ΙMO Ballast Water delay prompts revision of intermediate‐term tanker supply view

Older tankers have been given a new lease of life, meaning that the tanker market’s tonnage oversupply issues could take longer to resolve. In its latest weekly report, shipbroker Charles R. Weber noted that “in a development that caught many industry participants off guard, the IMO agreed last week to urging by a number of flag‐states to delay enforcement of Ballast Water Management Convention (BWMC) compliance for existing vessels from September 2017 to September 2019. Compliance for existing vessels calls for the fitting of Ballast Water Treatment systems from their first International Oil Pollution Prevention (IOPP) renewal survey after the enforcement date. Given the cost and lost time associated with BWT fittings, it had been a wide industry assumption that the mandate would hasten the phasing‐out of older vessels, which already face higher maintenance costs than their younger counterparts”.

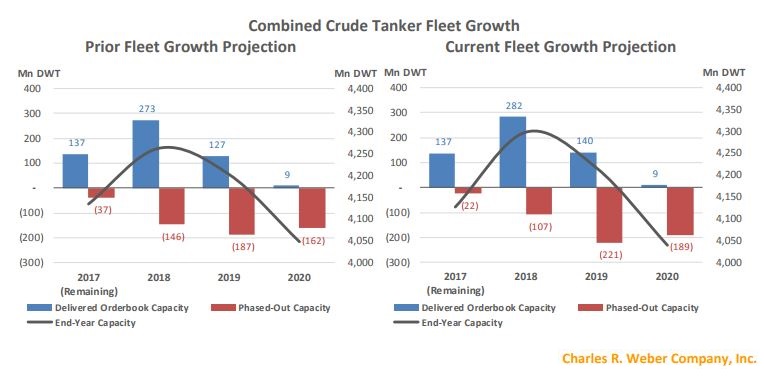

Indeed, according to CR Weber, “the September 2017 enforcement date had comprised a major component of the projected phase‐out timeline, particularly coming amid a challenging earnings environment for tankers amid a high pace of newbuilding deliveries. In light of the change, we have revised our granular, unit‐specific view of tanker phase‐out projections and have pushed forward a number of units’ projected phase‐out dates accordingly. In tandem, we have accounted for the fact that many aging units have completed major maintenance intervals recently, as well as the fact that owners of older units have shown an evident reluctance to phase‐out vessels on economic factors. Many of the older constituents of tanker fleets offer their owners comparatively low daily break‐even rates than their newer counterparts (being fully depreciated and/or facing low or no debt servicing requirements) and are often deployed to niche trades, which can be lucrative on this basis”, said the shipbroker.

CR Weber added that “our age‐related phase‐out target varies by asset class and is subject to the owner and deployment profile of each unit, but is generally 22.5 years with a decline to 20 years by 3Q19, when BWT comes into play – just ahead of the 2020 global 0.5% sulfur cap mandate, which brings its own set of compliance issues. This will likely maintain supply‐side headwinds into 2019, with a progression into a sustainable earnings recovery not envisioned until 3Q19. The segments that stand to be most adversely impacted by the revised view are the Suezmax and Aframax classes – which already stood to face the greatest forward supply‐side headwinds from a robust newbuilding delivery profile”, the shipbroker said.

“Prior to our revision, we projected that the Suezmax fleet would observed net growth of 10.0% and 1.6% during 2017 and 2018, respectively; our revised projections are 11.9% and 2.1%. The Aframax class was previously projected to post net growth of 6.1% and 0.3% during 2017 and 2018, respectively while the revised figures stand at 6.3% and 3.0%. VLCC fleet growth revisions are more moderate and include a higher YTD pace of phase‐outs than previously expected (due, in part, to some recent conversions and demolition sales). We previously projected that the VLCC would post net growth of 6.0% and 5.1% during 2017 and 2018, respectively, while our present projections are for 4.8% and 5.7%”, the shipbroker concluded.

Meanwhile, in the crude tanker market this week, CR Weber said that “the VLCC market commenced with modest rate gains which appeared likely to extent to notable gains as the supply/demand position appeared tight, if tenuous on the demand side. While demand‐side fears appear more likely to have been unfounded as indications suggest the July Middle East program will be on‐par with our week‐ago expectations (of 129 total spot cargoes), the fundamentals have disjointed and further rate gains were halted by charterers neglecting to reach forward into the August program. This meant that few Middle East cargoes were being worked. Just 12 fixtures were reported this week in the Middle East market, marking a 57% w/w decline to the slowest weekly demand period in the region in fourteen months. Meanwhile, chartering activity in the West Africa market was also slower; five fixtures materialized there, representing a w/w decline of four fixtures and the fewest in four‐weeks. Amid the slow pace of demand, unit availability rose markedly as a number of internal program units from Asian charterers were relet into the spot market. As a result, whereas last week the July program appeared likely to conclude with as few as eight surplus units, the projection now stands at 15. This is based on 35 units vying for 15 remaining July cargoes with five draws thereof to service West Africa demand expected”.

According to the shipbroker, “while this week’s fresh supply/demand disjointing eroded some of the week’s earlier rate gains, the market nevertheless closed in the black – and some further gains may well materialize during the upcoming week. Given that there remain a number of July cargoes outstanding while charterers are expected to start working August cargoes (having failed to reach forward on some of the early August stems as is usually the case), the pace of chartering activity should be busier, potentially lending support due to rate sentiment in tandem. Ultimately, however, with sufficient tonnage available and August’s first decade expected to be lighter than the same period during July, any observed strength will likely be short‐lived”, CR Weber concluded.

Source: Nikos Roussanoglou, Hellenic Shipping News Worldwide

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional