Tankers: Newbuilding Orders Limited Mostly to VLCCs

While newbuildings are thought to be the main risk to the future balance of the tanker market, it seems that it’s only VLCCs.

Much attention has been given in recent months to continued activity in newbuild VLCC tonnage. We, at Gibson’s, are not an exception to that, warning repeatedly about the risk of over-ordering if investment in VLCCs continues at such a relentless pace. However, what has gone largely unreported is the fact that the pattern of ordering activity has been completely different in other tanker segments, starting from Suezmaxes down to MRs.

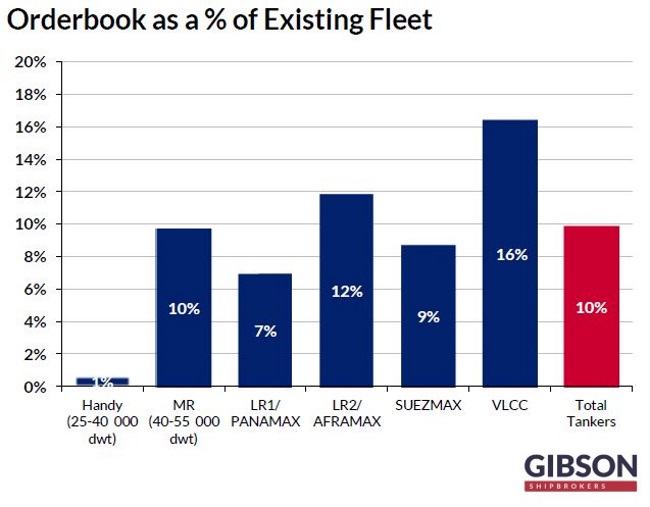

Most notably, investment in new tonnage has been minimal in the LR1/Panamax size group. Just 4 tankers have been ordered so far in 2018, while ordering was also highly limited over the previous two years. Without doubt, a lack of investment interest has been driven by poor performance. In recent years, LR1s have also faced an additional challenge in terms of the increased competition from both smaller and larger product carriers, frequently reporting lower earnings compared to other sizes. Not surprisingly, owners have showed preference for smaller MRs or bigger LR2s when ordering a new tanker. With the exception of Handy tankers, as of now LR1/Panamaxes have the smallest orderbook, at 7% relative to its existing fleet.

The orderbook for Suezmaxes is also becoming notably smaller. Only 2 firm tanker orders (plus 4 shuttle tankers) have been placed this year to date, while investment in new tonnage was also somewhat restricted in 2016 and 2017. As a result, the Suezmax orderbook has now fallen below 9% relative to its existing size, nearly three times smaller from its position two years ago.

The MR orderbook (40,000 to 55,000 dwt) stands close to 10%. Investment in new tonnage so far this year has been rather modest, with just 26 confirmed orders; yet, last year over 70 new tanker orders were placed. It is also worth pointing out that the orderbook for Handy tankers (25,000 to 40,000 dwt) is almost non-existent, with just 3 tankers yet to be delivered. However, this is largely a reflection of owners’ preference for the larger MR size when ordering new tonnage

Finally, LR2/Aframaxes have the second largest orderbook of all size groups, largely as a result of robust investment in 2017. Yet, investment has slowed once again this year, with 12 confirmed orders for the year to date. As such, the orderbook remains notably below that of VLCCs. Just under 12% of the LR2/Aframax fleet is on order versus 16% in the VLCC segment.

The above developments indicate that the growth in fleet size for most size groups could slow down notably next year, particularly if the demolition market remains active. Scheduled deliveries for Suezmaxes, LR2/Aframaxes and LR1/Panamaxes are expected to fall in 2019 to their lowest level since 2015. The number of scheduled deliveries in the MR segment in 2019 is on par with levels this year, yet still notably below the number of new deliveries seen between 2014 and 2016. This paints a much healthier picture in terms of fleet growth going forward. However, in order to see a much-needed rebound in tanker earnings, the current trend of robust ordering in the VLCC segment should certainly not be repeated in other tanker classes.

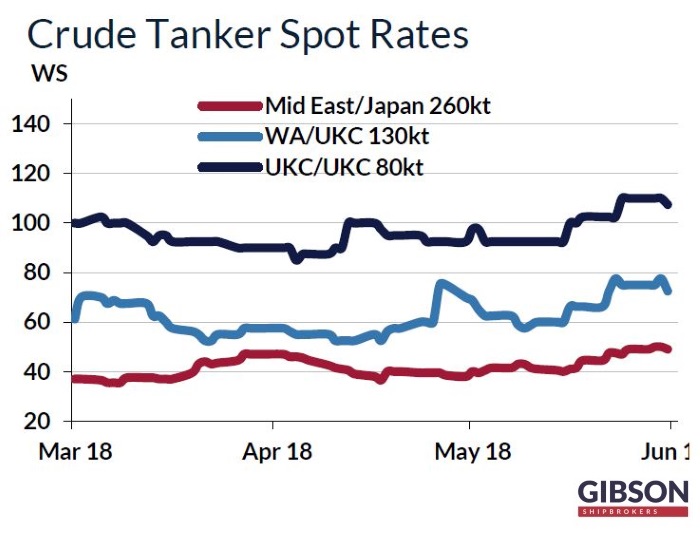

Meanwhile, in the Middle East market this week, Gibson said that “the week ended with broadly no change for VLCCs week on week with an initial slight push negated by a slower second half to leave rates at around ws 49 to the Far East for modern units and to ws 40 for older vessels, with rates to the West again at no better than ws 20 via Cape. Unless Charterers over-concentrate their activities over the last phase of the June programme, it is likely that the marketplace will again remain rangebound, and still very uninspiring when converted into TCE returns. The week started with Suezmaxes in high spirits as vessels continued to look into the Med for employment, however few were able to make sense of the longer ballast as Med/East rates flattened out and only modest local demand led AG/West rates to soften from ws 30 to mid ws 20’s while East rates remained in the ws 70 – 72.5 range. A busier final decade in Basrah provides some hope for Owners but tonnage supply should be sufficient to suppress rates from moving far from these levels. Aframaxes eased off from previous not-so-highs as enquiry moderated locally, and further afield. Rates chipped down to 80,000 by ws 95 to Singapore and may discount further into next week”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional