As IMO 2020 lures newcomers to bunker sector, profit is far from guaranteed

A pharmaceutical company’s ill-fated attempt to focus on trading bunker fuel derivatives highlights the unpredictability that IMO 2020 has injected into oil markets.

Having sold off its opioids business the previous year, in early 2018, Norway’s Vistin Pharma announced it would set up a new oil trading unit focusing on profiting from the International Maritime Organization’s lower sulfur limits for shipping in 2020. Ten months and $9.8 million of paper losses later, the company said in early January that it would be closing the unit.

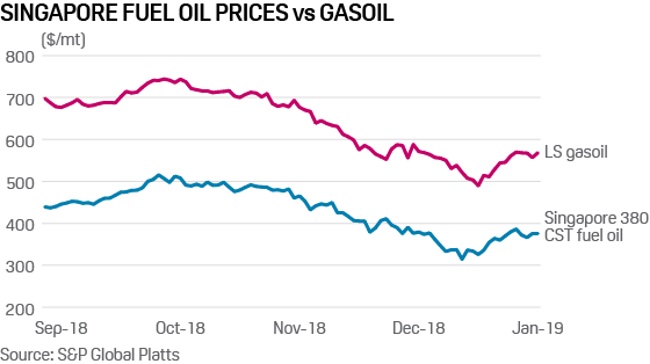

Vistin had bet on the spread between gasoil and high sulfur fuel oil in Singapore widening in the run-up to 2020, when fuel oil demand is set to plummet as the IMO prompts shipowners to shift to cleaner-burning fuels.

In a presentation from September 2018 on the company’s website, it projected the spread widening to as much as $800/mt by the end of 2020.

But the strategy appears to have been foiled by a combination of last year’s strength in fuel oil prices and the rapid drop in crude prices in the fourth quarter.

By December 31, the 150,000 mt of contracts the company held represented a mark-to-market loss of NOK 85 million ($9.8 million). Vistin’s head of energy trading resigned at the start of the year, and after a swift strategic review, the company decided to shutter the unit he had set up.

Not as easy as it looks

The episode highlights the dangers faced by some of the outside players currently eyeing up the bunker industry for money-making opportunities in 2020.

On paper the changes coming next year look easy to profit from: a sharp drop in fuel oil prices towards the end of 2019 and a more steady rise in middle distillates looks all but inevitable, and is potentially not yet fully priced into the forward curve.

But Vistin’s difficulties show how some of the less-familiar moving parts around IMO 2020 may make it tricky for new money to enter the bunker industry and take advantage of the regulatory disruption.

The scale of last year’s fuel oil strength was unexpected: a combination of sinking Russian output and firm Saudi demand left the bottom of the barrel briefly trading above gasoline prices in Singapore towards the end of 2018.

Investments in emissions-cleaning scrubber equipment may be another area where outside money gets tripped up by some of the nuances around how 2020 plays out.

Ships have the option of paying a few million dollars to install a scrubber that cleans their emissions and allows them to continue burning fuel oil, and financial institutions including Goldman Sachs have shown interest in financing these investments and profiting from the potential fuel bill savings to be made.

Scrubbers fall out of favour

But in recent months, the scrubber industry has been taken aback by a series of regulatory decisions against open-loop models of the technology — a type of scrubber that deposits sulfurous wash water back into the sea.

It recently emerged that China would be likely to ban the use of open-loop scrubbers in some of its waters, following a similar decision by Singapore last month, raising the prospect of those that have invested in — and financed — this equipment finding themselves unable to profit from it across large parts of Asia.

This isn’t to say that turning a profit will be impossible in 2020. Vistin Pharma’s bet may yet pay off to some extent.

The company has decided to hang onto its bunker derivative investments, and they may look less disastrous later this year as fuel oil’s recent strength wanes.

But outsiders coming to this industry for the first time in the run-up to 2020 will need to be wary. The bunker and shipping industries are anything but simple, and involvement with them is not for the faint-hearted.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional