Ships’ Scrapping Markets In Limbo

The market for the scrapping of old ships has remained in limbo over the course of the past couple of weeks, as a lingering lack of clarity pertaining to the true outcome of the Bangladeshi and Pakistani budgets that were announce at the end of May and early June respectively has continued to cloud the ship-recycling markets of the Indian sub-continent. In its latest weekly report, the world’s leading cash buyer GMS noted that “in fact, the Bangladesh Shipbreakers Association (BSBA) has voiced their concerns to the highest authorities in government in an attempt reverse the recently imposed 15% VAT on incoming ships. The initial feedback from their meetings with the finance ministry is that this move will likely be successful and the currently imposed VAT will now be postponed for at least another two years, which should see prices remain at par with those seen in the firstquarter of the year. Local steel plate prices following the cyclone in Bangladesh have shot up as well and it has been another dour week of constant rains in this market, which has seen the supply of ships steel into domestic steel mills remain extremely restricted. This, in conjunction with the news of the reversal of the dreaded VAT, could in turn see demand and offers improve going forward” GMS said.

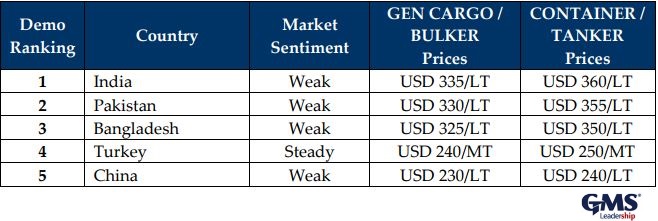

It added that “for the time being however, much of the offerings appear to be on hold, as several cash buyers remain confident about an impending improvement in prices from the current levels. However, as Bangladeshi end users are yet to affirm such suspicions with matching improvements from their end, a tense standoff has begun. In Pakistan, the Pakistan Shipbreakers Association (PSBA) is due to meet in the coming week as well, in order to address some of the concerns arising from their recent budgetary changes affecting their industry. Finally, with not much change to report from China or India for the week, Turkey remains the only steady market of the moment”, GMS concluded.

Meanwhile, according to the report, in the Bangladeshi market a curious situation arose, whereby the 15% VAT announced during the recent budget was reportedly withdrawn (or at least postponed for the next two years). Yet, despite the positive news, no upswing in the buying became apparent. While some anticipate that this announcement may take several weeks to fully materialize, the constant rains that have brought the industry to a virtual standstill of late coupled with an overall lack of supply that has seen very few vessels offered into the local market, appears to have affected the overall sentiment and temperament of ongoing negotiations. Notwithstanding, if last week’s spectacular sale of the favored Ukrainian built tanker STAVRONISI (16,048 LDT) at an amazing USD 375/LT LDT basis an ‘as is’ Singapore delivery provides any indication of what prices for upcoming vessels should be, this market certainly appears to be gearing up for a firmer than expected monsoon. Meanwhile, the prevailing confusion over the introduction of the new duties and taxes has resulted in numerous vessels facing ongoing delays in beaching”, GMS concluded.

In a separate weekly note, Allied Shipbroking said that “some slight improvement in terms of activity was being noted this past week, with the number of demo candidates being circulated showing signs of new life. This may well end up being the markets undoing, with the increased availability likely to allow for a softening in prices being quoted by cash buyers. The market seems to now be mainly moving by Indian and Pakistani breakers, with Bangladeshi buyers being taken out of the current competition by the ongoing dispute with regards to the proposed tax hikes. In terms of local steel prices, we are seeing a fairly stable market for the time being, however this has not convinced for any speculative buying to take place over the past two weeks, showing the jitters being felt by most buyers given that we are now firmly in the monsoon season and appetite amongst breakers is relatively subdued”, the shipbroker concluded.

Source: Nikos Roussanoglou, Hellenic Shipping News Worldwide

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional