7.21-7.25 Global Dry Bulk Market Weekly Comment

A close examination of recent spot chartering activity shows that 120 dry bulk vessels were chartered in the spot market last week. This is 9 more than were chartered during the previous week. Last week's vessel chartering activity included the chartering of 40 capesize vessels (1 more than the previous week), 48 panamax vessels (4 more than the previous week), 22 handymax vessels (4 more than the previous week), and 10 handysize vessels (the same amount as the previous week). Despite the rebound in chartering activity, capesize and handysize rates fell. Capesize rates ended last week averaging $8,621 /day, a decrease of $27 from a week ago. Panamax rates ended last week averaging $4,831/day, an increase of $150 (3%) from a week ago. Supramax rates ended last week averaging $7,097/day, an increase of $211 (3%) from a week ago. Handysize rates ended last week averaging $5,383/day, a decrease of $216 (4%) from a week ago.

Looking at dry bulk cargo trends in specific detail, a particularly large amount of Australian iron ore cargoes and South American grain cargoes surfaced in the market again last week. In total, 28 Australian iron ore cargoes surfaced in the market last week. This was 11 more than surfaced during the previous week and an extremely large amount. The Australian iron ore cargoes will be shipped to various buyers in Asia, mostly to buyers in China. In addition, 17 South American grain cargoes came to the market last week. This 1 more than was chartered during the previous week. The South American grain cargoes will be shipped to various buyers around the world.

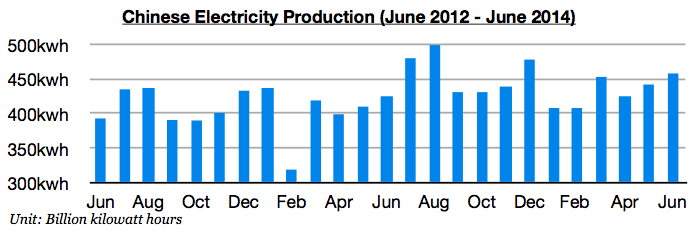

In China, recently released data shows that China produced 458 billion kilowatt hours of electricity in June. This is 16 billion kilowatt hours (4%) more than was produced in May and 33 billion kilowatt hours (8%) more than was produced in June 2013. In total, the first six months of this year have seen China produce 2.59 trillion kilowatt hours of electricity. This is 180 billion kilowatt hours (7.5%) more than was produced during the first six months of last year. Robust electricity production bodes well for thermal coal import demand prospects.

Chart is attached (data is in billion kilowatt hours).

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional