10.27-10.31 Global Dry Bulk Market Weekly Comment

A close examination of recent spot chartering activity shows that 128 dry bulk vessels were chartered in the spot market last week. This is an increase from the 100 vessels that were chartered during the previous week. As expected, rates for capesize and panamax vessels were able to find even greater support last week. Last week's vessel chartering activity included the chartering of 48 capesize vessels (6 more than the previous week), 52 panamax vessels (6 more than the previous week), 10 handymax vessels (4 more than the previous week), and 10 handysize vessels (4 more the previous week). Capesize rates ended last week averaging $24,413/day, an increase of $8,302 (52%) from a week ago. Panamax rates ended last week averaging $9,883/day, an increase of $912 (10%) from a week ago. Supramax rates ended last week averaging $9,326/day, a decrease of $86 (1%) from a week ago. Handysize rates ended last week averaging $6,839/day, a decrease of $314 (4%) from a week ago.

Looking at dry bulk cargo trends in specific detail, a particularly large amount of Indonesian thermal coal cargoes and Australian iron ore cargoes surfaced in the market last week. In total, 22 Indonesian thermal coal cargoes came to the market last week. This is 15 more than the previous week and very robust amount. The Indonesian thermal coal cargoes will be shipped to various buyers. In addition, 218 Australian iron ore cargoes came to the market last week. This is 2 less than surfaced during the previous week but still a very large amount. All of the Australian iron ore cargoes will be exported to buyers in China.

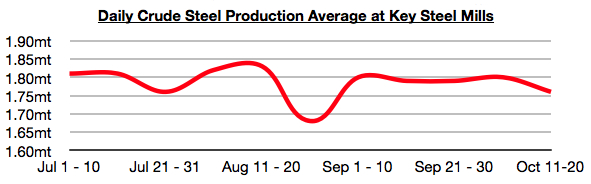

Recently released data from the China Iron and Steel Association (CISA) shows that average daily crude steel production at China's key steel mills totaled 1.76 million tons during October 11 to October 20. Although down from the 1.80 million ton level seen during the previous ten days, this still is a moderate level. Even more importantly, during this time demand for imported iron ore cargoes has remained strong. Overall, steel mills continue to consume a greater amount of imported iron ore over domestic iron ore as imports are both very cheap and much better for China’s environment. Going forward, this is very positive for capesize rates.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional