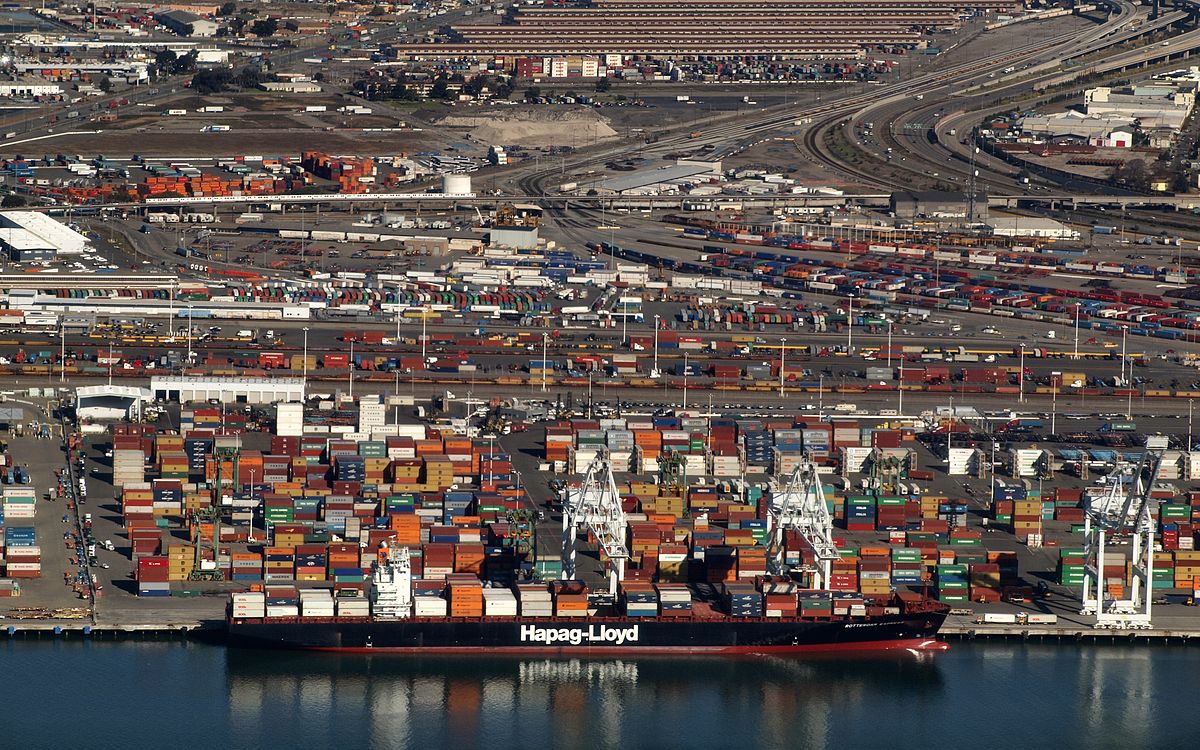

Hapag-Lloyd successfully places Senior Notes

Hapag-Lloyd AG has successfully placed Senior Notes and was able to upsize the volume from the originally announced EUR 300 million to EUR 450 million due to high demand. The Senior Notes are issued with a maturity of seven years and a coupon of 5.125%. The emission price was 100%. The proceeds will be used to redeem Hapag-Lloyd’s existing 7.75% and 7.50% Senior Euro Notes due 2018 and 2019.

“The successful placement is proof of the confidence Hapag-Lloyd enjoys on the capital markets as one of the world’s leading liner shipping companies. Now we can replace two existing notes with significantly more favorable notes, which will lower our interest burden,” said Nicolás Burr, Chief Financial Officer of Hapag-Lloyd.

The Notes will be listed on the Luxembourg Stock Exchange.

Source: Hapag-Lloyd

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional