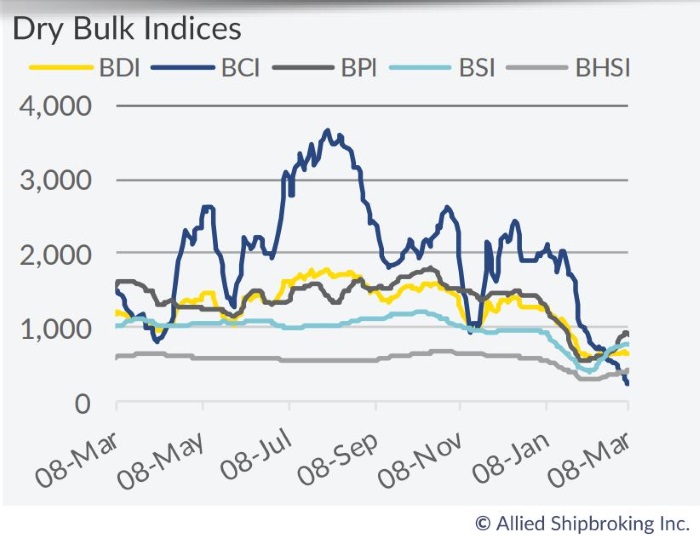

Dry Bulk Market: Future Prospects Don’t Seem to Point Upwards

The prospects for a swift and sustainable recovery in the dry bulk market, seem to be diminishing, at least for the time being. In its latest weekly report, shipbroker Allied Shipbroking said that “in the midst of troubled conditions for the dry bulk market and a continual slack being observed overall even after the annual Chinese New Year drop, the flow of news coming through seems to still be disheartening as to the future prospects of the freight market. Just this past week China announced that it will slash its GDP growth target for the year down to 6-6.5% from a hard target of 6.5% that it had over the past two years. In part this move seems to be more so triggered to offer Beijing flexibility in the policies it will issue, but at the same time reflects on the view that the economy is facing considerable pressure right now pinned between a difficult trade negotiation with the US and strong commitment to deal with both economic as well as environmental faced internally. On the economic front it is trying to tackle the immense level of corporate debt and defaults that are on the rise. On the environmental front, the efforts made to improve living standards in many of the mega-cities along its coast has caused significant disruptions in its industrial production levels”.

According to Allied’s, George Lazaridis, Head of Research & Valuations, “on the latter point, it is no coincidence that we witnessed a significant tumble in the import volumes of coal and iron ore that entered the country during February. Since then we have seen a fair amount of rebound, especially in the case of iron ore, with further restocking set to take place over the coming weeks as demand for these commodities starts to kick off once more. Evidence of this has started to take shape in the futures market with prices for a number of dry bulk commodity contracts on the Shanghai Futures Exchange making a significant jump today. The troubles still faced by Vale in Brazil in reference to the dam that burst back in January are still considerable and disruptions are still being faced in the iron ore trade. There may well be a bigger flow of cargoes to be seen once normal operations resume at all the Brazilian mines, however for the time being any increases in demand will likely have to be sourced from alternative regions”.

Lazaridis added that “things haven’t been helped much by the continued uncertainty as to the outcome of the ongoing trade talks between the US and China, with Chinea’s soyabean imports having dropped in February to their lowest monthly figure for the last four years. Some progress seems to have been made over the past month in terms of some sort of agreement being reached by the world’s two largest economies, however in the opinion of most in the market, this still seems to be painstakingly slow and to some extent taking the form of a rollercoaster ride. Just this past week a touch of optimism was seen from the news that state-owned firms from China had snapped up contracts for at least 0.5 million tonnes of soybeans from the US to be made during the summer months. This may very well be but a drop in the ocean compared to the rumored commitment made by the Chinese to by an additional 10 million tonnes of US soybeans, however it could be pointing towards a sense of progress being made and that we may well see more and more such purchases being made by state-owned firms over the next couple of months. Given all these factors the improvement in the dry bulk freight market is likely to stick to a slow and cumbersome course over the next couple of months, while sentiment has been dampened significantly, something that has been thoroughly reflected in both the numbers being quoted in the paper market and the activity being noted in the sale and purchase market over the past couple of weeks”, he concluded.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional