, the container shipping market is viewed as made up of two key elements: the freight market for moving boxes from A to B, and the charter market for hiring ships. Often these markets are happily moving in sync, but that’s not always the case. How does the relationship work and how closely have these markets moved in relation to each other, both in recent times and historically?

Happy Couple?

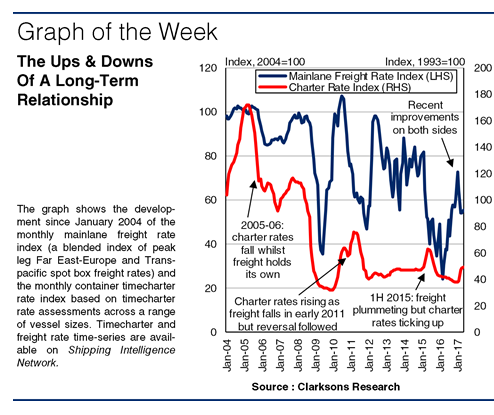

Let’s start with recent history. Improved fundamentals in 2016, when box trade grew by 3.8% but containership capacity expanded by just 1.2%, and into 2017, have had a twin impact on the container shipping markets. Firstly they helped the box freight market bottom out. The mainlane freight rate index (see graph) increased from 24 in Mar-16 to 73 in Jan-17, and this pattern has been mirrored across many trade lanes. Secondly, the backdrop eventually helped support a slightly improved charter market, with rates moving away from the bottom of the cycle in late Q1 2017. In theory, demand from freight market end users (shippers) filters down to the vessel charter market in the end, with additional volume driving charterers (liner companies) to access additional units (from owners).

Splits And Separations

But does the power of the fundamentals always drag the two markets along together? It is not always the case; they often move apart. Before the financial crisis, the freight market appeared somewhat less volatile than today, but that did not always see the markets in sync. Despite more than 20% cargo growth in 2005-06, and the freight market holding most of its ground, the charter rate index slumped by 47% from an all-time high of 172 in Apr-05 to 91 in Dec-06, as super-cycle peak rates proved unsustainable.

The post-downturn period has seen similar instances. The box shipping markets moved into an era of ‘micro’ management of supply (slow steaming, idling and cascading) and this has impacted both freight and charter markets. In both early 2011 and 1H 2015 charter rates rose as freight rates dropped like a stone. In 2011 the freight rate index dropped by 38% to 47 whilst the charter rate index rallied, as operators deployed additional capacity to the detriment of freight rates. But soon after the opposite occurred, and freight rates increased but charter rates dropped back to bottom of the cycle levels where they remained for the next three years.

Re-Coupling…

In the long-term, however, the two spheres do appear to be aligned. What simple inspection suggests, the numbers confirm. In only 33 of the months on the graph (21%) have the markets actually moved in opposite directions (excluding monthly movements of less than 1%).

Let’s Stick Together!

So, the two box markets do move independently at times but they often move in sync and when apart they tend to re-align (what econometricians might call an ‘error correction mechanism’). Perhaps this just confirms that ‘cargo is king’ and the supply side eventually adjusts. Whatever the case, box shipping’s famous couple can’t keep themselves apart for too long.

Source: Clarksons

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional