Dry Bulk Market: New Peaks a Thing of the Past as Harsh Reality Sets In

With the first quarter of 2019 already past us, it’s now becoming increasingly obvious that the dry bulk market will find it hard to experience a third consecutive year of recovery, not to mention new peaks. In its latest weekly report, shipbroker Allied Shipbroking said that “a mere 6 months ago, the prevailing sentiment was that 2019 would be the third year of a consecutive recovery in the market, with the shared prevailing thought being that the market was finally ready for new peaks. Strong fundamentals and bullish sentiment were among the favorite topics discussed in most shipping circles. No one would argue against this, given the tremendous improvement in the supply-demand dynamics that was being witnessed”.

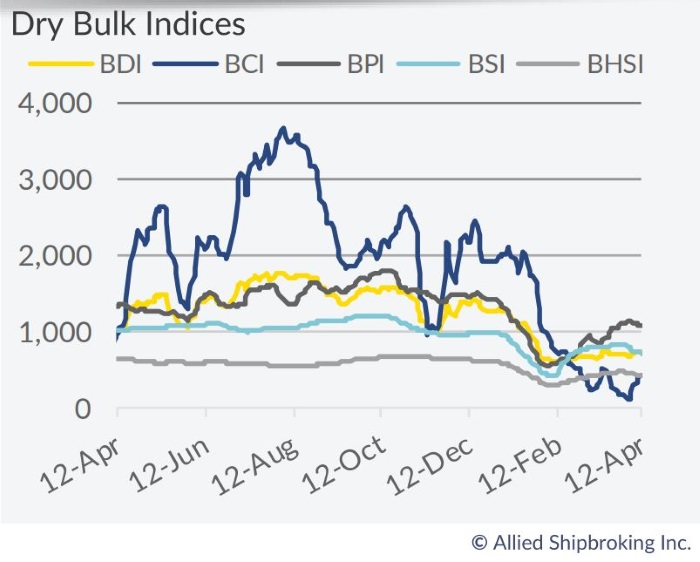

According to Mr. Thomas Chasapis Research Analyst with Allied Shipbroking, “now that we have already dipped into the 2nd quarter of the year and given the deep disappointment that we have seen in the freight market developments during the last couple of months, it seems as a good opportunity to undertake a more thorough analysis of the currently prevailing market condition. So as to better capture the setback noted in 1Q19, a year-on-year comparison could be in order. Focusing on the main dry indices (BCI, BPI, BSI, BHSI) the downward correction (on an annualized basis) was quite severe, with losses reaching 42%, 38.8%, 25.2% and 28.4% respectively on their average figures”.

Chasapis added that “against this, it seems redundant to further examine at this point the level of distance from prior expectations in respect to current year’s returns. Without trying to sound overly-pessimistic, it is worth pointing out that we haven’t even mentioned how realized volatility has been affected during the same time frame, or how the excessive uncertainty has damaged the market’s upward potential. If we were to measure the forward sentiment through the paper market, the prevailing bearish attitude is clearly visible. Looking forward onto the next 5 years, the quoted FFA contracts throughout this period have been under considerable pressure, greatly effected as it would seem by the very turbulent spot freight market”.

Furthermore, “in the shortrun, if current expectations as imprinted in the paper market are realized, we are facing a year-on-year 31.5%, 20.8%, 17.8% and 10.1% decline in the Capesize, Panamax, Supramax and Handysize TCA averages respectively. Understanding the struggle of the whole situation is important, without, though, misplacing the positive signs. Against what was witnessed back in February, the monthly average figures for almost all size segments (the exception being that of Capes) witnessed a considerable boost, with the Panamax rising by 49.9%, the Supramax by 38.3% and the Handysize by 35.9%. So, given how quickly these markets are showing capable of rebalancing themselves when there is market support to feed from, we may well expect a fair recovery to take shape and some good gains to be noted before the year comes to a close”, Chasapis said.

According to Allied’s analyst, “furthermore, when taking into consideration the increased activity noted in terms of ship recycling and the mediocre volumes of new ordering taking shape, a more robust future balance seems to be slowly taking shape. All-in-all, it looks as though the most probable scenario is that 2019 won’t be a stellar year for the dry bulk sector. The “hope” for the rest of year is that the market will succeed some sort of rebalancing, without causing any further derailment from the overall recovery path set by 2017 and the first half of 2018. With all that being said, taking into consideration the aftermath of what was witnessed in the Capesize market after a sudden unpredictable single shock (a tail risk), we should never forget how quickly market fundamentals could turn on their head and bring everything into a sharp downward spiral. Let’s hope this will be the last of a series of “big” surprises to be had for a long time”, Chasapis concluded.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional