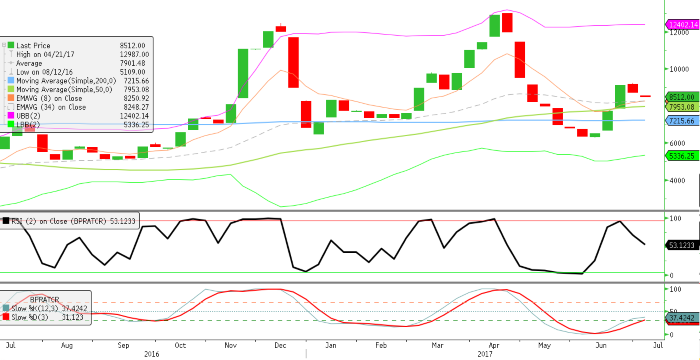

Dry Bulk FFA: Panamax Index on Corrective Phase

Panamax Index Weekly

Resistance – 9,174, 9,803, 11,065

Support – 7,931, 7,886, 6,281

As highlighted last week, 14 straight up days on the index indicated potential exhaustion.

The weekly chart is now in a corrective phase but remains above the both the 50 and 200 period MA’s.

Downside moves that hold above the USD 7,886 support should attract technical buyers to the market targeting the recent high at USD 9,174 and potentially higher.

A close below the USD 7,886 should have market buyers looking to tighten risk as this would be below the weekly open of the last significant bull candle and confirms a lower high, suggesting lower pricing could follow.

Panamax Q4 17 Daily

Resistance – 10,335, 10,435, 11,700

Support –9,280, 9,155, 8,390

The Q4 futures are currently finding resistance at the 200 period MA, having recently closed below the USD 9,435 support. The break in support should have technical sellers looking for a lower high and have market longs looking to tighten risk.

The Q4 futures are currently near the middle of its range between USD 8,390 and USD 10,335. This makes it a dangerous area to enter fresh trades. A close below USD 9,280 would suggest that the range support could be tested. Likewise a close above USD 9,705 would make the range resistance at USD 10,335 the logical target.

Note, the stochastic is oversold, not a buy signal but it does warn that momentum is slowing down.

Panamax Cal 18 Daily

Resistance – 8,987, 9,270, 9,475

Support – 8,340, 8,000, 7,715

The close below the USD 8,560 support will have sellers looking for potential entry, as the buying momentum is starting to weaken.

The oversold stochastic will be a concern as it could limit downside moves from here. Market sellers should be cautious on a close above USD 8,678 as it would suggest the Cal 18 could test the USD 8,987 resistance level. A failure close above the resistance would be a more attractive sell area to sellers, due to the stochastic being oversold at this point.

A close above the resistance will alert market buyers to potential higher prices. The fresh low will stop this from being an outright buy, but it will put them on alert for buying opportunities on a market pullback.

The recent upward swing failed at a key resistance, the oversold stochastic would suggest this could be tested again. If it holds, technical sellers will be emboldened.

Panamax Q4 V Cal 18 Daily

Resistance – 1,357, 1,585, 1,932

Support – 775, 386, 145

The Q4 v Cal 18 spread is currently in a range between USD 775 and USD 1,357, meaning the high low signals will be unreliable.

Support has recently held on an oversold stochastic which will have attracted buyers to the market looking to test the upside resistance at USD 1,357.

Ultimately the spread needs to break out from its range, a close above USD 1.357 should attract technical buyers targeting USD 1,585. Likewise a close below the USD 775 support should attract technical sellers targeting the USD 386 level.

Source: FIS

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional