9.22-9.24 Hot Issues in the Dry Bulk Market

Dry Bulk Market Remains Mixed

Through the first three days of this week, the Baltic Dry Index has decreased by 19 points to 1,056 points. This represents a 2% decrease from the end of last week. Capesize and panamax rates have decreased, while supramax and handysize rates have increased. Going forward, rates for all dry bulk vessel classes are likely to see support soon although sentiment in the capesize market is very weak. It should be much more positive, though, as Chinese iron ore import demand has remained very strong and Brazilian iron ore production is set to rise much further through the end of this year. Global spot chartering activity has fallen this week however. A total of 48 dry bulk cargoes have been chartered in the spot market so far this week. In comparison, 55 cargoes were chartered during the first three days of last week.

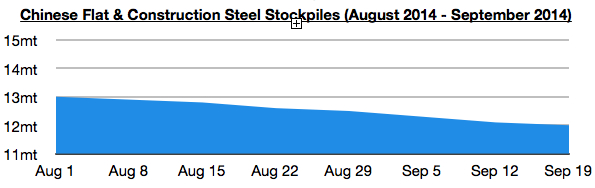

Chinese Steel Stockpiles Continue to Decline

Stockpiles of flat and construction steel products in China currently total approximately 12 million tons, 100,000 tons (-1%) less than a week ago. Chinese steel stockpiles have been coming under all but steady pressure since the middle of March and are now down by 2.4 million tons (-18%) on a year-on-year basis. It remains encouraging that steel stockpiles have remained much lower than last year’s level, even as steel production in China has remained well above last year's record level. Chinese steel prices continue to decline, however, but so too have spot iron ore prices will have allowed Chinese steel mills' profit margins to remain much improved from the start of this year. This is causing Chinese steel production to stay robust.

Indian Coal Mines to be Shut Down

India's Supreme Court has made its long awaited decision on what do with the many coal mines deemed as having been illegally allocated to various companies during 1994 to 2010. The Supreme Court has decided that all but 4 of the coal mines must shut down, including coal mines currently in operation. Licenses for 214 out of 218 mines will be canceled, including 42 mines that are currently in operation and/or have been close to starting operation. The mines will have six months to continue producing before they must shut down. It is positive for future Indian coal import prospects that 214 of the 218 mines will be shut down. Indian coal production has been struggling to meet demand, and imports have been finding significant support as a result. With 42 mines now set to be shut down in six months, it will further boost Indian coal imports in the future. This is a positive development for the dry bulk shipping market, and will most help the panamax, handymax, and capesize segments of the market.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional