Newbuilding activity going from strength to strenght

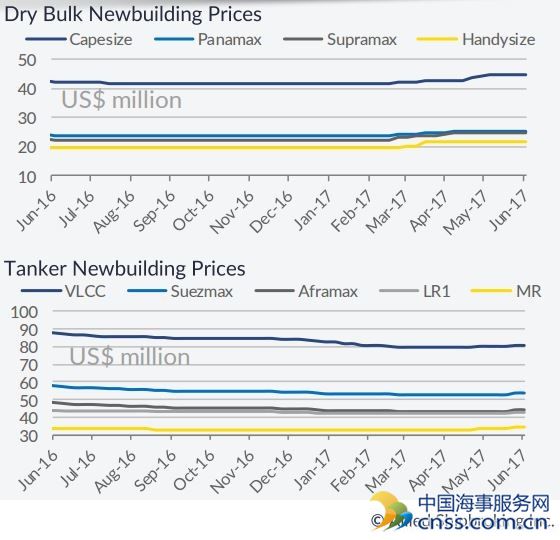

Tankers as well as dry bulkers are the “most wanted” asset classes among newbuildings, as ordering activity is actively stronger than last year. In its latest weekly report, Allied Shipbroking said that “we continue to see a fair flow of activity emerging once more this week, with a number of dry bulk and tanker contracts coming to light this week. Overall interest seems to have slightly eased however now something that may well lead to a drop in new ordering activity over the rest of the summer period. This will be primarily driven by the performance of the dry bulk freight market, given that the biggest increase in interest this year has been primarily triggered by the vastly improved sentiment noted in this sector in the first quarter of the year. On a further note it seems as though prices will also continue to increase further given that most shipbuilders find the current levels unsustainable for their operations, while at the same time the increases seen in the secondhand market have provided shipbuilders further room to push for better levels and balance their cash flows once more”.

In a separate newbuilding note, Clarkson Platou Hellas said that “in tankers, Daehan have received an order for two firm 114,000 DWT LR2 Tankers from Clients of Metrostar Management. The duo will deliver within 2018 from Haenam, Korea. In Gas, Hyundai Heavy Industries have signed a contract with Knutsen OAS Shipping AS for one firm plus one optional 180,000 CBM LNG Carriers for delivery in 2019. Petredec have announced an order for two firm plus two optional 84,000 CBM VLGCs at Jiangnan Shipyard in China. The two firm units are set for deliver in 2Q and 3Q 2019, respectively.”, the shipbroker noted.

Meanwhile, things are rather active in the S&P markets as well. Ship valuations’ specialist VesselsValue said in a weekly note that tanker values have remained stable. “The Suezmax Hrvatska (166,400 DWT, Brodosplit, May 2005) sold for USD 20.7 mil vs VV USD 20.7 mil keeping values stable. The King Dorian (73,600 DWT, New Times Shipbuilding, Jan 2007) sold for USD 14.5 mil vs VV USD 14.7 mil, slightly softening LR1 values”

In the dry bulk market, VV noted that “Capesize and Supramax values softened this week, whereas Panamax and Handy values remained stable. The Pacific Canopus (180,300 DWT, Dalian Shipbuilding Industry Corp, Jan 2012) sold for USD 26.0 mil vs VV USD 27.6 mil, softening capsize values. The resale Panamax Hull 1577 (81,600 DWT, Tsuneishi Zosen, Mar 2019) sold on subs for USD 28.5 mil vs VV USD 28.8 mil. The Pacific Leader (56,500 DWT, Jiangsu Hantong Ship HI, Jul 2012) sold for USD 11.0 mil vs VV USD 13.3 mil softening Supramax values. The Open-Hatch Handy Bulker Sea Majesty (32,300 DWT, Kanada, May 2008) sold for USD 8.3 mil vs VV USD 8.5 mil keeping values stable”, it concluded.

In a similar note, Allied said that “on the dry bulk side, we have still to see anything to write home about in terms of activity. Things are still moving relatively slow, though there is a sense now that this will start to shift given the recent trends being noted in the freight market. As such expectations have started to shift towards the possibility of a more active summer period, especially when you take into consideration that most a view that the 4Q2017 will see another strong rally in freight rates and as such will have marked this summer as the last chance for relatively cheap buys in the secondhand market. On the tanker side, we witnessed a slightly more active week on the large crude carriers with the previously failed Hyundai Suezmax resale deal emerging this week now to new buyers. On the product tankers we still see a fair flow especially in the MR ranges, while we also heard rumors of the 2003 built LR2 “SILVAPLANA” being picked up by Bakri Navigation for US$ 13.0million”, the shipbroker concluded

Source: Nikos Roussanoglou, Hellenic Shipping News Worldwide

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional