OPEC Supply Cuts Under The Microscope

The OPEC-led deal, under which major oil producers agreed to cut output, has had a major impact on the oil market and oil trade patterns this year. However, a number of recent developments have led to concerns over the solidity of the pact, and uncertainty over compliance in the rest of the year raises questions over how crude oil trade could be affected further.

The Underlying Mechanics

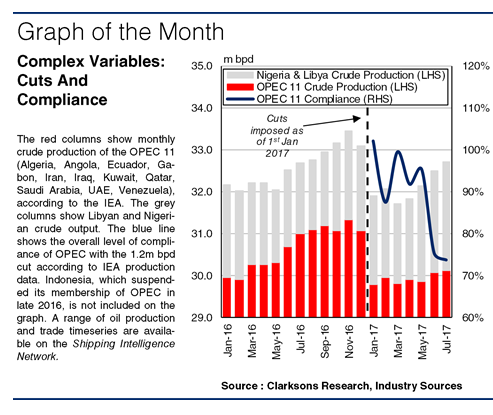

In November 2016, 11 members of OPEC (excluding Libya and Nigeria) agreed to reduce their collective crude output by 1.2m bpd relative to the group’s October production level in an effort to rebalance the oil market, effective as of January 1st 2017. Initially, the deal was for six months, although it was recently extended until March 2018. Compliance with the cuts exceeded 100% in January, largely due to Saudi Arabia, who cut 50% more than its pledged 0.49m bpd. Overall, compliance remained high throughout the first five months of the year. Average Saudi compliance of 129% in January-May led to a 5% y-o-y fall in the country’s crude exports in this period. However, lower Middle Eastern exports was one factor which helped to boost long-haul trade, in particular from the US to Asia.

Not-So-Harmonic Oscillations

However, a number of factors have undermined the impact of the deal. The first of these has been faster than expected improvement in Libyan and Nigerian output in recent months. Since the start of 2017, the increase in the two African countries’ crude output has been equivalent to 55% of the total cut pledged by OPEC. Meanwhile, Ecuador left the deal in June and has raised concerns that other participants may follow suit. On top of this, with Iraq’s compliance in June at only 29%, and Saudi Arabia increasing their output to back over 10m bpd, overall OPEC compliance with the deal slipped to around 75% in June and July. This is all also occurring against a backdrop of rising US shale output, which is undermining the likelihood of a higher oil price.

Possible Scenarios

As a result of uncertainty over compliance with the production deal, there are a range of scenarios for trade flows in the rest of 2017. In one scenario, assuming that average compliance amongst Middle Eastern producers in the rest of the year is 30% lower than in 1H 2017, this could add an extra 0.16m bpd on to 2017 crude production in the region, compared to if compliance in 2H 2017 remained in line with the 1H average. This case may support VLCC demand in the Gulf. However, it could also potentially hinder long-haul trade. For instance, if the additional Middle Eastern crude produced was exported to Asia, displacing the equivalent volume of US crude exports to Asia, this could limit global crude tonne-mile trade growth in full year 2017 to 3.6% as opposed to the 4.3% expected if compliance does not drop. However, this would still represent a fairly firm rate of growth.

So, recently there have been a number of factors undermining the impact of the OPEC deal. Depending on how these play out, there are a range of potential outcomes for oil output in various regions this year. As a result, this continues to cast a fair degree of uncertainty over the outlook for crude trade and tanker demand in the rest of 2017.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional