Global Dry Bulk Market Weekly Comment

A close examination of recent spot chartering activity shows that 101 dry bulk vessels were chartered in the spot market last week. This is 12 less than were chartered during the previous week. Last week's vessel chartering activity included the chartering of 35 capesize vessels (10 less than the previous week), 39 panamax vessels (2 less than the previous week), 20 handymax vessels (2 less than the previous week), and 7 handysize vessels (2 more the previous week). The decline in chartering activity put pressure on dry bulk rates in all segments of the market, with panamax rates falling by the most as the panamax market remains very oversupplied with vessels. Capesize rates ended last week averaging $13,050/day, a decrease of $320 (2%) from a week ago. Panamax rates ended last week averaging $4,670/day, a decrease of $1,168 (20%) from a week ago. Supramax rates ended last week averaging $7,822/day, a decrease of $567 (7%) from a week ago. Handysize rates ended last week averaging $6,833/day, a decrease of $302 (4%) from a week ago.

Looking at dry bulk cargo trends in specific detail, a particularly large amount of Australian iron ore cargoes and South American grain cargoes surfaced in the market again last week. This has remained a constant in the market for several weeks. In total, 20 Australian iron ore cargoes surfaced in the market last week. This was 3 less than surfaced during the previous week but still a very large amount. The Australian iron ore cargoes will be shipped to various buyers in Asia. In addition, 16 South American grain cargoes came to the market last week. This was 6 less than were chartered during the previous week but still a firm amount. The South American grain cargoes will be shipped to various buyers around the world.

In China, new reports continue to surface of additional small and medium-sized domestic Chinese iron ore mines suspending iron ore production. Chinese demand for imported iron ore cargoes has stayed robust, though, as spot iron ore cargo prices remain low and very attractive to Chinese steel mills (spot iron ore prices have fallen because so much new iron ore is being produced in Australia and Brazil). More small and medium-sized Chinese domestic iron ore mines are now suspending iron ore production, however, because Chinese mines have very high costs and more can't make money on the currently low spot iron ore prices. A decline in Chinese iron ore production is poised to continue during the next several months - which is very good for capesize freight rates. During the next several months, Chinese iron ore production will fall but iron ore production in Australia and Brazil is set to continue to increase by a very large amount. This is also very good for China's steel mills. Robust iron ore production in Australia and Brazil will cause iron ore prices to stay very low and keep costs down for Chinese steel mills. Chinese steel mills are poised to continue importing a very large amount of low-priced iron ore imports.

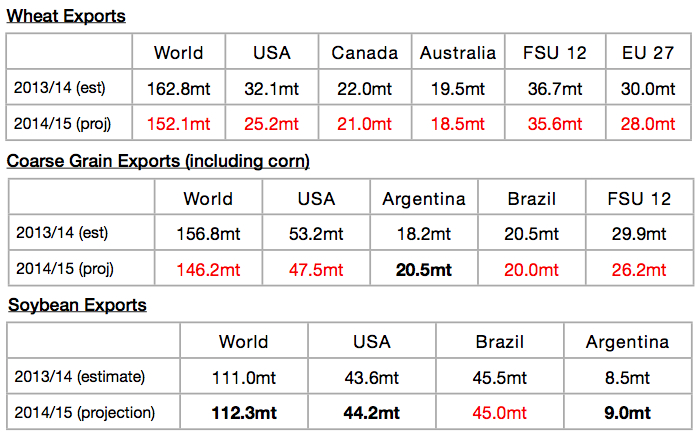

Regarding the grain market, the United States Department of Agriculture (USDA) has released its latest forecast for 2014/15 global grain trade. The USDA currently predicts that 339.7 million tons of grain will be exported worldwide during the 2014/15 grain trade marketing year. This is 400,000 tons more than its previous trade estimate released one month ago but 20.5 million tons (-6%) less than is estimated to have been exported during the 2013/14 grain trade marketing year. In the iron ore market, reports continue to surface of more small and medium-sized iron ore miners in China halting production due to low spot prices. This is causing demand for iron ore imports to remain very strong.

Chart is attached (data is in million tons).

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional