9.15-9.17 Hot Issues in the Dry Bulk Market

Dry Bulk Rates Under Temporary Pressure

Through the first three days of this week, the Baltic Dry Index has decreased by 57 points to 1,124 points. This represents a 5% decrease from the end of last week. Capesize and panamax rates have decreased, while supramax, and handysize rates have increased. Going forward, rates for all dry bulk vessel classes are likely to see support soon and capesize freight rates in particular are set to find a very large amount of support. Capesize vessel availability remains tight and much more capesize cargoes of coal and iron ore are set to surface in both the Atlantic and Pacific basins soon. Global spot chartering activity has increased this week. A total of 55 dry bulk cargoes have been chartered in the spot market so far this week. In comparison, 54 cargoes were chartered during the first three days of last week.

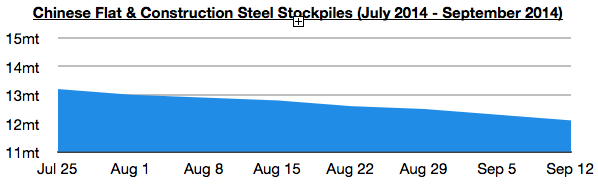

Chinese Steel Stockpiles Continue to Decline

Stockpiles of flat and construction steel products in China currently total approximately 12.1 million tons, 200,000 tons (-2%) less than a week ago. Chinese steel stockpiles have been coming under all but steady pressure since the middle of March and are now down by 2.4 million tons (-17%) on a year-on-year basis. It remains encouraging that steel stockpiles have remained much lower than last year’s level, even as steel production in China has remained well above last year's record level.

Capesize Rates to Increase Much Further

Capesize rates remain poised to find an extremely large amount of support during the upcoming weeks and month. Capesize vessel availability remains tight in the Atlantic basin, and in particular much more capesize Brazilian iron ore cargoes are set to come to the spot market extremely soon. This will propel capesize rates to very high levels. At the same time, capesize fleet growth is already quite low and is set to stay low. An upcoming increase in Brazilian iron ore shipments, coinciding with a tight capesize Atlantic basin and capesize fleet growth remaining low, all point to a significant increase in capesize rates occurring very soon.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional