Tanker Market: The Iranian Factor May Soon Come Into Play

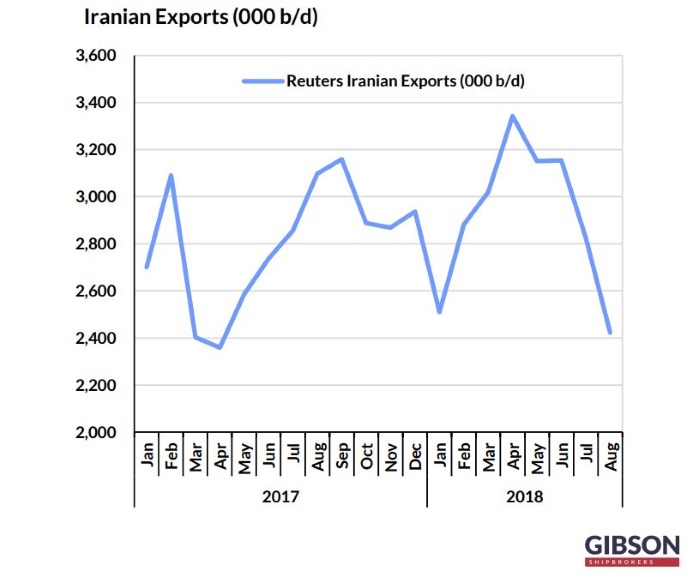

Once again, the loss of Iranian oil for the international market is an eventuality, which is bound to alter fundamentals in the tanker market. In its latest weekly report, shipbroker Gibson commented that “as we move closer to the November 5th re-imposition of sanctions against Iran, the impact is starting to become more noticeable for the tanker market. The IEA reported this week that Iranian crude production had fallen by 150,000 b/d to 3.63 million b/d in August, the lowest since July 2016. Ship tracking data suggests that exports have fallen further, by 400,000-500,000 b/d to around 2.4 million b/d. So, the question really is, by how much and how quickly will Iranian production fall and who is going to replace those lost barrels?”

According to Gibson, “during the last round of sanctions output fell as low as 2.6-2.7 million b/d, with exports generally around the 1.2-1.3 million b/d mark. Whilst it might be reasonable to expect similar levels this time around, Iran may find itself with fewer willing buyers. South Korea has stopped buying all together, with the last cargo imported in July, and appears willing to comply with US demands. Japan and India have also reduced imports in recent months, but have sought waivers from the US, and it looks likely that they will both continue to import at least some volumes of Iranian crude after sanctions are imposed. Reliance Industries and Nayara (formerly Essar) look set to stop purchases altogether but the state owned refiners appear prepared to continue imports”.

Meanwhile, “in Europe, volumes are already easing off as sanctions approach. For the time being, some cargoes are still heading towards Spain, Italy and Turkey. Whilst shipments to the European Union are expected to cease entirely ahead of November 5th; Turkey, which continued to import Iranian crude throughout the last period of sanctions, may continue doing so, particularly when current US-Turkey relations are considered. By contrast, China may even step up purchases as Iran is forced to offer increasingly attractive discounts, whilst utilisating state owned NITC to handle delivery and cargo insurance”, said the shipbroker.

“Iranian exports will have to decline. Replacement barrels from elsewhere will therefore be needed. OPEC production is increasing, having hit a 2018 peak of 32.63 million b/d in August. However, additional volumes are likely to be required to offset the expected decline from Iran. Outside OPEC, the US could of course become a key source of additional supply for the global oil markets, with refiners in Korea, India and Japan already taking more. However, the US cannot shoulder the burden alone whilst also keeping oil prices at an acceptable level. Earlier this week US Energy Secretary Rick Perry met his Saudi and Russian counterparts, reportedly to urge them to guarantee supplies in order to keep prices in check, a key political point for President Trump. For the tanker market, what Saudi Arabia, Russia and the rest of OPEC do is key. Quite simply, if the lost Iranian barrels are compensated by supplies from elsewhere, there will be more demand for the international tanker fleet, as the NITC fleet will not be able to compete for these cargoes”, Gibson concluded.

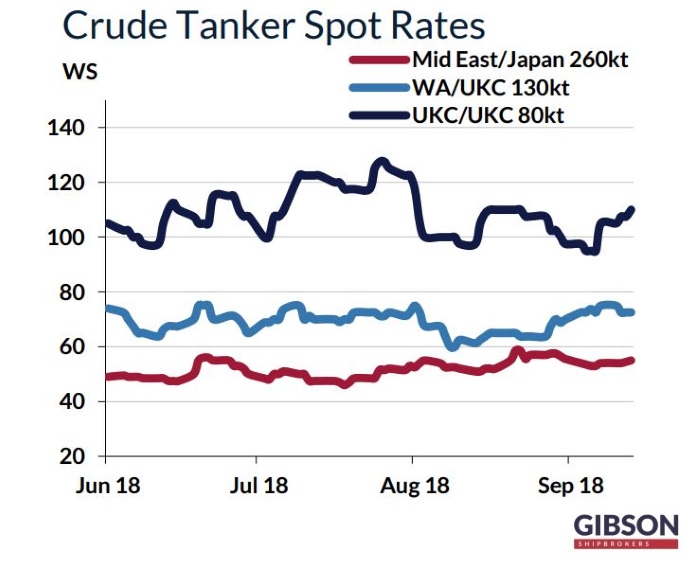

Meanwhile, in the crude tanker market this week, in the Middle East, Gibson said that “VLCC Owners will feel a little deflated this week after it offered so much potential, with a good number of cargoes expected to enter the market, but in fact gave very little. Even with this, Owners have been able to slightly strengthen rates to both East and West directions, with last done being 270,000mt x ws 55.5 for a voyage to China and 280,000mt x ws 20 to the USGulf via Suez Canal. There is still a chance that Charterers do in fact have some end month positions to cover and if that is the case, then Owners should be able to secure further premiums over last done. A quieter week for the Suezmax market has seen rates remaining supressed at 140,000mt x ws 27.5 to the West and 130,000mt x ws 80 for Eastern destinations. Next week is expected to be more active but we still have a long tonnage list, which will keep rates unchanged. The outlook on Monday was bleak for Aframaxes in the AGulf, with plentiful good quality tonnage options visible for Charterers and little outstanding enquiry. However, a steady flow of activity has kept rates pretty steady. AGulf-East began the week at 80 x ws 107.5-110 levels but has only slipped to around the 80 x ws105 level as we draw a close to week 37”, the shipbroker concluded.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional