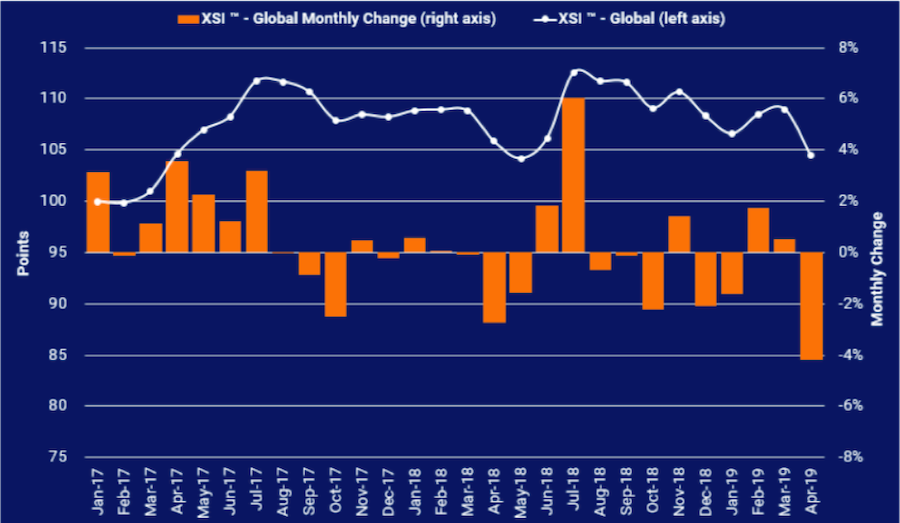

Container freight rates slump 4.2% in April

Container freight rates fell 4.2% in April to their lowest level since June last according XSI Public Indices published by Xeneta.

The indices based on crowd-sourced data covering 160,000 port-to-port pairings fell back sharply last month having reported container rate rises of 2.5% in February and 0.5% in March.

The indices stand at 104.45 points at the end of April, the lowest level since June last year.

The rate falls were across the board with European imports fell by 4.8%, while exports declined by 1.9%; for Asia the import benchmark dropped by 2.1% while exports slumped 3.6%; and for the US the export benchmark fell by 2%, while the import index dropped by 3.4%.

“The reasons for the decline are complex, but certainly overcapacity on the European trades (with Ocean Alliance increasing activity and new slots for a standalone HMM service) and continued fall out from the US-China trade war (where shippers initially front loaded cargoes to avoid additional cost) have added to longer term structural issues and political/economic uncertainty,” commented Xeneta ceo Patrik Berglund.

“In short, suppliers have benefited from a market in flux due to trade wars, IMO, socio-economical factors, like Brexit, and now the situation is turning. As always, uncertain waters may lie ahead for the contract market.”

Berglund said the outlook remains uncertain, “Geopolitics remain stubbornly unpredictable, with on-going uncertainty over US-China relations, while no one – not even the people at the very top – appear to have a clear view of what is happening regarding Brexit and its consequences.”

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional