International Dry Bulk Market Weekly Comment

May 19, 2014 - May 23, 2014

Weekly Dry Bulk Observation

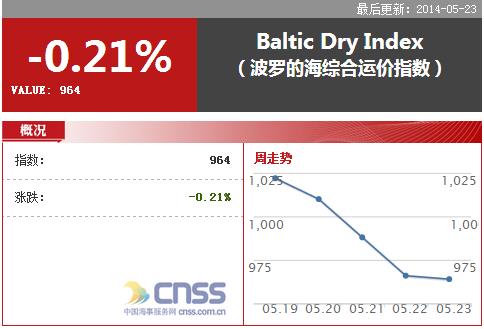

The international dry bulk market ended last week with the Baltic Dry Index (BDI) at 964 points, a decrease of 63 points (6%) from a week ago. The capesize market saw the largest decrease in rates, but capesize rates found support on Friday which is very encouraging. Chinese demand for imported iron ore cargoes has remained very strong, which is leading to very strong demand for capesize vessels and caused capesize rates to rebound on Friday. Overall, dry bulk spot chartering activity was very firm last week. In total, 125 dry bulk vessels were chartered in the spot market last week. This is just 11 less than were chartered during the previous week. Sentiment in the market has remained fairly positive. A total of 11 dry bulk vessels were chartered for period deals last week, which was the same amount chartered during the previous week.

Capesize vessels

Capesize rates ended last week averaging $9,721/day, which was a decrease of $1,484 (13%) from a week ago. Spot Australian iron ore cargoes remained very firm last week, with all of the major players again very active. In total, 17 spot Australian iron ore cargoes surfaced in the market last week which was a strong amount and just 4 less than surfaced during the previous week. Only a few Brazilian spot iron ore cargoes surfaced again however. Only 5 spot Brazilian iron ore cargoes surfaced last week, which was 1 more than surfaced in the market during the previous week. The rate of the Australia-Qingdao route has declined by 2.3% from a week ago to $7.695/ton. The daily cost to charter a capesize vessel for a Pacific round-trip voyage has declined by 124.9% from a week ago to $9,600/day. The rate of the Tubarao-Qingdao route has fallen by 2.8% from a week ago to $18.905/ton. The rate of the Tubarao-Rotterdam route has fallen by 3.5% from a week ago to $7.494/ton. In addition, the daily cost to charter a capesize vessel for an Atlantic round-trip voyage has fallen by 22.2% from a week ago to $8,505/day. In the time charter market, the capesize time charter market was less active last week as only one capesize vessel was chartered for a period deal. This is one less than was chartered during the previous week. Most recently, a 179,000 dwt vessel was chartered for 10 to 12 months for $22,500/day.

Panamax Vessels

Panamax rates ended last week averaging $8,061/day, which was a decrease of $312 (4%) from a week ago. A very large amount of South American grain cargoes surfaced again last week which has helped panamax rates remained relatively firm. However, a large amount of new panamax vessels continue to be delivered which has put a small amount of pressure on overall panamax freight rates. The rate of the Atlantic to Far East route has decreased by 2.5% from a week ago to $15,071/day. The daily cost to charter a panamax vessel for an Atlantic round-trip voyage has decreased by 6.4% from a week ago to $7,788/day. The daily cost to charter a panamax vessel for a Pacific round-trip voyage has decreased by 3.5% from a week ago to $7,663/day. The rate of the Far East to Europe route has decreased by 3.3% to $1,543/day. In the time charter market, the panamax time charter market was more active last week as six panamax vessels were chartered for period deals. This is one more than was chartered during the previous week. Most recently, an 80,000 dwt vessel was chartered for 3 to 5 months for $10,650/day.

Supramax Vessels

Supramax rates ended last week averaging $9,052/day, which was a decrease of $343 (4%). While down slightly from a week ago, supramax rates remain at good levels that are well above basic operating costs. The rate of the US Gulf-Europe route has declined by 2.7% to $10,722/day. The rate of the Black Sea to Far East route has fallen by 5.5% to $11,233/day. In addition, the rate of the Europe-Far East route has fallen by 3.6% to $13,325/day. The cost to charter a supramax vessel for an Asia-NOPAC or Australian round-trip voyage has fallen by 3.8% to $9,194/day. In the time charter market, the supramax time charter market was more active last week. Four supramax vessels were chartered for period deals. This is one more than was chartered during the previous week. Most recently, a 56,000 dwt vessel was chartered for 3 to 5 months for $13,000/day.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional