11.10-11.14 Global Dry Bulk Market Weekly Comment

A close examination of recent spot chartering activity shows that 117 dry bulk vessels were chartered in the spot market last week. This is an increase from the 105 vessels that were chartered during the previous week. Rates for capesize vessels fell last week but are expected to rise again this week. Prospects for the rest of the dry bulk market are less clear. Last week's vessel chartering activity included the chartering of 54 capesize vessels (2 more than the previous week), 42 panamax vessels (3 more than the previous week), 10 handymax vessels (3 more than the previous week), and 9 handysize vessels (4 more the previous week). Capesize rates ended last week averaging $20,660/day, a decrease of $5,445 (21%) from a week ago. Panamax rates ended last week averaging $8,718/day, a decrease of $762 (8%) from a week ago. Supramax rates ended last week averaging $9,149/day, a decrease of $60 (1%) from a week ago. Handysize rates ended last week averaging $6,544/day, a decrease of $85 (1%) from a week ago.

Looking at dry bulk cargo trends in specific detail, a particularly large amount of Australian iron ore cargoes, Brazilian iron ore cargoes, and Indonesian thermal coal cargoes surfaced in the market last week. In total, 22 Australian iron ore cargoes came to the market last week. This is 7 more than surfaced during the previous week. All of these Australian iron ore cargoes will be shipped to buyers in China. In addition, 15 Brazilian iron ore cargoes came to the market last week. This is 10 more than surfaced during the previous week. The Brazilian iron ore cargoes will be shipped to buyers in China and Europe. 15 Indonesian thermal coal cargoes also came to the market last week. This is 1 less than the previous week but still a very robust amount. The Indonesian thermal coal cargoes will be exported to various buyers in Asia.

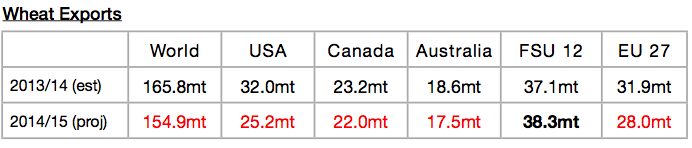

Last week, the United States Department of Agriculture (USDA) released its latest global grain trade forecast which projects that 2014/15 global grain trade will total 344.1 million tons. This is a reduction of 1 million tons. A month ago, the USDA projected 2014/15 global grain trade would total 345.1 million tons. The forecast has primarily been lowered due to smaller expectations for Australian wheat exports. Global wheat exports are now expected to total 154.9 million tons, 1.1 million tons less than was forecast a month ago. 2014/15 Australian wheat exports are now expected to total 17.5 million tons. A month ago, they were anticipated to total 18.5 million tons. The forecast for Australian wheat exports has been lowered due to a less optimistic forecast for Australia’s wheat crop. Australian wheat production is now expected to total 24 million tons. A month ago, the crop was forecast to total 25 million tons.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional